The Bull Case For AT&T (T) Could Change Following Record 5G Spectrum Integration and Network Expansion

Reviewed by Sasha Jovanovic

- AT&T announced it has rapidly deployed the mid-band spectrum acquired from EchoStar, significantly increasing nationwide 5G download speeds and expanding high-speed network coverage to more than 5,300 cities across 48 states.

- This record-fast integration not only improves wireless and home internet performance for millions but is also expected to enhance operational efficiency and long-term growth by reducing the need for costly new cell sites.

- We'll examine how AT&T's swift mid-band spectrum rollout may reinforce its investment narrative by accelerating nationwide network improvements.

Find companies with promising cash flow potential yet trading below their fair value.

AT&T Investment Narrative Recap

For shareholders, the core belief underpinning an investment in AT&T centers on the company’s ability to expand its high-value mobility and fiber base while maintaining stable cash flows and protecting margins. The rapid integration of EchoStar’s mid-band spectrum meaningfully boosts network quality and 5G capacity, supporting near-term subscriber growth and reducing the urgency for capital-intensive buildouts. However, competitive pressure and elevated postpaid churn remain the most significant risks, which this rollout may moderate but not eliminate.

Among recent developments, AT&T’s $12 billion revolving credit agreement and $17.5 billion delayed draw term loan directly relate to building network capability and supporting continued nationwide 5G and fiber expansion. This financial maneuver is relevant to the company’s catalysts, as access to additional, flexible capital may be essential in rapidly executing ambitious network upgrades like the current spectrum deployment without constraining operating liquidity or growth plans.

Yet, in contrast to these improvements, investors should be aware of the possibility that persistent competitive pressure and increasing churn could still weigh on subscriber growth and margins if...

Read the full narrative on AT&T (it's free!)

AT&T's outlook envisions $130.6 billion in revenue and $17.0 billion in earnings by 2028. This scenario assumes a 1.7% annual revenue growth and a $4.3 billion increase in earnings from the current $12.7 billion level.

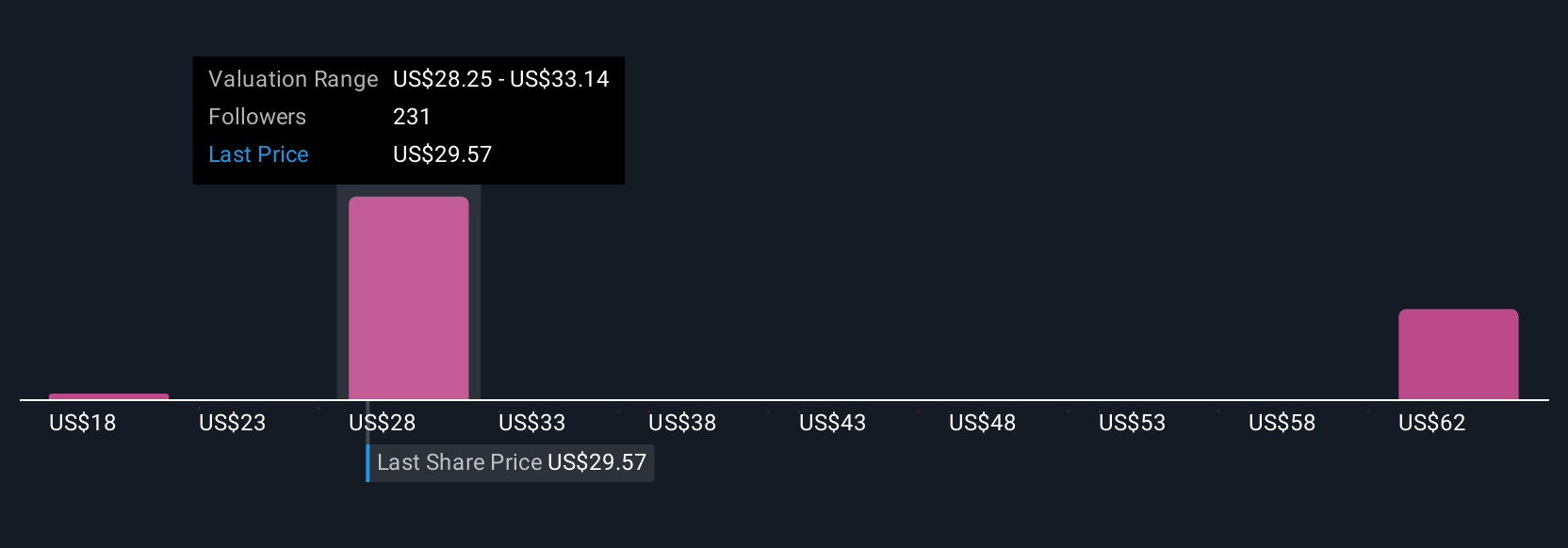

Uncover how AT&T's forecasts yield a $30.99 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Bullish analysts see far greater potential, expecting AT&T’s annual revenues to reach US$130.2 billion and earnings of US$17.6 billion by 2028. Compared to the baseline, these estimates assume investments like the EchoStar spectrum deal will accelerate growth and strengthen margins. This shows just how much forecasts, and your view as an investor, can differ when weighing the impact of recent network advances versus competition risks. It’s important to understand both perspectives as you make your own assessment.

Explore 15 other fair value estimates on AT&T - why the stock might be worth 29% less than the current price!

Build Your Own AT&T Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AT&T research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free AT&T research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AT&T's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:T

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.