- United States

- /

- Communications

- /

- NYSE:UI

Ubiquiti (UI) Reports US$664M Sales In Third Quarter

Reviewed by Simply Wall St

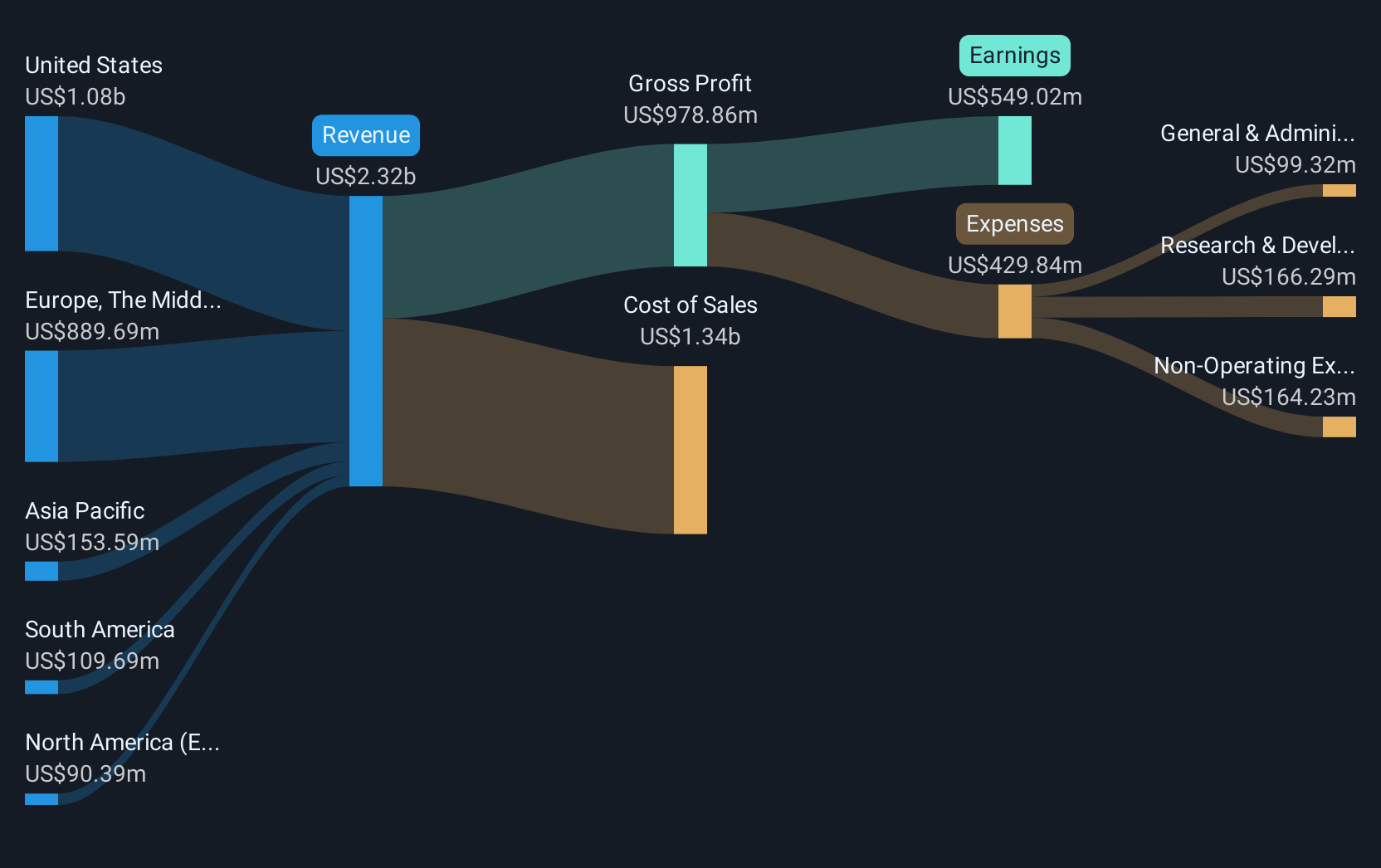

Ubiquiti (UI) recently experienced a notable shift when it was removed from several prominent Russell indices on June 28 and 30, 2025, marking a significant event in its trading narrative. Alongside these index removals, the company reported impressive third-quarter earnings, with sales rising to $664 million and net income reaching $180 million. This performance, coupled with strategic financial results, likely played a pivotal role in driving Ubiquiti's price movement, which soared by 50% over the past quarter. This robust increase contrasts with the broader market's more moderate performance, highlighting Ubiquiti's individual growth narrative amidst market dynamics.

Ubiquiti has 1 weakness we think you should know about.

Over the past year, Ubiquiti (UI) reported a significant total shareholder return of 170.14%, reflecting a robust appreciation in share price alongside dividend payouts. This performance contrasts with the US market return of 12.4% and the US Communications industry return of 34.6% over the same period, underscoring Ubiquiti's impressive relative strength.

The removal from the Russell indices and the publication of strong third-quarter earnings appear to have contributed positively to Ubiquiti's financial outlook. The company's revenue and net income growth observed in recent quarters could influence future earnings forecasts, potentially reinforcing investor confidence. However, it is important to juxtapose this share price rally against a current target price of US$343.50, which suggests a discount that may imply different market expectations.

Examine Ubiquiti's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UI

Ubiquiti

Develops networking technology for service providers, enterprises, and consumers.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives