- United States

- /

- Wireless Telecom

- /

- NasdaqCM:VEON

QazCode–MeetKai AI Partnership Might Change The Case For Investing In VEON (VEON)

Reviewed by Sasha Jovanovic

- In late November 2025, VEON Ltd. announced that its software company QazCode signed a cooperation agreement with MeetKai to develop and train large language models for new AI-based digital products across Kazakhstan, Uzbekistan, Ukraine, Pakistan, and Bangladesh.

- This collaboration highlights VEON’s focus on creating AI solutions with deep regional language capabilities and cultural understanding, aiming to bring localized digital services to over 150 million customers.

- We'll explore how expanding local-language AI development through the QazCode–MeetKai partnership may shape VEON's investment outlook.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

VEON Investment Narrative Recap

For those considering VEON, the key investment story centers on the company’s transformation into a regionally focused digital services provider, aiming to unlock long-term growth by deepening local integration and technology deployment. The new QazCode–MeetKai partnership reaffirms VEON's ambition to lead in locally relevant AI, but does not have a material impact on the most pressing short-term catalyst: sustaining local-currency revenue growth while managing sharp currency devaluations and margin pressures across core emerging markets.

The announcement that VEON has reaffirmed its 2025 revenue guidance, anticipating 13-15% local-currency growth, is particularly relevant in this context, as it signals management’s commitment to delivering near-term financial targets despite recent operating losses and exposure to volatile regional currencies. The roll-out of new AI-powered digital products via QazCode may broaden VEON’s digital footprint, but supporting growth and margin expansion amid heavy ongoing investment and macroeconomic headwinds remains the central challenge shareholders must monitor most closely.

By contrast, investors should be aware that a rapid shift to digital services could pressure group EBITDA margins if operating costs climb or...

Read the full narrative on VEON (it's free!)

VEON's narrative projects $5.1 billion in revenue and $688.2 million in earnings by 2028. This requires 7.0% yearly revenue growth but a $295.8 million decrease in earnings from current earnings of $984.0 million.

Uncover how VEON's forecasts yield a $69.64 fair value, a 30% upside to its current price.

Exploring Other Perspectives

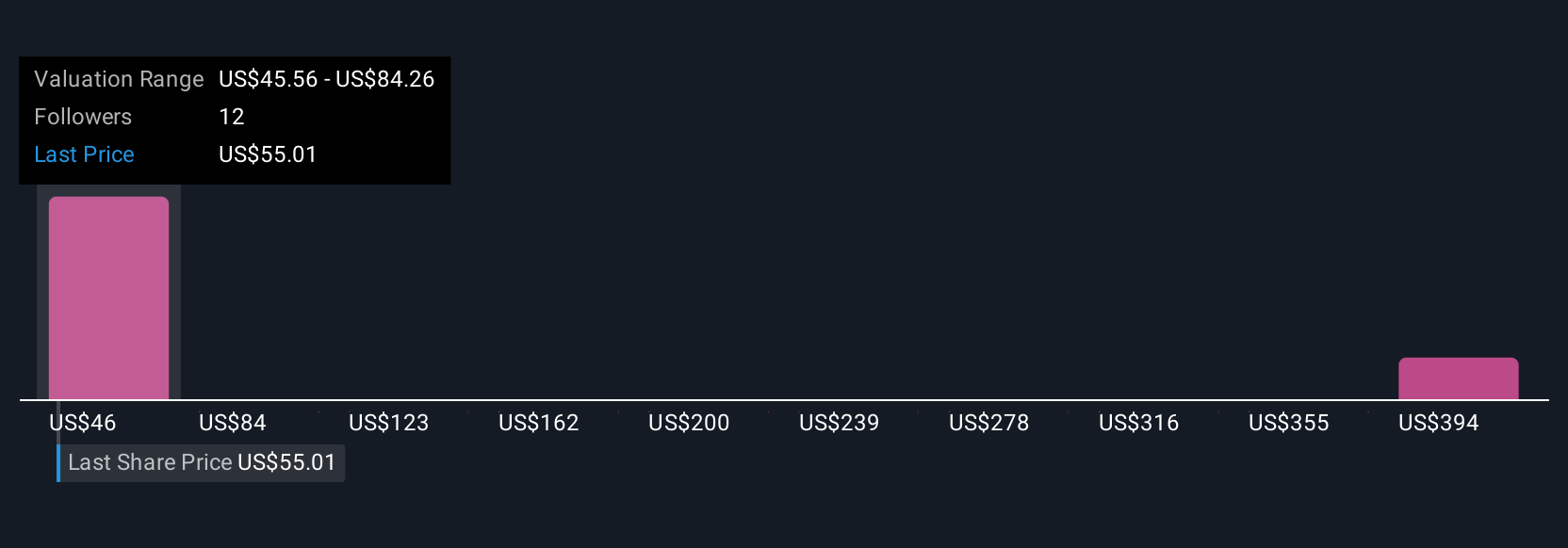

Four fair value estimates from the Simply Wall St Community range from US$45.56 to US$501.52 per share. While views diverge, many remain focused on VEON’s ongoing local-currency growth targets and their significance for future performance, explore how differing forecasts can shape your understanding of value.

Explore 4 other fair value estimates on VEON - why the stock might be worth 15% less than the current price!

Build Your Own VEON Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VEON research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free VEON research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VEON's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VEON

VEON

A digital operator, provides telecommunications and digital services to corporate and individual customers in Pakistan, Ukraine, Kazakhstan, Uzbekistan, and Bangladesh.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026