- United States

- /

- Tech Hardware

- /

- NYSE:IONQ

IonQ (IONQ) Is Up 18.2% After Defense Drone Partnership With Heven AeroTech – Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Heven AeroTech has announced a new investment and partnership with IonQ, aiming to integrate IonQ’s quantum computing, networking, sensing, and security technologies into Heven’s hydrogen-powered autonomous drones for aerospace and defense applications.

- This collaboration is set to advance uncrewed aerial system capabilities in GPS-denied and high-risk environments, signaling expanding real-world use cases for quantum technologies.

- We’ll explore how IonQ’s entry into defense-focused drone technology enhances its investment narrative and broadens its potential addressable market.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is IonQ's Investment Narrative?

To be a shareholder in IonQ, you need to believe in quantum computing’s potential to transform industries over the long term, and have confidence that IonQ can capture a meaningful share of that future opportunity. The recent Heven AeroTech deal demonstrates IonQ’s push to move beyond the lab and secure early commercial partnerships in defense and aerospace, helping to validate its platform and accelerate market adoption. While this partnership highlights the growing relevance of quantum technologies, its short-term financial impact is unlikely to be substantial given IonQ’s current size and the early stage of the quantum market. Near-term catalysts, such as rapid revenue growth and continued government alliances, remain intact, but so do key risks, including sustained losses, competition from big tech, and dilution from ongoing share issuance. The Heven announcement reinforces IonQ’s ambition, but investors should remain focused on the underlying challenges as enthusiasm for quantum continues to rise.

However, keep in mind that shareholder dilution remains an ongoing concern.

Exploring Other Perspectives

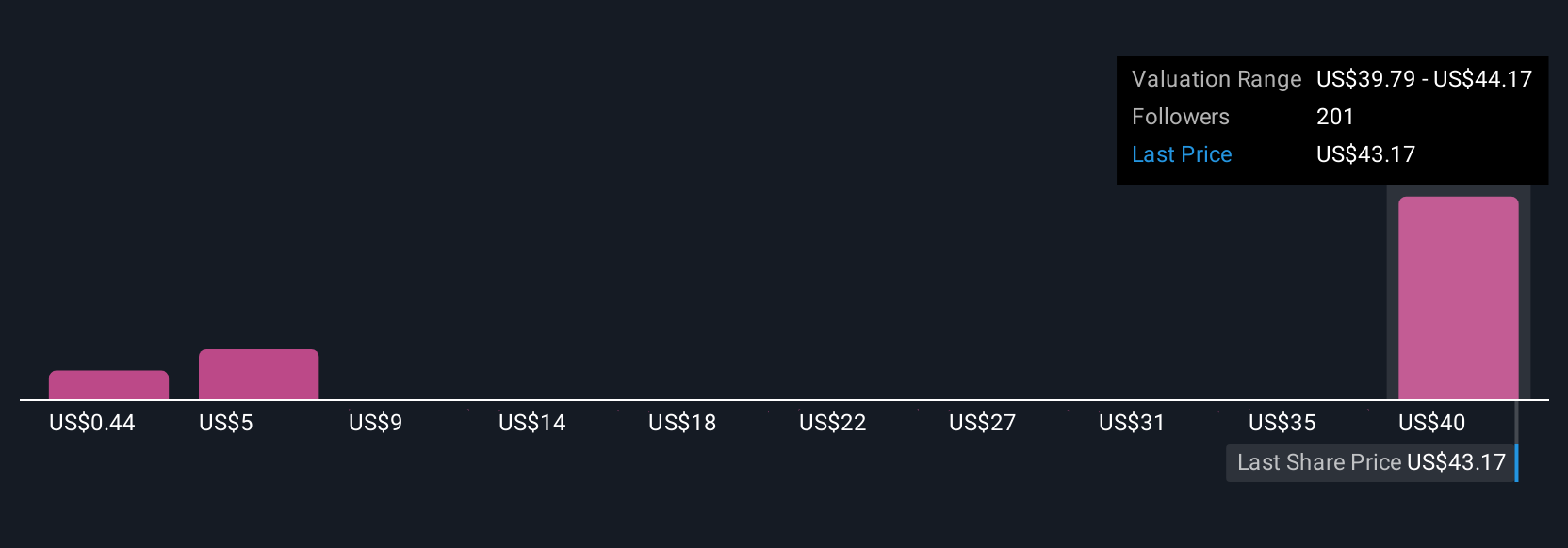

Explore 64 other fair value estimates on IonQ - why the stock might be worth less than half the current price!

Build Your Own IonQ Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IonQ research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free IonQ research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IonQ's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IONQ

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.