A Look at Jabil's Valuation After Expanding Battery Storage Alliance with Inno in Thailand

Reviewed by Simply Wall St

Jabil (JBL) announced it is expanding its partnership with Inno through a joint investment in a battery energy storage system enclosure facility in Rayong, Thailand. The collaboration highlights Jabil’s focus on supporting advanced energy storage solutions across multiple industries.

See our latest analysis for Jabil.

Jabil’s move to deepen its alliance in energy storage solutions comes as the stock continues its impressive run, with a 1-year total shareholder return of nearly 63% and a five-year total return approaching 477%. Momentum has built steadily this year, reflected in a nearly 50% year-to-date share price return, which signals growing investor confidence as the company wins fresh business in next-generation sectors.

If you’re watching companies advancing in tech and clean energy, now is the perfect opportunity to discover other high-growth names in our curated list: See the full list for free.

With such robust gains already this year and new growth engines coming online, the key question is whether Jabil’s shares still present an attractive entry point or if the market has already priced in its future prospects.

Most Popular Narrative: 13.5% Undervalued

With Jabil closing at $213.93, the most widely tracked narrative values the company significantly higher and suggests its market upside is yet to be fully realized. The analysis supports this view with expectations for business expansion and a reshaping of sector dynamics.

Strong demand in AI-related markets, with expected revenue growth of 40% year on year, indicates significant potential to drive future revenue and improve operating margins through an expanded share of high-growth technology sectors.

Curious how Jabil's bold expansion in high-tech industries is informing such a high fair value? The calculations hinge on an aggressive earnings outlook and profit margins that point to a structural shift in the business. Wondering what assumptions the analysts made to justify this price? Catch the full narrative for the answers that investors are debating right now.

Result: Fair Value of $247.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing weakness in renewable energy and persistent inventory challenges could undermine Jabil’s projected growth. These factors may dampen the optimism reflected in current valuations.

Find out about the key risks to this Jabil narrative.

Another View: Is the Market Getting Ahead of Itself?

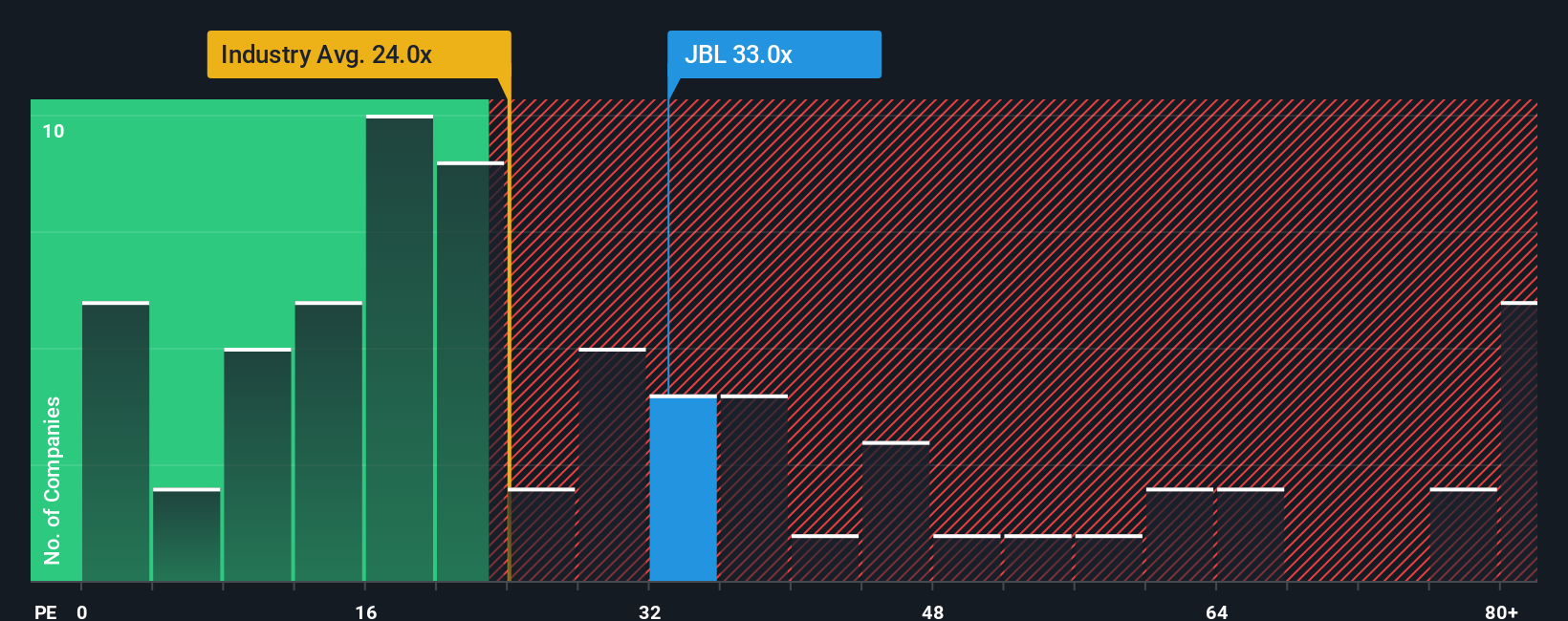

Looking at how Jabil is valued compared to its peers, its price-to-earnings ratio stands at 34.8x. This is notably higher than the US Electronic industry average of 25.2x and even above the fair ratio of 34.1x. This suggests the stock is priced for growth, leaving little margin for error. If expectations slip, there could be valuation risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Jabil Narrative

If you think the numbers tell a different story or want to explore your own perspective, you can easily put together your own take in just minutes. Do it your way.

A great starting point for your Jabil research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t limit your strategy to a single stock. Use the Simply Wall Street Screener to access handpicked ideas and catch new opportunities before the crowd.

- Boost your portfolio’s future with these 865 undervalued stocks based on cash flows that show strong potential based on solid cash flow analysis and attractive entry points.

- Secure reliable income streams by checking out these 14 dividend stocks with yields > 3% that offer yields greater than 3% alongside sustainable financial health.

- Capitalize on the next technology surge and tap into these 25 AI penny stocks poised to shape tomorrow’s digital landscape and innovation trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JBL

Jabil

Provides engineering, manufacturing, and supply chain solutions worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives