AT&T (T) Partners With Gigs To Revolutionize Mobile Plans Through App Integration

Reviewed by Simply Wall St

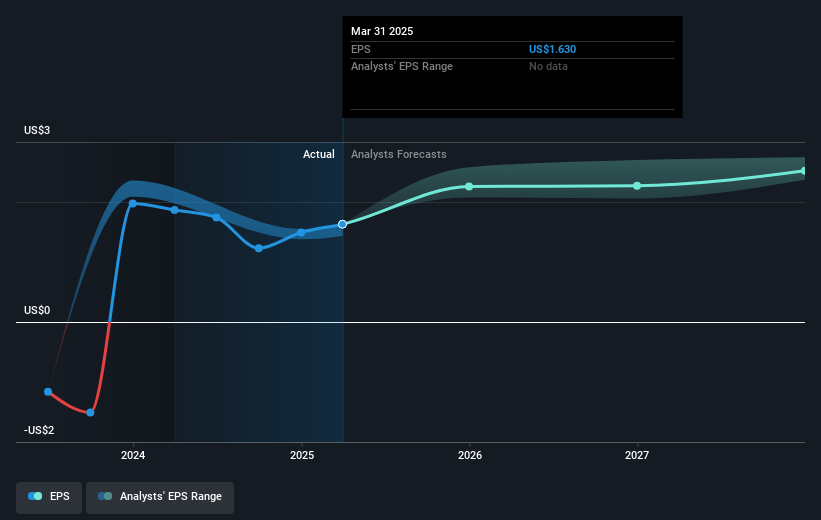

Recently, AT&T (T) announced a transformative partnership with Gigs, aiming to integrate mobile plan delivery into consumer apps—a move that may enhance customer acquisition efficiency and loyalty. Over the last quarter, AT&T's share price increased by 5%, aligning with the broader market trend, which also saw positive movements. The tech-heavy Nasdaq's robust performance, boosted by a broader rise in tech stocks, mirrors a strong sectoral momentum that may have supported AT&T's price increase. Additionally, AT&T’s positive earnings report, including boosted revenue and net income growth, likely added strength to its quarterly stock performance.

AT&T has 3 weaknesses we think you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent collaboration between AT&T and Gigs may significantly impact the company's strategic direction, particularly with efforts to optimize customer acquisition and boost loyalty through mobile app integrations. This initiative aligns with AT&T’s focus on enhancing its telecommunications network through 5G and fiber investments, potentially bolstering market share and improving net margins through operational efficiencies. Over a longer three-year period, AT&T shares achieved a total return of 109.71%, including dividends, reflecting resilience and value generation despite competitive and regulatory challenges.

In the past year, AT&T's return performance surpassed the US Telecom industry, which returned 16.4%, indicating relative strength in its strategic initiatives and market positioning. The announcement of the partnership with Gigs could further influence revenue and earnings forecasts, potentially enhancing growth aspects through innovative service offerings and improved customer retention. With the current share price of US$29.49 closely approaching the price target of US$30.62, the company seems to have a narrow margin for movement according to consensus analyst estimates, highlighting the importance of continued operational success and strategic implementation in achieving higher valuations.

Review our historical performance report to gain insights into AT&T's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:T

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026