TE Connectivity (TEL): Examining Valuation After Record Q4 Revenue and Optimistic Growth Outlook

Reviewed by Simply Wall St

TE Connectivity (TEL) just posted a record fourth-quarter revenue, supported by healthy demand in both its Transportation and Industrial divisions. Management is optimistic and cites growth prospects related to AI, automotive electrification, and energy-grid upgrades.

See our latest analysis for TE Connectivity.

After a stellar fourth quarter and upbeat outlook, TE Connectivity's momentum has been strong this year, with a year-to-date share price return of 60.8% and a one-year total shareholder return of nearly 52%. Recent positives such as higher revenues and a notable drop in short interest suggest investors are embracing its growth story, even after a brief pullback in the last month.

If you’re interested in what other innovative tech-industrial companies are up to this season, now’s the time to explore See the full list for free.

But with such a surge in performance and optimism already reflected in the price, is TE Connectivity still trading at an attractive valuation, or has the market already accounted for all of this expected growth?

Most Popular Narrative: 16.3% Undervalued

TE Connectivity’s most widely followed valuation narrative points to a fair value of $270.24 per share, which is well above the latest closing price of $226.15. This perspective emphasizes robust growth drivers, margin expansion, and high-conviction financial forecasts in the years ahead.

Structural investments in manufacturing localization (over 70% now localized) and operational footprint optimization have enabled margin expansion, highlighted by Industrial segment margins rising nearly 400bps year-over-year. This is expected to continue to support strong incremental earnings conversion as volumes grow.

How aggressive are the forecasts behind this optimistic price estimate? Discover the margin targets and profit growth assumptions analysts are considering as potential drivers for further upside. One projection, in particular, could influence your perspective on what is possible for TEL.

Result: Fair Value of $270.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing demand in key AI or energy segments, or challenges with supply chain and manufacturing optimization, could quickly temper this optimistic growth outlook.

Find out about the key risks to this TE Connectivity narrative.

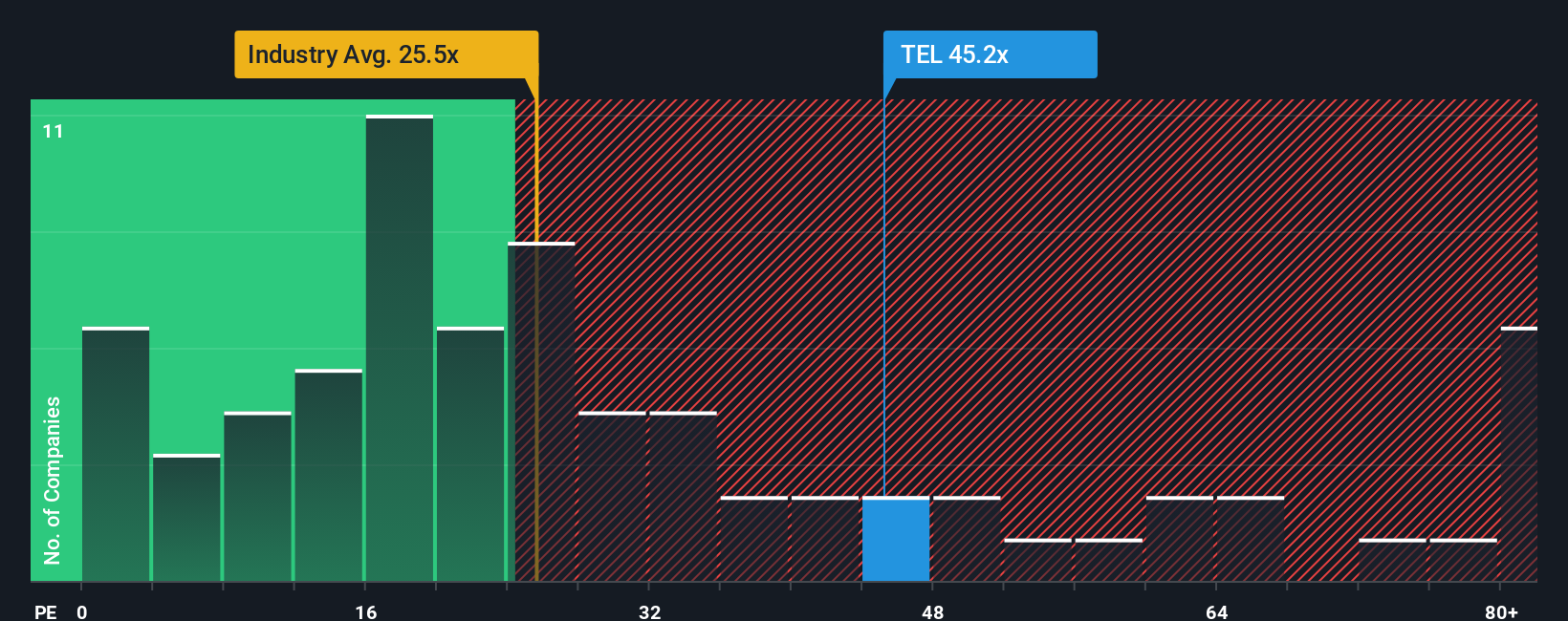

Another View: Market Multiples Suggest a Rich Valuation

While some see TE Connectivity as undervalued based on growth forecasts, a look at price-to-earnings multiples tells another story. The company's ratio of 36.1x is noticeably higher than both the US Electronic industry average of 24x and the peer average of 35.2x. Even compared to a fair ratio of 32.5x, TE Connectivity trades at a premium. This suggests investors are already paying up for future potential. Could this premium signal higher risk if the growth story falters?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TE Connectivity Narrative

If you have your own perspective or want to dive deeper, you can easily build your own view in just a few minutes. Do it your way

A great starting point for your TE Connectivity research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Winning Investment Ideas?

Don't let fresh opportunities pass you by. Make your portfolio stand out by tapping into unique stock ideas that fit your goals and risk tolerance.

- Turbocharge your income by tapping into these 15 dividend stocks with yields > 3% and access top companies delivering high dividend yields with sustainable cash flows.

- Stay ahead of the curve with these 25 AI penny stocks and spot emerging leaders at the frontier of artificial intelligence innovation.

- Capitalize on hidden value by checking out these 913 undervalued stocks based on cash flows that our analysts believe are trading below their true worth at this time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TE Connectivity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TEL

TE Connectivity

Manufactures and sells connectivity and sensor solutions in Europe, the Middle East, Africa, the Asia–Pacific, and the Americas.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026