Does AT&T’s Recent 19.8% Rally Signal More Room for the Stock in 2025?

Reviewed by Bailey Pemberton

- Curious if AT&T’s share price truly reflects its value right now? You’re not alone, and you’re in the right place to get answers that actually make sense.

- The stock has enjoyed a 19.8% return over the past year, and is up 14.0% year-to-date, signaling growing investor confidence and potentially hinting at some untapped potential.

- Recent headlines have highlighted AT&T's continued investments in expanding its 5G network and strategic moves in fiber-optic deployment. Partners and analysts both see these developments as catalysts for future growth, which has helped boost sentiment behind the recent price surge.

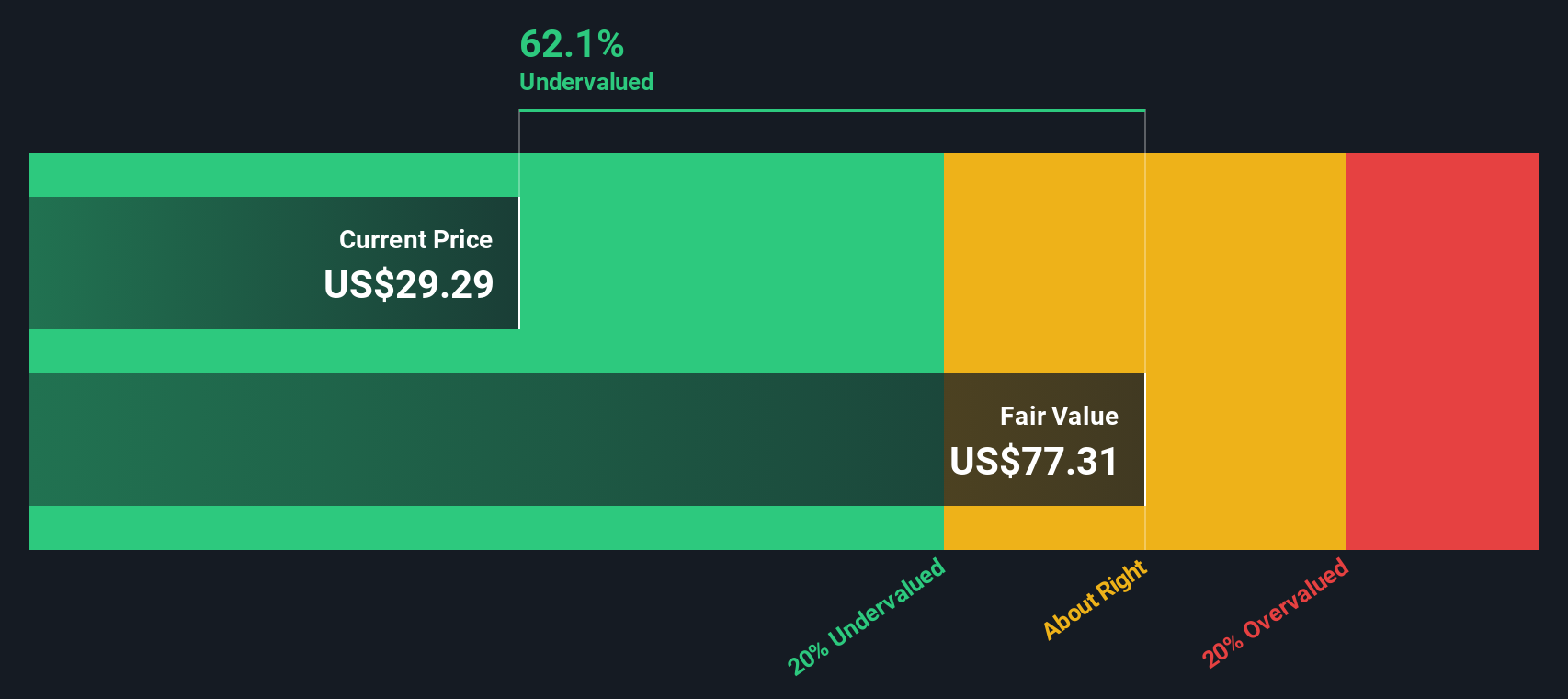

- AT&T lands a 5 out of 6 on our undervaluation checks, which puts it in rare company. Next, let’s dig into the valuation methods themselves. If you stick around, we’ll reveal a smarter way to figure out what the market might be missing.

Approach 1: AT&T Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. For AT&T, this model uses a two-stage process that combines analyst projections for the next five years with longer-term extrapolations.

AT&T’s trailing twelve month Free Cash Flow stands at $21.8 billion. Analyst projections put Free Cash Flow at around $20.3 billion by 2029, and Simply Wall St extends these forecasts out ten years, reaching $24.8 billion by 2035. These cash flows, all reported in USD, are then discounted to reflect their present value.

Based on this analysis, AT&T’s estimated intrinsic value comes to $59.23 per share. With the current share price trading at a 56.1% discount to this value, the DCF analysis indicates significant undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AT&T is undervalued by 56.1%. Track this in your watchlist or portfolio, or discover 915 more undervalued stocks based on cash flows.

Approach 2: AT&T Price vs Earnings

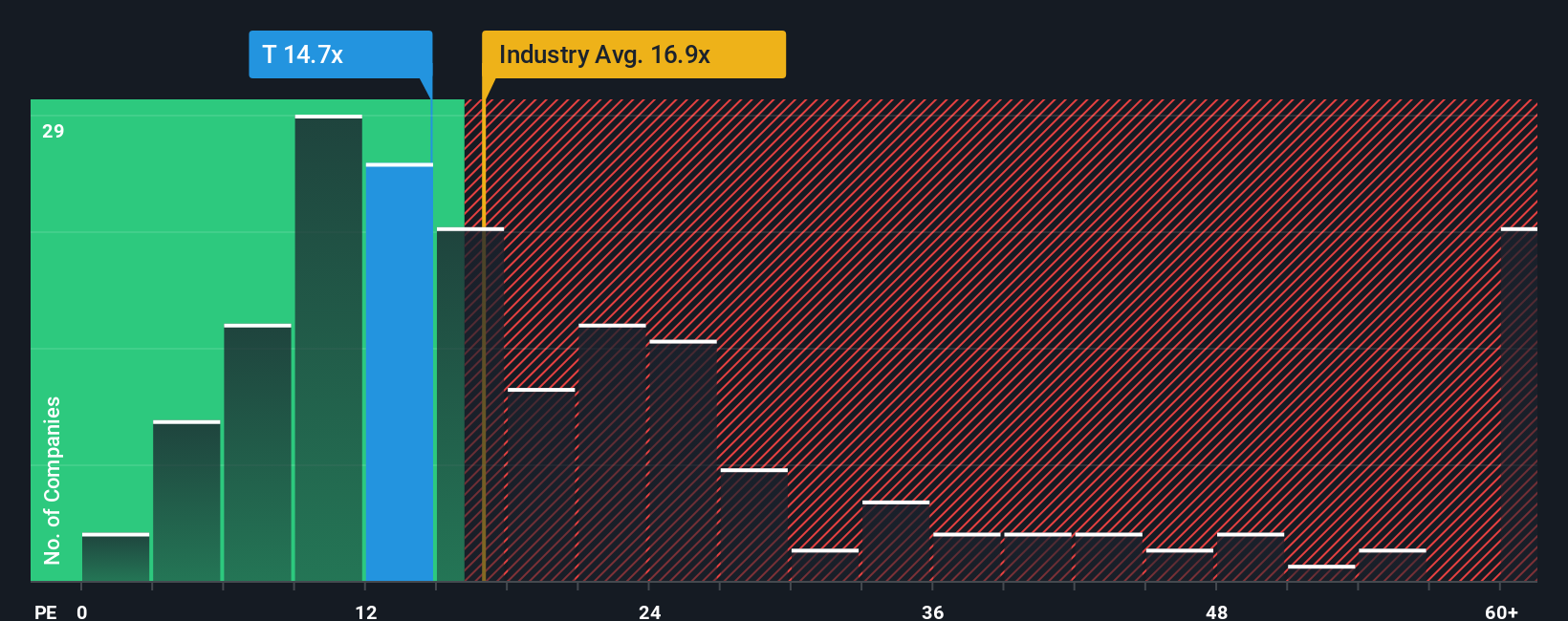

The Price-to-Earnings (PE) ratio is a primary valuation metric for profitable companies like AT&T because it reflects how much investors are willing to pay for each dollar of earnings. It allows you to quickly gauge if a stock is expensive or inexpensive compared to both peers and the broader sector, which is especially useful for established, income-generating businesses.

What counts as a "fair" PE ratio depends on several factors, such as a company’s anticipated growth and the risks it faces. Higher growth prospects and lower risk often justify a higher PE, while uncertainty or slower growth tends to put downward pressure on this multiple.

Currently, AT&T trades at a PE ratio of 8.32x. This is slightly below the peer average of 8.63x and well below the telecom industry average of 16.19x. The proprietary Fair Ratio for AT&T, as calculated by Simply Wall St, is 11.43x. The "Fair Ratio" is a nuanced metric that considers not just market comparisons, but also growth rates, profit margins, industry specifics, and risk factors unique to AT&T. This tailored approach aims to provide a more realistic sense of the stock’s value than simple peer or industry averages can offer.

Because AT&T's current PE of 8.32x is significantly lower than its Fair Ratio of 11.43x, the evidence suggests the stock may be undervalued when accounting for the company's fundamentals and growth profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AT&T Narrative

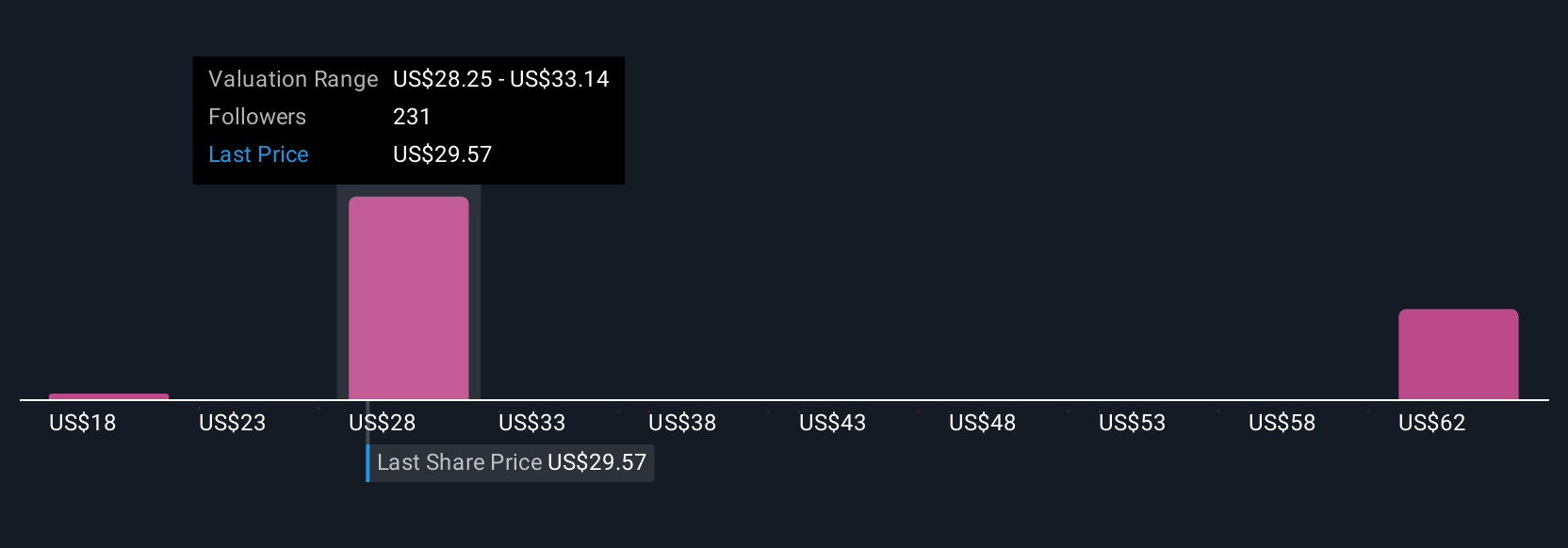

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple way for you to express your own perspective on a company; your story behind the numbers; by linking your assumptions about fair value, revenue, earnings, and profit margins to a big-picture financial forecast.

Narratives connect what is happening in the real world with the company’s financial outlook and translate your expectations directly into a personal fair value estimate. They make complex analysis accessible to everyone, and with millions of investors already using Narratives on Simply Wall St’s Community page, you can instantly see how others are thinking about AT&T (or share your own).

By comparing the Fair Value from your Narrative to the current share price, you can easily decide whether it is a good time to buy or sell. Narratives also update automatically when new events like earnings or news are released, keeping your view current. For example, one AT&T investor might forecast a fair value as high as $34.00, while another, more cautious user might see it as low as $15.49, based on their unique expectations and assumptions.

Do you think there's more to the story for AT&T? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:T

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026