- United States

- /

- Telecom Services and Carriers

- /

- NYSE:LUMN

Lumen Technologies (LUMN): Losses Deepen With 27.5% Annual Pace, Profitability Remains Elusive

Reviewed by Simply Wall St

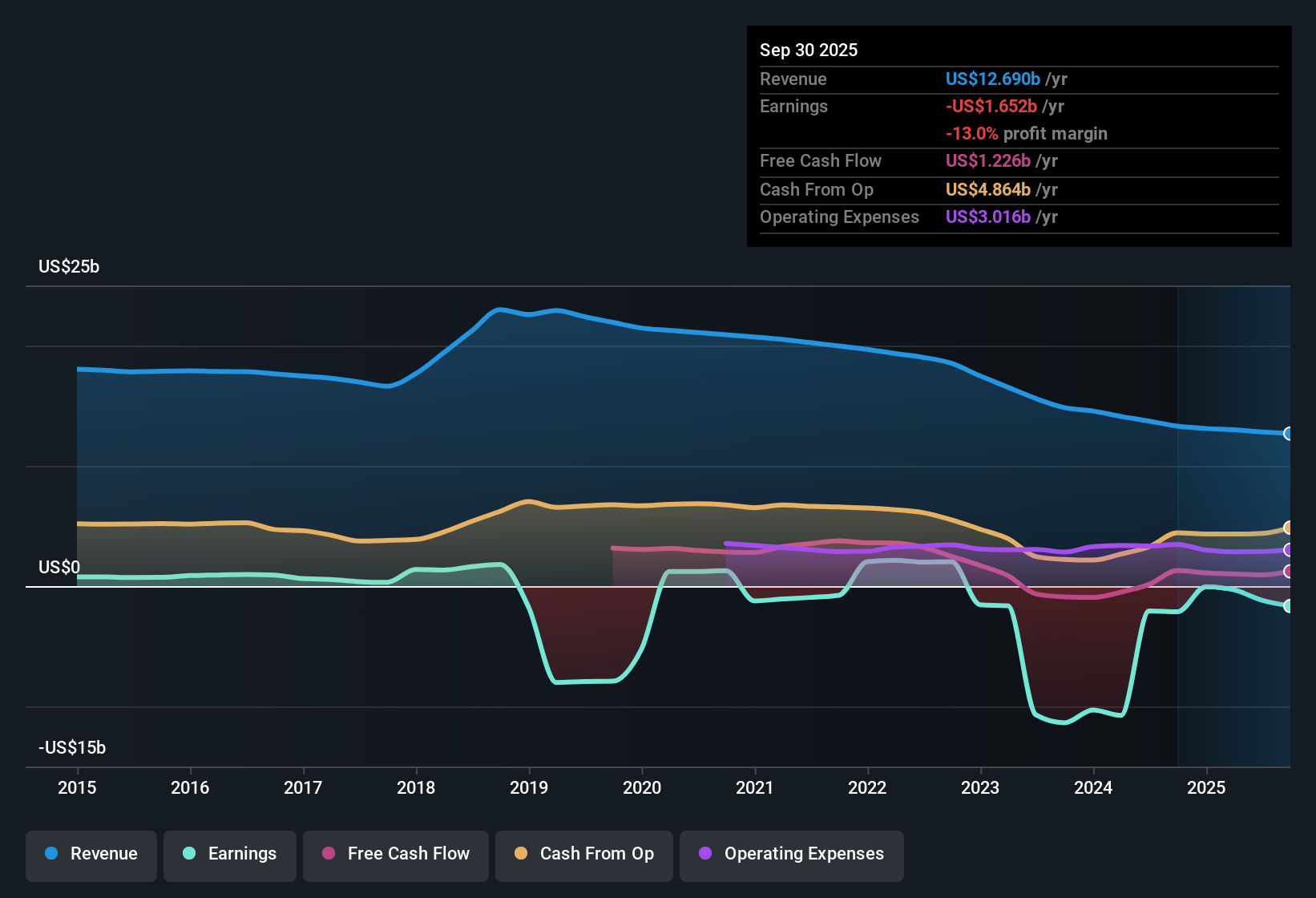

Lumen Technologies (LUMN) remains unprofitable, with losses accelerating by 27.5% per year over the past five years. Revenue is projected to decline by 4.2% per year for the next three years, and profit margins have shown no improvement according to the latest figures, with the company continuing to report losses. The main draw for investors is its relatively low Price-to-Sales Ratio of 0.8x; however, this is offset by both a lack of profitability and ongoing share price instability in recent months.

See our full analysis for Lumen Technologies.Next up, we will examine how these latest numbers compare against the current community and analyst narratives, highlighting where expectations match reality and where surprises might have emerged.

See what the community is saying about Lumen Technologies

Debt Reduction Moves May Lower Interest Costs

- Lumen’s pending sale of its consumer fiber-to-the-home business to AT&T is expected to lower annual interest expense by $300 to $400 million and provide capital for enterprise-focused growth.

- According to the analysts' consensus view, strategic refinancing and deleveraging should help modernize the network, but persistent debt pressure and capital requirements may keep long-term financial resilience in question.

- Analysts highlight that while asset sales and refinancing will reduce leverage, ongoing high capital expenditures and debt pose risks to future cash flows and margin stability.

- Despite these efforts, Lumen’s balance sheet will still carry substantial obligations, leaving it exposed if cost savings from restructuring do not materialize quickly.

- To see how analysts break down Lumen’s risks and growth pivots, here's the full consensus narrative for a deeper look: 📊 Read the full Lumen Technologies Consensus Narrative.

AI and Digital Contracts Offer Margin Lift

- Lumen’s large pipeline of AI-driven network infrastructure and platform connectivity contracts with hyperscalers and data centers is expected to generate higher-margin, long-duration recurring revenues and boost operating leverage.

- The analysts' consensus notes that, despite ongoing legacy product declines and competitive headwinds, business refocus on high-growth digital and enterprise platforms is set to stabilize EBITDA and may set the stage for margin expansion.

- Consensus narrative points out that new digital platform and NaaS contracts with enterprise and cloud partners expand commercial reach and network utilization, supporting long-term operating improvements.

- However, the pace of margin gains will depend on successfully offsetting double-digit decline rates in legacy revenues, which analysts caution remains a tall order for near-term earnings growth.

Valuation Balanced Between Risks and Sale Multiples

- Lumen’s Price-to-Sales Ratio of 0.8x is a steep discount to the US Telecom average of 1.2x and peer average of 7.2x, yet its share price of $10.28 sits well above the DCF fair value of $0.78.

- The analysts' consensus narrative frames Lumen as neither deeply undervalued nor overly expensive given current expectations, since the analyst target of $5.28 is about 49% below the current share price, reflecting how ongoing losses and debt risks balance out any value signal from low sales multiples.

- Consensus view suggests that for Lumen to be genuinely cheap at today’s price, the market needs to believe that margins will rebound toward industry levels by 2028 and that cost-cutting plus digital growth will overcome legacy declines.

- However, the limited gap between price and target signals skepticism among analysts about rapid improvement, making valuation a toss-up unless key catalysts deliver soon.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Lumen Technologies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on these numbers? Share your view and shape your own narrative in just a few minutes. Do it your way.

A great starting point for your Lumen Technologies research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Lumen’s persistent losses, heavy debt burden, and uncertain margin rebound demonstrate ongoing financial health challenges that put its future stability at risk.

If you prefer companies with stronger balance sheets and less exposure to these risks, discover healthier alternatives with solid balance sheet and fundamentals stocks screener (1981 results) designed to withstand market and economic uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUMN

Lumen Technologies

A networking company, provides integrated products and services to business and mass customers in the United States and internationally.

Undervalued with low risk.

Similar Companies

Market Insights

Community Narratives