A Look at Mirion Technologies (MIR) Valuation After Director Lawrence Kingsley’s Large Insider Share Sale

Reviewed by Simply Wall St

Mirion Technologies (MIR) slipped after director Lawrence D. Kingsley sold 300,000 shares, a sizable insider move that attracted investors’ attention and raised fresh questions about the stock’s near term trajectory.

See our latest analysis for Mirion Technologies.

The insider sale comes after a choppy stretch for Mirion, with a 30 day share price return of minus 12.36% but a strong year to date share price return of 47.87% and robust multi year total shareholder returns. This suggests that longer term momentum remains intact.

If this insider move has you rethinking your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership for other compelling ideas where insiders have meaningful skin in the game.

With shares still trading at a roughly 24% discount to analyst targets but with little apparent margin to some intrinsic value estimates, investors now face a key question: is Mirion a mispriced growth story, or is the market already baking in its next leg higher?

Most Popular Narrative: 19.3% Undervalued

With Mirion closing at $25.02 against a narrative fair value of $31, the valuation case hinges on ambitious growth, margin expansion, and capital deployment.

Continued rollout of new digital platforms, such as the Vital and Apex Guard software, along with the strategic Certrec acquisition (bringing SaaS based, AI enabled compliance tools), positions Mirion to capture premium pricing, drive software mix expansion, and unlock operating leverage, benefitting margins and long term earnings potential.

Curious how modest top line assumptions translate into a rich future earnings multiple? The story leans heavily on rising margins and recurring software economics. Want to see the full playbook behind that growth math and valuation leap? Read on to unpack the projections driving this fair value call.

Result: Fair Value of $31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors should watch for slower nuclear build pipelines or integration missteps on recent deals, as either could derail the margin expansion underpinning this valuation.

Find out about the key risks to this Mirion Technologies narrative.

Another Lens on Valuation

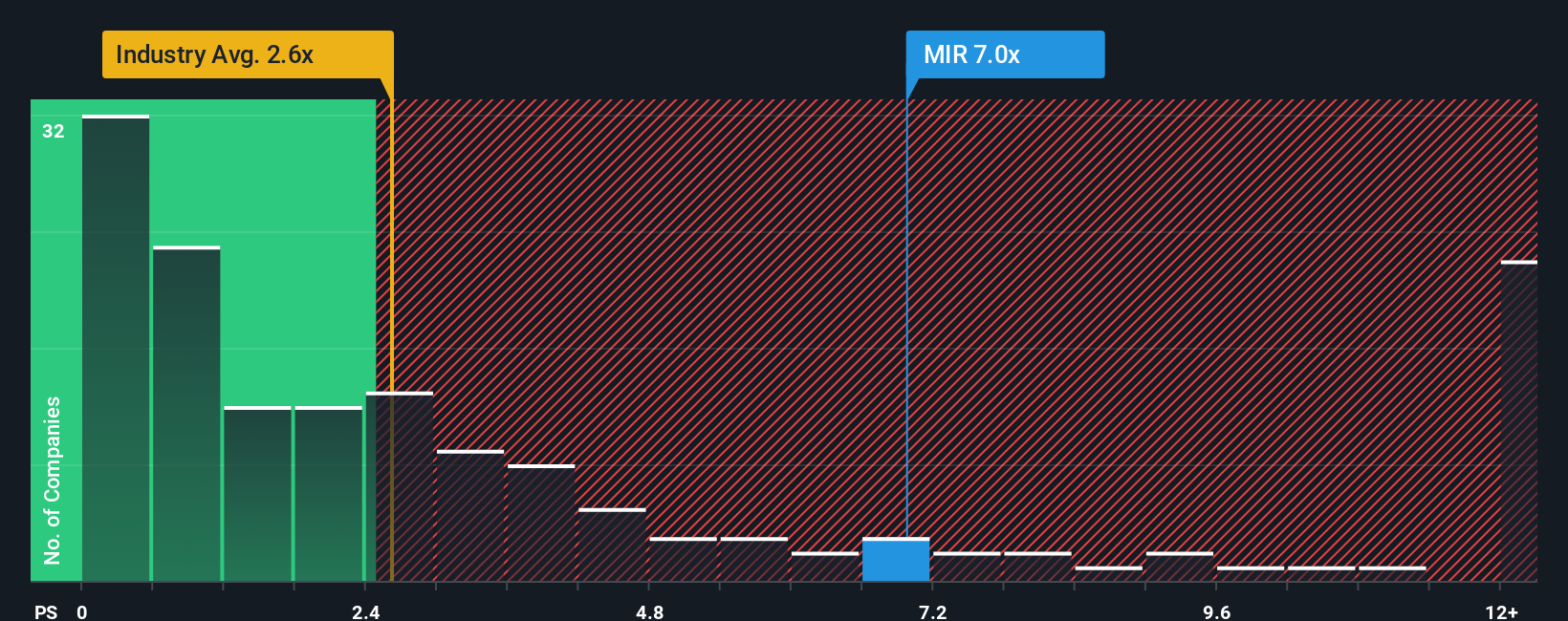

On sales based metrics, Mirion looks far less forgiving. Its price to sales ratio sits at 6.4 times, well above the US Electronic industry at 2.5 times, peers at 4.3 times, and even its own fair ratio of 3.8 times, implying meaningful downside if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mirion Technologies Narrative

If you are not fully convinced by this angle, or simply want to dive into the numbers yourself, you can build a complete view in minutes: Do it your way.

A great starting point for your Mirion Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop with one stock; use the Simply Wall St Screener to uncover new opportunities that fit your strategy and keep your portfolio working harder.

- Capture early growth by scanning these 3575 penny stocks with strong financials that pair low share prices with improving fundamentals and stronger balance sheets.

- Position ahead of the next tech wave by sifting through these 26 AI penny stocks targeting real world AI adoption across industries.

- Explore value potential by focusing on these 908 undervalued stocks based on cash flows where discounted cash flows highlight situations in which the market price differs from the estimated intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MIR

Mirion Technologies

Provides radiation detection, measurement, analysis, and monitoring products and services in North America, Europe, and the Asia Pacific.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026