- United States

- /

- Tech Hardware

- /

- NYSE:IONQ

IonQ (NYSE:IONQ) Appoints New CEO Reports US$332M Loss and Plans US$500M Equity Offering

Reviewed by Simply Wall St

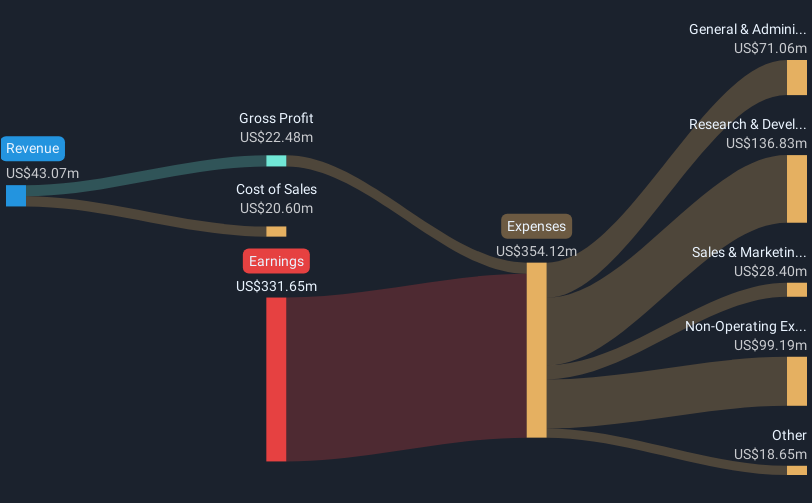

IonQ (NYSE:IONQ) recently appointed Niccolo de Masi as CEO, while reporting a significant increase in both quarterly sales to $11.7 million and net loss to $202 million compared to the previous year. Despite the growth in sales, the heavy losses and a follow-on equity offering of $500 million may have contributed to the company's 7% price decline last quarter. This drop in IonQ's shares aligns with broader market trends where major tech stocks, including Nvidia and Salesforce, saw declines amid investor concerns about economic policies and tariffs announced by President Trump. Moreover, the mixed performance of U.S. stock indexes, such as the Dow Jones Industrial Average rising by 0.7%, contrasted with the declines in the tech-heavy Nasdaq Composite, further emphasized the uncertain sentiment surrounding tech stocks during this period.

See the full analysis report here for a deeper understanding of IonQ.

Over the past year, IonQ's total shareholder return soared 165.81%. This remarkable performance outpaced both the broader US Tech industry, which returned 33.4%, and the overall US Market at 16.7%. Several key developments have likely influenced this significant increase. The company secured a large $54.5 million contract with the United States Air Force Research Lab for quantum systems design, boosting its reputation and future revenue prospects. In addition, IonQ announced a breakthrough in partial error correction in quantum applications in June, highlighting its technological advancements. The launch of a new quantum operating system in December further showcased IonQ's commitment to innovation.

The impressive momentum continued with IonQ renewing a partnership with Abu Dhabi’s Quantum Research Center in January, and announcing plans to acquire ID Quantique SA. Despite unresolved profitability concerns, the company's advances in quantum computing technology and strategic partnerships appear to be fostering investor confidence, reflected in IonQ's strong total returns over the past year.

- Get the full picture of IonQ's valuation metrics and investment prospects—click to explore.

- Discover the key vulnerabilities in IonQ's business with our detailed risk assessment.

- Already own IonQ? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IONQ

IonQ

Engages in the development of general-purpose quantum computing systems in the United States.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives