- United States

- /

- Communications

- /

- NYSE:MSI

Will Strong Q3 Results and Steady Outlook Reshape Motorola Solutions' (MSI) Investment Narrative?

Reviewed by Sasha Jovanovic

- On October 30, 2025, Motorola Solutions reported third quarter results with revenue of US$3.01 billion and net income of US$562 million, alongside maintaining full-year 2025 revenue guidance of approximately US$11.65 billion.

- The company also advanced its long-term buyback program, repurchasing over 258,000 shares last quarter, while confirming expectations of strong revenue growth in the fourth quarter.

- We’ll explore how the company’s reaffirmed revenue growth projections and stable earnings profile may influence its forward-looking investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Motorola Solutions Investment Narrative Recap

To be a shareholder in Motorola Solutions, you need strong conviction in the ongoing transition from legacy hardware to high-margin software and managed service offerings, all relying on robust, recurring demand from public safety and government clients. The Q3 results and reaffirmed full-year guidance signal consistency and should support the key near-term catalyst, strong fourth-quarter revenue growth expectations, while not materially changing the main risk: long-term pressure on core LMR and MCN products as broadband and open-source solutions expand.

Among the latest announcements, the confirmation of approximately 11% expected revenue growth in the fourth quarter stands out, spotlighting order stability and resilience in Motorola's customer base. This outlook directly addresses short-term growth priorities but does not fully address the structural risk of technology shifts and eventual migration away from traditional communication platforms.

By contrast, any such gradual disruption to Motorola’s legacy portfolio represents a risk investors should be mindful of, especially as ...

Read the full narrative on Motorola Solutions (it's free!)

Motorola Solutions' outlook forecasts $13.8 billion in revenue and $2.8 billion in earnings by 2028. This scenario assumes 7.5% annual revenue growth and an increase of $0.7 billion in earnings from the current $2.1 billion.

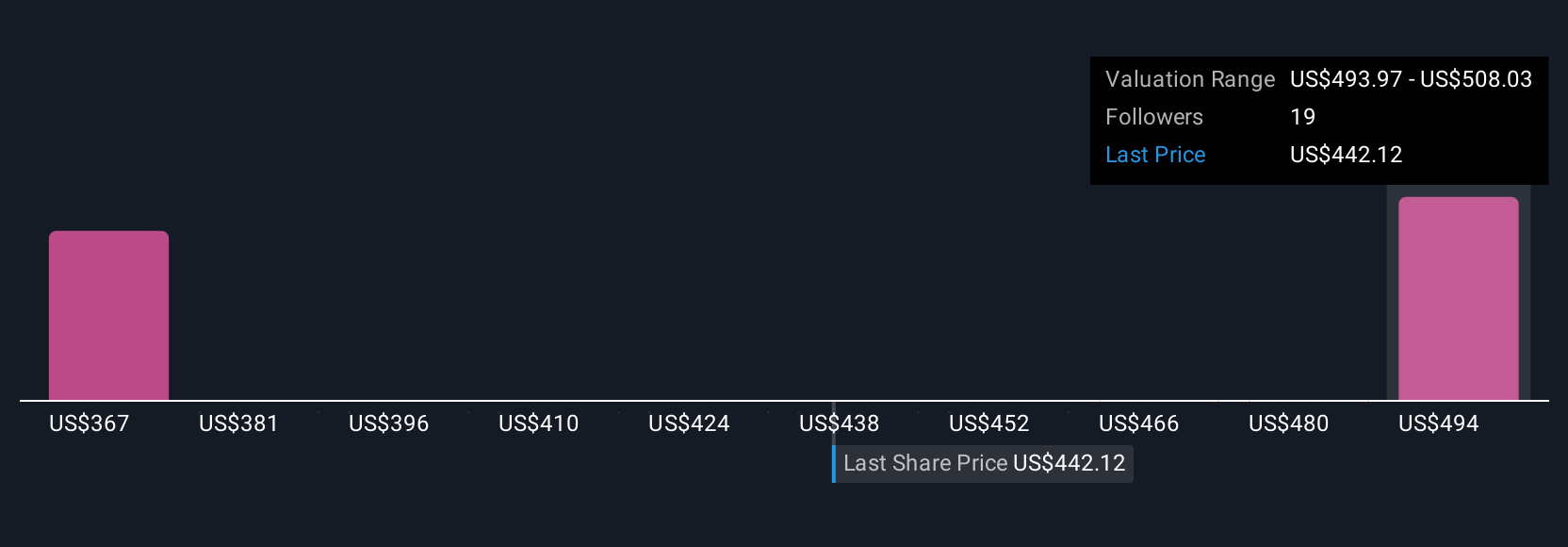

Uncover how Motorola Solutions' forecasts yield a $497.89 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided four fair value estimates for Motorola Solutions ranging from US$375.52 to US$497.89 per share. While these views differ, continued dependence on government procurement cycles remains a crucial factor that could shape future returns for shareholders, explore these alternative opinions to see how investor sentiment varies.

Explore 4 other fair value estimates on Motorola Solutions - why the stock might be worth as much as 27% more than the current price!

Build Your Own Motorola Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Motorola Solutions research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Motorola Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Motorola Solutions' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSI

Motorola Solutions

Provides public safety and enterprise security solutions in the United States, the United Kingdom, Canada, and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives