- United States

- /

- Tech Hardware

- /

- NYSE:PSTG

Pure Storage (PSTG): Exploring Current Valuation Following Recent Share Price Pullback

Reviewed by Simply Wall St

See our latest analysis for Pure Storage.

Despite a 10.3% dip in the past month, Pure Storage still stands out for its impressive momentum, with a 41.7% year-to-date share price return and an even stronger one-year total shareholder return of nearly 67%. This trend reflects sustained investor interest and confidence in Pure Storage’s long-term growth story.

If tech’s current run has you curious about other market leaders, now is a prime moment to discover See the full list for free.

Yet with strong recent gains and robust business growth, the question remains: is Pure Storage undervalued at today’s price, or have markets already accounted for all the company’s future prospects, leaving little room for upside?

Most Popular Narrative: 4% Undervalued

At the latest closing price of $88.55, the most widely referenced narrative estimates Pure Storage’s fair value at $92.21. Analyst projections and market optimism are influencing sentiment in a bullish direction. However, the narrative’s foundation comes from assumptions about earnings growth and industry leadership.

Momentum in subscription-based offerings like Evergreen//One and Cloud Block Store, demonstrated by strong annual recurring revenue (ARR) growth, a rising share of total revenue, and robust RPO backlog, improves revenue predictability, reduces earnings volatility, and supports higher overall gross margin.

Want to see what’s driving Pure Storage’s value in the eyes of analysts? Forecast-beating revenues, significant profit margin improvements, and a premium future multiple are central to this narrative. Could the key to its current price be in assumptions few are willing to make public? Find out what numbers are fueling this valuation.

Result: Fair Value of $92.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing competition and uncertainties in cloud transition could challenge Pure Storage’s growth narrative. These factors may potentially impact revenue predictability and future valuations.

Find out about the key risks to this Pure Storage narrative.

Another View: Market Ratios Tell a Different Story

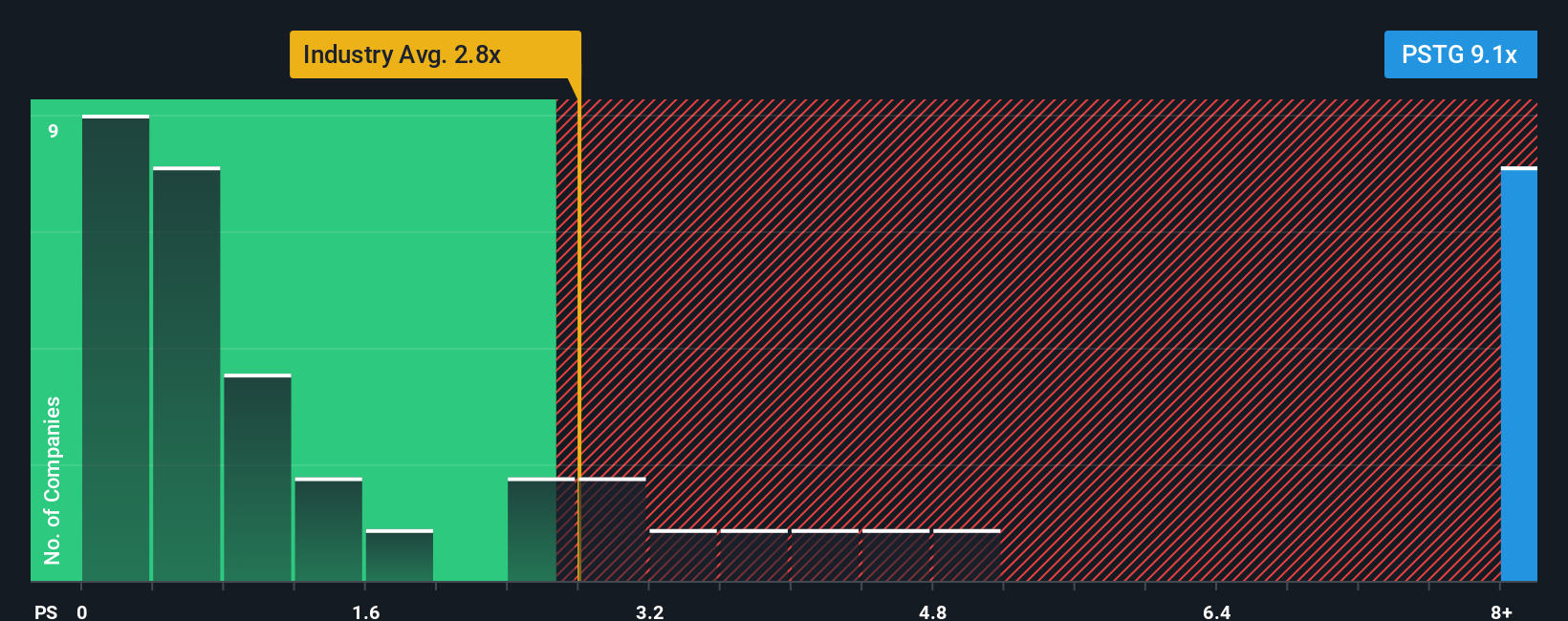

Looking at Pure Storage’s price-to-sales ratio of 8.7x, the shares appear expensive compared to the US Tech industry’s 1.6x average and peers at 2.1x. While our fair ratio estimate sits higher at 11.9x, the current premium could signal higher valuation risk if growth expectations waver. Does the market’s optimism leave little margin for error?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pure Storage Narrative

If you want to examine Pure Storage’s financials firsthand, you can build and test your own view of its value in under three minutes. Do it your way

A great starting point for your Pure Storage research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Missing out on fresh opportunities can cost more than you think. Take the lead and put your curiosity to work by checking out these exceptional investment themes.

- Capitalize on disruptive tech by targeting these 25 AI penny stocks, which are pushing the boundaries of artificial intelligence innovation and shaping tomorrow’s digital landscape.

- Secure passive income and potential stability by reviewing these 14 dividend stocks with yields > 3%, offering attractive yields above 3% for investors focused on long-term returns.

- Get ahead of market trends with these 81 cryptocurrency and blockchain stocks, which tap into blockchain breakthroughs and the expanding world of digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSTG

Pure Storage

Provides data storage and management technologies, products, and services in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026