- United States

- /

- Airlines

- /

- NasdaqGS:AAL

Exploring American Airlines (AAL) Valuation Following Successful Resolution of Airbus A320 Software Glitch

Reviewed by Simply Wall St

American Airlines (AAL) recently resolved a software glitch that affected its Airbus A320 fleet. The company completed updates with little impact on flight schedules, which helped ease concerns about reliability and ongoing operations.

See our latest analysis for American Airlines Group.

Resolving the Airbus A320 software glitch brought a sigh of relief just as American Airlines prepares for high-profile industry conferences. However, investor sentiment remains mixed. Despite a 6.3% gain in the 30-day share price return, its one-year total shareholder return stands at -3.5%. This shows that momentum is recovering, but the stock is still working to regain longer-term ground.

If you’re interested in how legacy carriers stack up, now’s a great time to see the full list of sector peers in our See the full list for free..

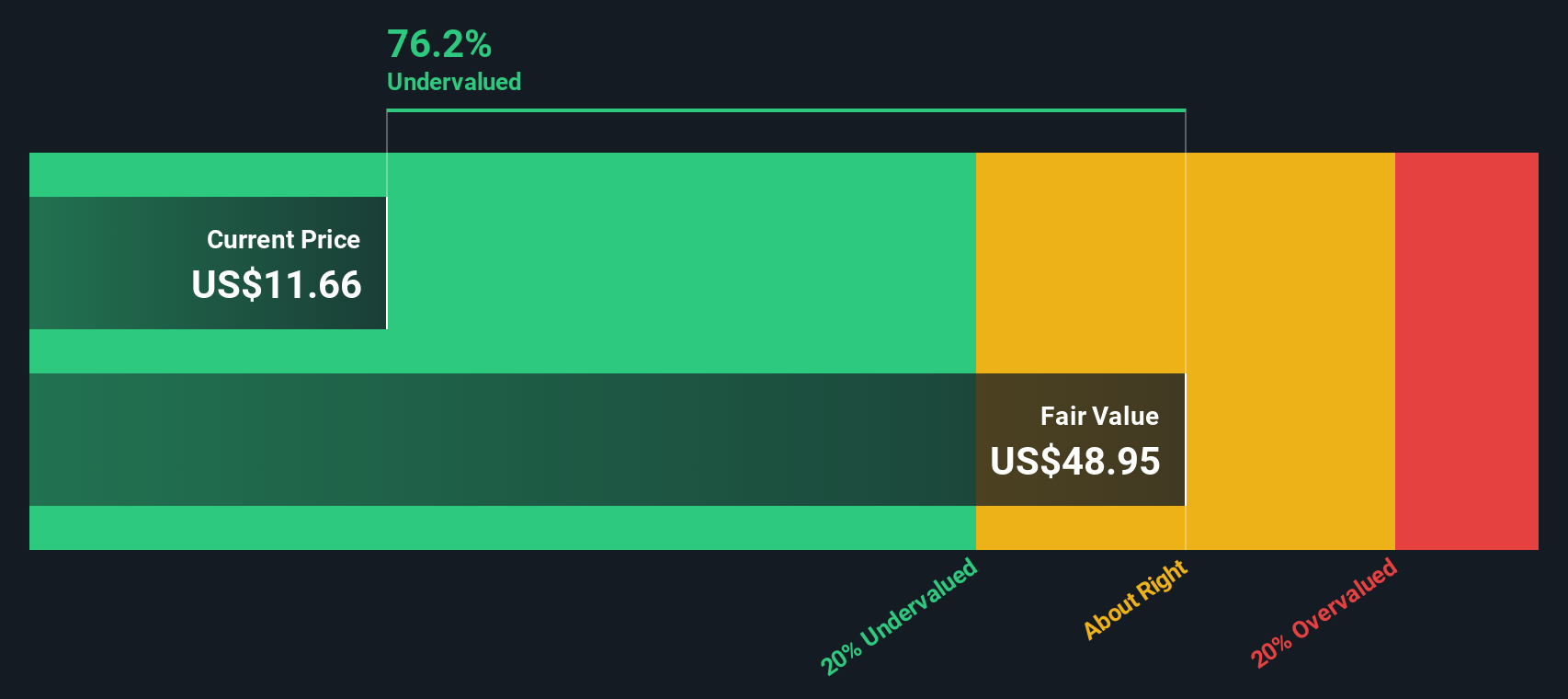

With American Airlines shares still trading at a substantial discount to intrinsic value, but recent gains already reflecting better news, investors now face a classic dilemma: Is this a genuine buying opportunity, or is the market simply pricing in anticipated recovery?

Most Popular Narrative: 31.6% Overvalued

Compared to American Airlines' last close at $13.96, the most followed narrative suggests a fair value that is materially lower. This highlights the contrast with the recent share momentum and prompts a closer look at why some investors remain unconvinced despite operational progress.

There is a single reason why American is the least attractive of US legacy carriers (in terms of investing, anyway): its balance sheet. While most airlines, and certainly those in the US, have significant debt, American's situation is more severe with negative equity. Any startup with a balance sheet like this one would likely struggle to survive.

Curious about the assumptions that drive such a skeptical view? What would it take for a turnaround to be reflected in the numbers? The tension between high growth potential and a precarious capital structure shapes this story, and the ambitious profit forecasts supporting the fair value estimate may challenge conventional thinking about airline valuations.

Result: Fair Value of $10.61 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, easier refinancing or successful premium cabin strategies could quickly challenge the prevailing view that American’s recovery remains out of reach for now.

Find out about the key risks to this American Airlines Group narrative.

Another View: Discounted Cash Flow Perspective

While narrative consensus points to American Airlines being overvalued based on investor sentiment, our SWS DCF model presents a very different story. According to this approach, shares currently trade at a large 40% discount to the model’s fair value. Is the market too pessimistic, or is the model overlooking real risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out American Airlines Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 930 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own American Airlines Group Narrative

If you have a different perspective or want to explore the numbers on your own, you can create a custom narrative in just a few minutes. Do it your way.

A great starting point for your American Airlines Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step ahead of the crowd and spot your next winning opportunity. Filter best-in-class stocks tailored to your investing style with the Simply Wall Street Screener, or you might regret missing out on what's next.

- Unlock potential growth by targeting these 930 undervalued stocks based on cash flows that are trading below their cash flow value and positioned for future market gains.

- Boost your passive income by tapping into these 14 dividend stocks with yields > 3% offering attractive yields and stable financials, suitable for building long-term wealth.

- Stay ahead of disruptive change by focusing on these 25 AI penny stocks positioned to benefit from breakthroughs in artificial intelligence and dynamic industry trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAL

American Airlines Group

Through its subsidiaries, operates as a network air carrier in the United States, Latin America, Atlantic, and Pacific.

Solid track record and good value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026