- United States

- /

- Communications

- /

- NYSE:MSI

Should Mark Lashier’s Board Appointment and Dividend Increase Prompt Action From Motorola Solutions (MSI) Investors?

Reviewed by Sasha Jovanovic

- Motorola Solutions recently announced an 11% increase in its regular quarterly dividend to US$1.21 per share and appointed Mark Lashier, chairman and CEO of Phillips 66, to its board of directors effective November 18, 2025.

- Lashier's extensive leadership experience in energy and petrochemicals could bring fresh insights to Motorola Solutions’ governance and long-term growth initiatives.

- We'll examine how the board appointment of Mark Lashier may influence Motorola Solutions' evolving investment narrative and future direction.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Motorola Solutions Investment Narrative Recap

Motorola Solutions appeals most to investors who see the long-term need for secure public safety and enterprise communication due to ongoing security concerns and modernization cycles. The recent appointment of Mark Lashier to the board is unlikely to meaningfully affect the most immediate catalyst, the company’s expansion into unmanned systems, drones, AI solutions, and managed services, but doesn’t alleviate the key risk tied to the security of core government contracts and volatile funding cycles.

Among the latest updates, the 11% increase in the regular quarterly dividend to US$1.21 per share stands out, reflecting ongoing shareholder returns. In the broader context, this news is aligned with Motorola’s stable financial position, but it does not alter the potential impact of disruptive technologies like broadband and interoperable platforms on its core LMR/MCN business.

Yet, investors should be especially mindful that, in contrast to the positive signals, the risk around government contract dependence remains and…

Read the full narrative on Motorola Solutions (it's free!)

Motorola Solutions' narrative projects $13.8 billion revenue and $2.8 billion earnings by 2028. This requires 7.5% yearly revenue growth and a $0.7 billion earnings increase from $2.1 billion.

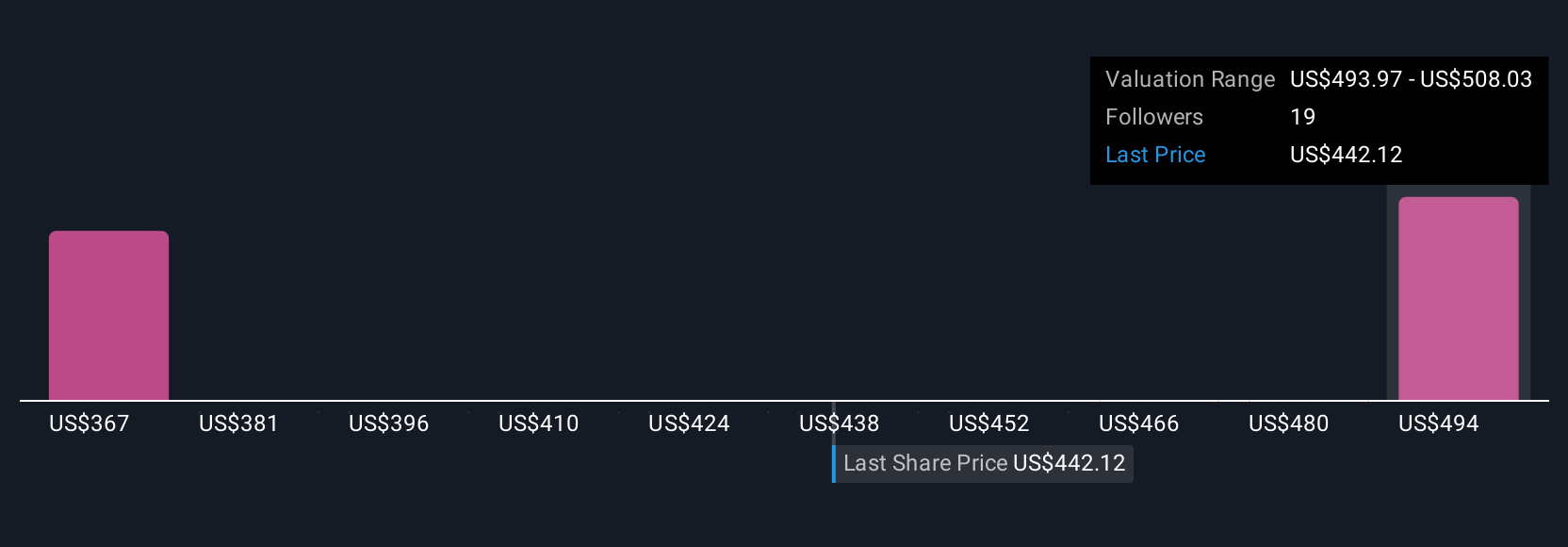

Uncover how Motorola Solutions' forecasts yield a $498.44 fair value, a 35% upside to its current price.

Exploring Other Perspectives

Four different fair value estimates from the Simply Wall St Community range from US$374.80 to US$498.44, showing a broad span of views on Motorola Solutions. As you compare these figures, remember how the risk of budget-driven swings in government contracts could shape the company’s future and consider reviewing other perspectives to see how they address this.

Explore 4 other fair value estimates on Motorola Solutions - why the stock might be worth just $374.80!

Build Your Own Motorola Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Motorola Solutions research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Motorola Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Motorola Solutions' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSI

Motorola Solutions

Provides public safety and enterprise security solutions in the United States, the United Kingdom, Canada, and internationally.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.