Why Vishay (VSH) Is Up 9.3% After Launching New EV Battery and Charging Components

Reviewed by Sasha Jovanovic

- In late November 2025, Vishay Intertechnology announced the release of two new automotive-qualified components: a 1,500 V solid-state relay for electric vehicle battery monitoring and a 30 W thick film power resistor for on-board charging and motor control applications.

- These product launches demonstrate Vishay's ongoing push to address high-voltage and reliability needs for next-generation electric vehicles and industrial energy storage systems.

- We'll examine how Vishay's introduction of advanced EV battery components shapes its investment narrative and prospects in high-growth markets.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Vishay Intertechnology Investment Narrative Recap

To be a shareholder in Vishay Intertechnology, you have to believe in the company’s ability to leverage its vast product portfolio and recent capacity expansion to capture rising demand in automotive electrification, smart grid infrastructure, and industrial automation. The late November launches of advanced automotive-qualified components reinforce Vishay's positioning for growth in these markets but do not materially change its most important near-term catalyst: a reversal of recent profitability challenges, especially as ongoing margin pressure remains a key risk for the business right now.

Among recent announcements, Vishay’s Board declared a US$0.10 per share dividend on November 19, 2025. While this supports the company’s aim to return value to shareholders, the sustainability of cash distributions remains closely linked to Vishay’s ability to improve operating margins and generate positive free cash flow, given its current earnings profile and heavy investment phase.

However, investors should not overlook the risk that continued margin challenges and ongoing negative cash flow...

Read the full narrative on Vishay Intertechnology (it's free!)

Vishay Intertechnology's narrative projects $3.5 billion revenue and $587.0 million earnings by 2028. This requires 6.6% yearly revenue growth and a $674.7 million increase in earnings from the current -$87.7 million.

Uncover how Vishay Intertechnology's forecasts yield a $14.00 fair value, in line with its current price.

Exploring Other Perspectives

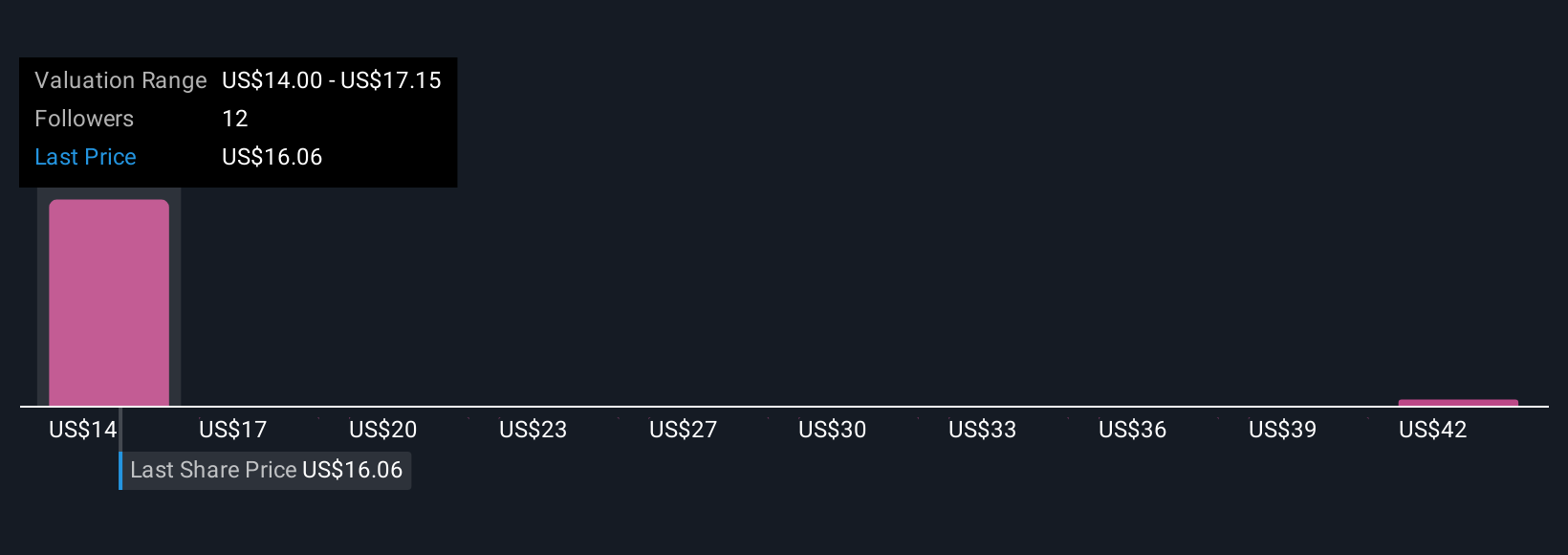

Simply Wall St Community members assigned Vishay’s fair value anywhere from US$6.87 to US$45.54, based on three distinct perspectives. The persistent margin and profitability headwinds highlighted by analysts only underline why investors may arrive at such different views on future performance.

Explore 3 other fair value estimates on Vishay Intertechnology - why the stock might be worth over 3x more than the current price!

Build Your Own Vishay Intertechnology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vishay Intertechnology research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Vishay Intertechnology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vishay Intertechnology's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VSH

Vishay Intertechnology

Manufactures and sells discrete semiconductors and passive electronic components in the United States, Germany, rest of Europe, Israel, and Asia.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026