- United States

- /

- Telecom Services and Carriers

- /

- NYSE:LUMN

Lumen Technologies (LUMN): Assessing Valuation After New AI Security and Networking Product Launches

Reviewed by Simply Wall St

Lumen Technologies has announced a series of new product launches focused on AI-driven security and enterprise networking. Highlights include expanded cloud protection for AWS customers and a managed threat detection offering in partnership with Microsoft.

See our latest analysis for Lumen Technologies.

Lumen Technologies has packed the past few weeks with high-impact launches and new collaborations, each spotlighting bolder AI-driven security and networking capabilities. This momentum seems to have woken up the market, with Lumen’s share price rallying 75.6% over the past 90 days. Even with volatility in the last month, the company’s total return for investors is up 23% over the past year, suggesting confidence is building around its transformation story and growth runway.

If you’re interested in finding more companies driving growth with advanced technology, check out the latest movers in our tech and AI growth screener, See the full list for free.

So with a powerful rally underway, but considering a volatile history and plenty of investor skepticism, is Lumen still flying under the radar as a bargain? Or is all that future growth already reflected in the current price?

Most Popular Narrative: 14.6% Overvalued

Lumen Technologies’ most widely followed narrative suggests that the stock trades above its fair value estimate, which is based on forecasts for normalization in earnings amid ongoing revenue headwinds. This signals that the bullish recovery in share price has moved ahead of analyst consensus fair value expectations.

Lumen's large pipeline of AI-driven network infrastructure and Platform Connectivity Fiber (PCF) contracts, particularly with hyperscalers and data center providers, positions the company to capture long-duration, higher-margin recurring revenues from explosive data growth. This benefits long-term revenue and margin expansion. Growing adoption of Lumen's Network-as-a-Service (NaaS) and digital platform by enterprise customers, combined with upcoming integrations into major cloud and tech solution marketplaces, expands commercial reach and improves network utilization, supporting future revenue acceleration and operating leverage.

Curious how ambitious contract wins and cloud partnerships could shake up Lumen’s valuation math? The dominant narrative claims a turnaround, driven by bold projected margin gains and a hard pivot from legacy business. Want the inside track on the powerful assumptions, like what margin leap and revenue mix shift are baked in? Click to see what's driving this controversial fair value.

Result: Fair Value of $7.23 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in legacy revenue and continued execution challenges could quickly undermine the current optimism surrounding Lumen’s turnaround narrative.

Find out about the key risks to this Lumen Technologies narrative.

Another View: Comparing Price Ratios

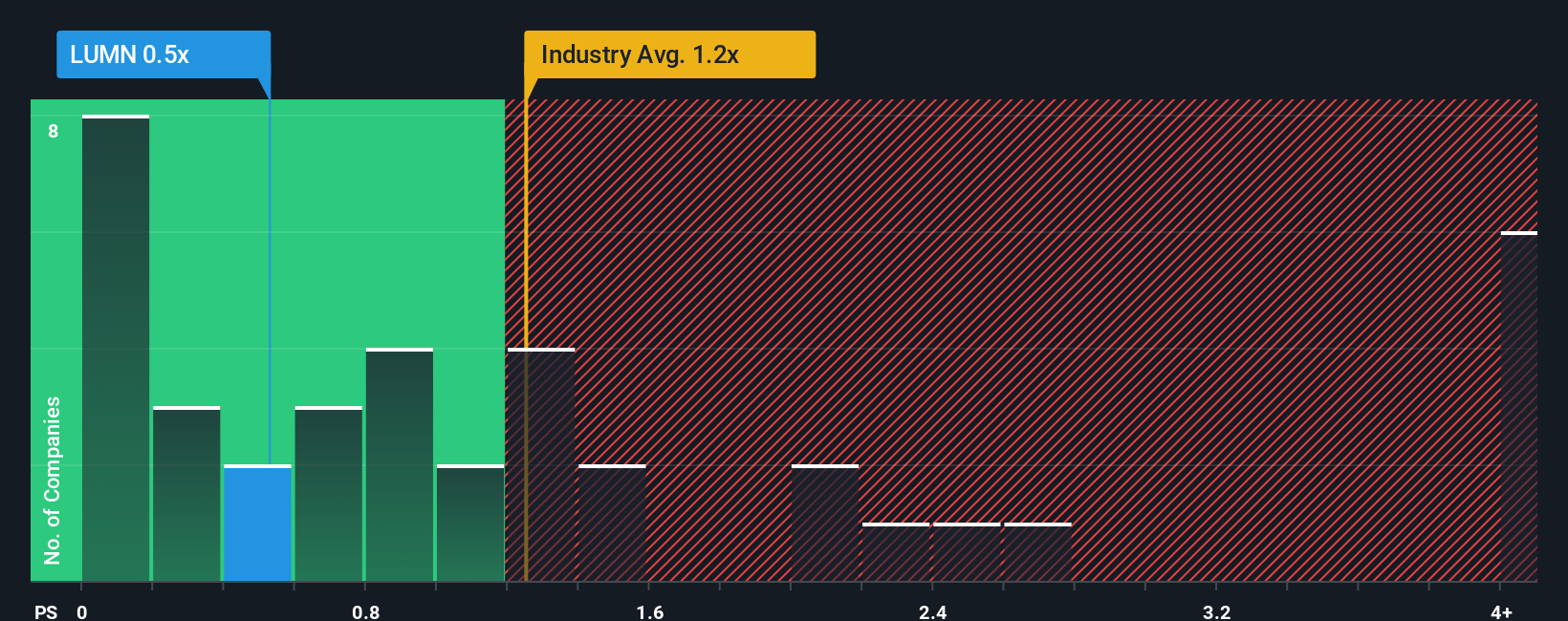

While analysts argue Lumen Technologies is trading above its fair value, our price-to-sales ratio analysis suggests a different story. With a ratio of just 0.7x compared to the peer average of 7.9x and a fair ratio of 1.3x, the shares look inexpensive relative to both competitors and market expectations. Does this disconnect reveal real opportunity, or are there unseen risks holding the price back?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lumen Technologies Narrative

If you want to challenge the consensus or dig deeper into the numbers, you can build your own perspective in just a few minutes. Do it your way

A great starting point for your Lumen Technologies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take your investment strategy to the next level with top picks you might miss otherwise. The market will not wait, so act decisively and stay ahead of the crowd.

- Spot income opportunities and boost your portfolio’s yield as you check out these 14 dividend stocks with yields > 3% paying over 3% annually.

- Ride the wave of innovation by targeting these 25 AI penny stocks leading breakthroughs and shaping tomorrow’s technology landscape.

- Catch the next growth story early by scanning these 3565 penny stocks with strong financials with solid financials and market potential before everyone else does.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUMN

Lumen Technologies

A networking company, provides integrated products and services to business and mass customers in the United States and internationally.

Undervalued with low risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026