- United States

- /

- Marine and Shipping

- /

- NasdaqGS:CCEC

How Capital Clean Energy Carriers' Return to Profitability Will Impact CCEC Investors

Reviewed by Sasha Jovanovic

- Capital Clean Energy Carriers Corp. recently announced its third-quarter earnings, reporting sales of US$99.51 million and a net income of US$23.76 million, compared to a net loss a year earlier, as it continues its focus on LNG and energy transition shipping.

- This turnaround, driven by improved profitability and the company's active restructuring through vessel sales and newbuild financing, marks a significant shift in operational and financial momentum.

- We'll explore how the marked shift to profitability amid the operational restructuring affects Capital Clean Energy Carriers' investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Capital Clean Energy Carriers Investment Narrative Recap

To own shares in Capital Clean Energy Carriers, investors need to believe in the company's ability to deliver steady profit growth by successfully executing its transition toward LNG and clean energy shipping, while managing the risks tied to high floating interest rate exposure and reliance on long-term contracts for its specialized fleet. The recent return to profitability improves short-term sentiment, but does not materially resolve uncertainties around future contract wins and employment for new vessels, which continue to be the biggest swing factor and risk ahead.

Among the recent corporate developments, the appointment of energy veteran Martin Houston to the board stands out, as this brings additional expertise to steer through the transformation and potential growth in energy transition shipping. The strengthened board could enhance oversight, but achieving reliable long-term vessel employment remains a critical catalyst for future results.

However, investors should be aware that amid this turnaround, the company’s heavy dependence on floating-rate debt means any movement in interest rates could quickly change the earnings picture...

Read the full narrative on Capital Clean Energy Carriers (it's free!)

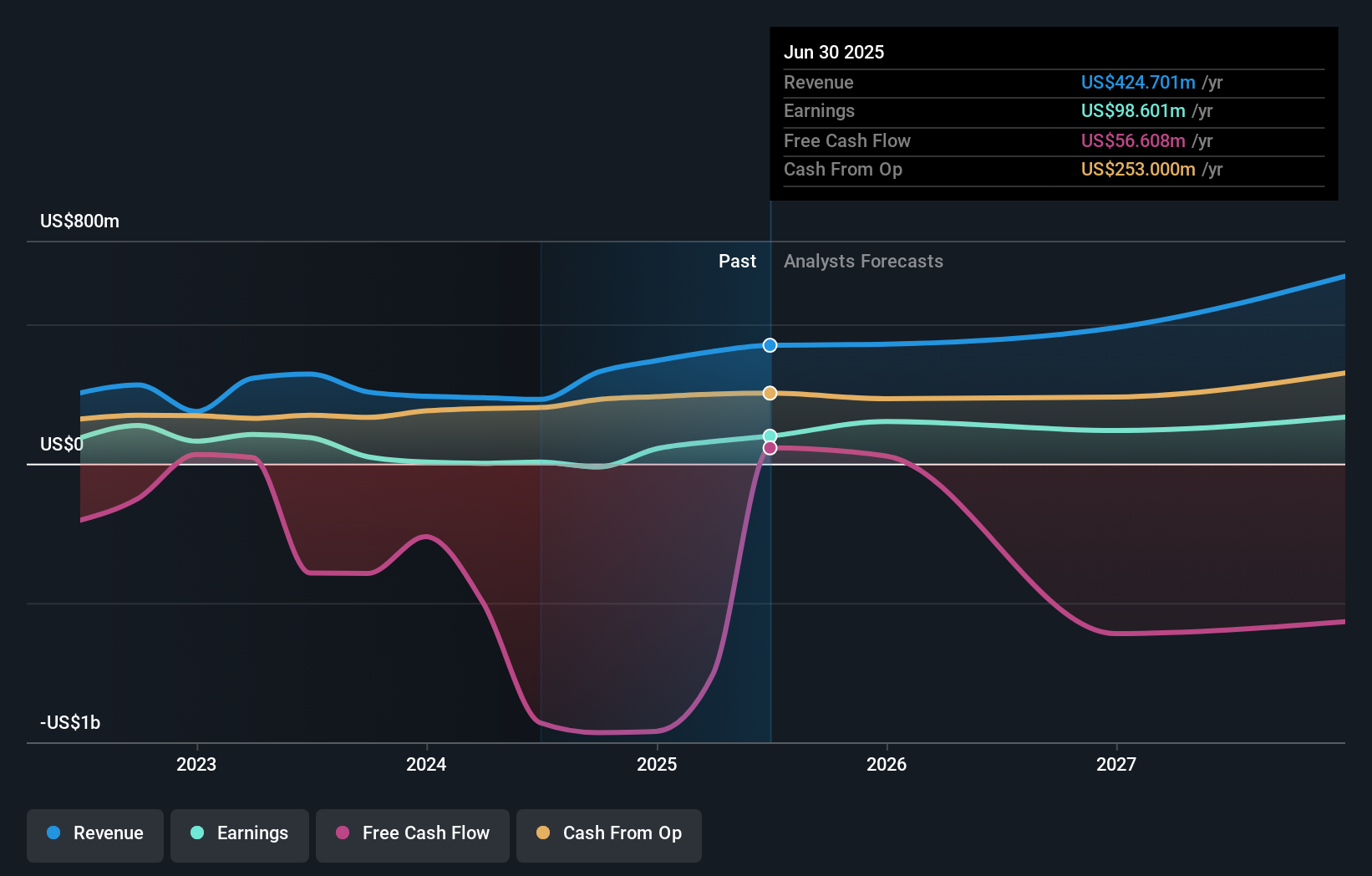

Capital Clean Energy Carriers' outlook anticipates $683.8 million in revenue and $161.0 million in earnings by 2028. This projection implies a 17.2% annual revenue growth rate and a $62.4 million increase in earnings from the current $98.6 million level.

Uncover how Capital Clean Energy Carriers' forecasts yield a $25.80 fair value, a 25% upside to its current price.

Exploring Other Perspectives

One member of the Simply Wall St Community values the company at US$25.80 per share, showing a single data point with no diversity in opinion. With profits now rebounding after a loss last year, there are still significant risks from fluctuating interest expenses that could affect both expectations and performance across the market, review multiple perspectives to see both sides.

Explore another fair value estimate on Capital Clean Energy Carriers - why the stock might be worth as much as 25% more than the current price!

Build Your Own Capital Clean Energy Carriers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Capital Clean Energy Carriers research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Capital Clean Energy Carriers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Capital Clean Energy Carriers' overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCEC

Capital Clean Energy Carriers

A shipping company, provides marine transportation services in Greece.

Acceptable track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives