How Investors Are Reacting To Jabil (JBL) Expanding Battery Enclosure Manufacturing in Thailand

Reviewed by Sasha Jovanovic

- Jabil Inc. recently announced that it has expanded its collaboration with Inno to manufacture battery energy storage system enclosures in a new 15,000-square-meter site in Rayong, Thailand, which broke ground on November 3 and will begin prototyping by late 2026.

- This investment underscores Jabil's move to provide a full lifecycle solution for battery storage customers by bringing key manufacturing capabilities closer to Southeast Asian logistics hubs, addressing material costs and supply efficiencies.

- We'll examine how Jabil's move to co-invest in Thai battery enclosure manufacturing could influence its long-term industry positioning and growth outlook.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Jabil Investment Narrative Recap

To be a shareholder in Jabil, you have to believe in the company's ability to expand global manufacturing services for fast-growing sectors like energy storage, while managing potential revenue headwinds in regulated industries and the consumer sector. The expanded partnership in Thailand is a long-term development and does not materially change near-term catalysts, such as strengthening AI-related demand or the biggest risk: ongoing demand weakness and profit margin pressures in renewables and consumer-facing segments.

Of Jabil's recent moves, the July 2025 collaboration with Endeavour Energy, focused on delivering modular, AI-ready infrastructure, is closely aligned with the current Thai battery enclosure project, pointing to a broader effort to serve energy and technology markets with greater supply chain efficiency and vertical integration. As both initiatives gain traction, catalysts such as improved positions in high-growth energy and infrastructure sectors remain top of mind.

By contrast, investors should also consider that ongoing caution in the EV and renewable energy markets continues to weigh on...

Read the full narrative on Jabil (it's free!)

Jabil's outlook anticipates $34.3 billion in revenue and $1.3 billion in earnings by 2028. This implies annual revenue growth of 6.4% and a $723 million increase in earnings from the current level of $577 million.

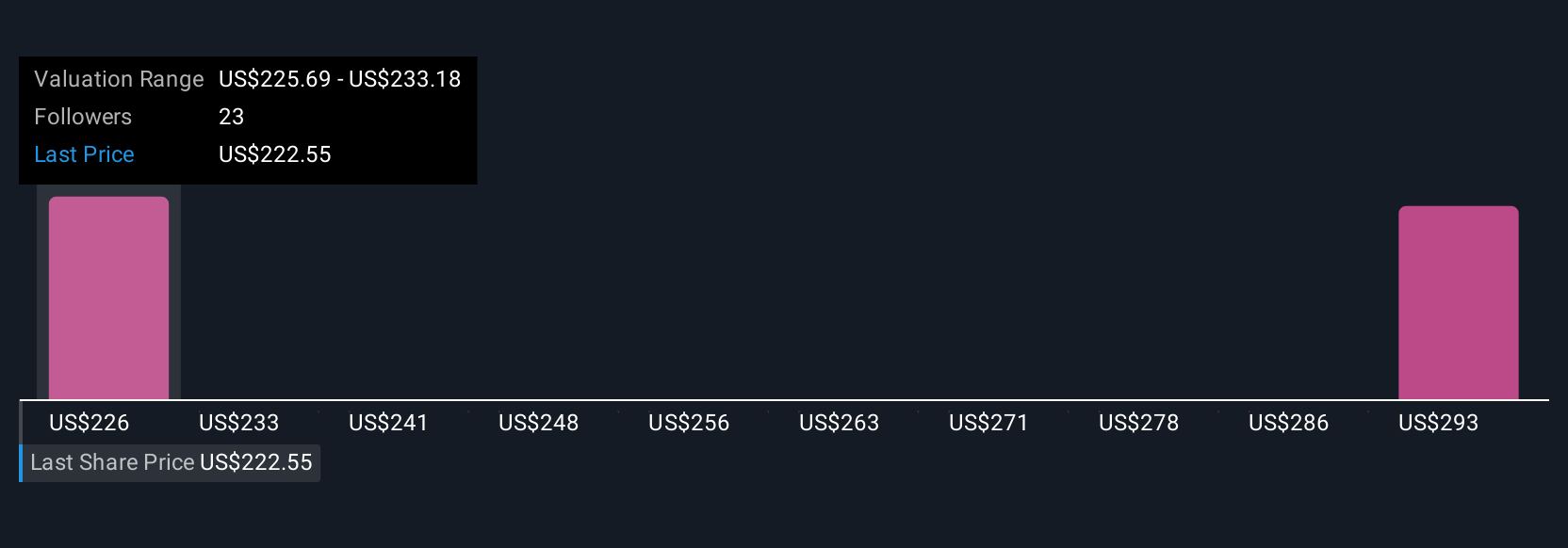

Uncover how Jabil's forecasts yield a $247.38 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community estimates put Jabil’s fair value between US$247.38 and US$258.46 per share. Despite a tight spread, many see opportunities tied to supply chain investments, but challenges in end-market demand remain an important factor to weigh. Explore how your view compares with these diverse opinions.

Explore 2 other fair value estimates on Jabil - why the stock might be worth just $247.38!

Build Your Own Jabil Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jabil research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Jabil research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jabil's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JBL

Jabil

Provides engineering, manufacturing, and supply chain solutions worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives