A Look at Corning's Valuation Following Earnings Beat and Growth in AI, Optical, and Solar Products

Reviewed by Simply Wall St

Corning released its third-quarter results with adjusted earnings and revenues both beating expectations, driven by strong demand in optical communications and generative AI-related products. Growth in U.S.-made solar products also played a key role.

See our latest analysis for Corning.

The upbeat quarterly results have come alongside a powerful rally in Corning's shares, with the stock up 77.5% year-to-date and the 1-year total shareholder return reaching 71.8%. While momentum has cooled off a bit in recent weeks, Corning’s three-year and five-year total returns of 170.7% and 150.8% reflect its ability to continue delivering value for patient investors as new catalysts like AI and renewable energy products come into focus.

If Corning’s growth story has you curious about what else is on the rise, it could be the perfect time to broaden your search and discover See the full list for free.

With shares posting triple-digit returns over the past few years and optimistic growth projections ahead, investors may wonder if Corning is still undervalued after its latest earnings beat or if the market has already priced in its future potential.

Most Popular Narrative: 11.2% Undervalued

At $82.90 per share, Corning is trading below the fair value pegged at $93.31 by the most widely followed narrative. This suggests upside potential according to current consensus, with the latest valuation based on bullish assumptions about optical and solar sector strength.

Corning's Springboard plan aims to add more than $4 billion in annualized sales by 2026, driven by strong demand in Optical Communications and Solar sectors due to powerful secular trends, which may positively impact revenue growth. The company sees substantial growth in Optical Communications, particularly in innovations for Gen AI data centers, which are expected to drive incremental revenue and accelerate operating margin improvements toward 20% by the end of 2026.

What is fueling this optimism? The standout narrative expects Corning to benefit from a tech supercycle and highlights ambitious sales and margin goals. Want a front-row seat to projections that could transform the company’s future and possibly the entire sector? See inside the forecast and find the missing number.

Result: Fair Value of $93.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent concerns about global trade tensions and reliance on non-GAAP measures could quickly shift investor sentiment if business conditions change.

Find out about the key risks to this Corning narrative.

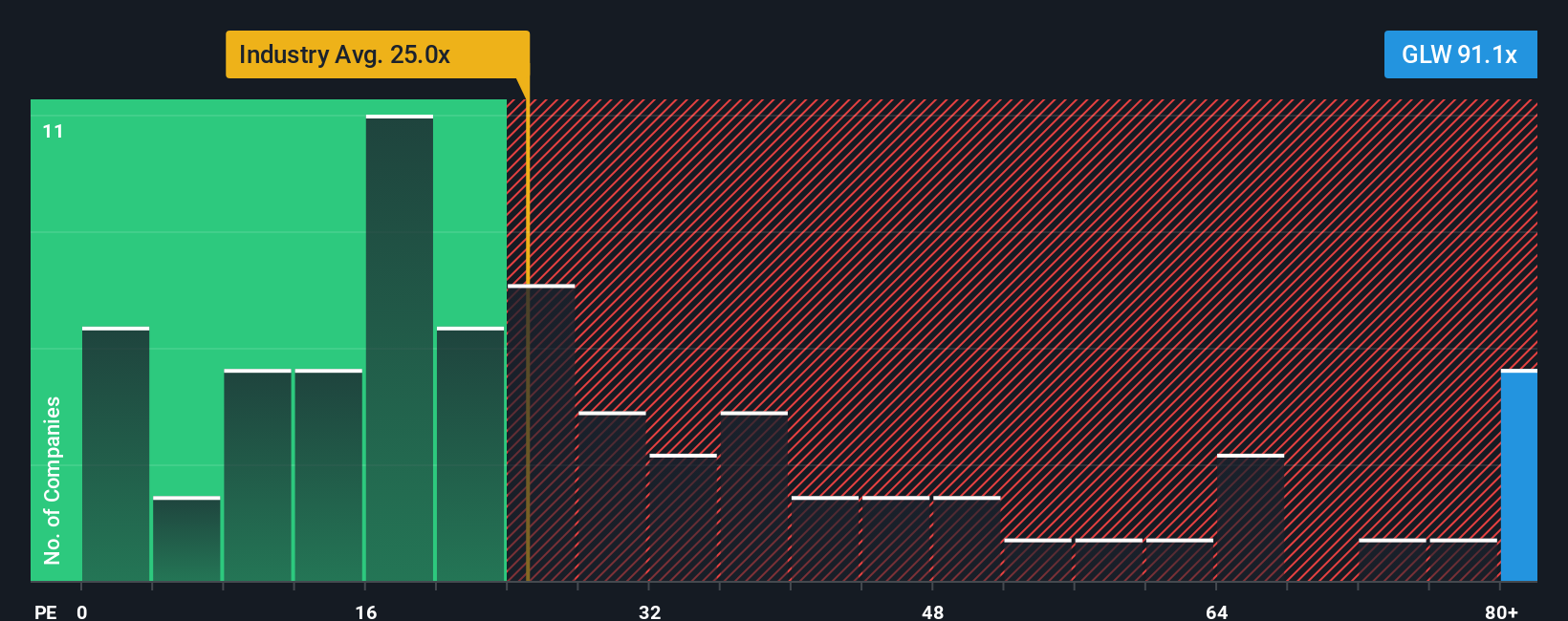

Another View: High Multiple Signals Valuation Risk

Looking from another angle, Corning’s share price reflects a price-to-earnings ratio of 52x. That puts it well above the US Electronic industry average of 23.9x and higher than the fair ratio of 34.9x calculated by our regression analysis. This premium may leave investors exposed if growth slows. So, is the optimism justified or has the market already run ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Corning Narrative

Curious to see how your own take stacks up against the popular views, or want to investigate the numbers firsthand? It's quick and easy to develop your own perspective. Just give it a try with Do it your way

A great starting point for your Corning research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

There’s no need to limit your search to just one company. Make smarter moves by uncovering other compelling opportunities through powerful Simply Wall Street screeners.

- Capitalize on growth by spotting AI-powered companies at the forefront of machine learning. Check out these 25 AI penny stocks and see which are breaking new barriers.

- Maximize your portfolio’s long-term yield by targeting established businesses with consistent income. Start with these 14 dividend stocks with yields > 3% to find what’s paying off right now.

- Ride the next wave of financial innovation and access direct exposure to blockchain developments by reviewing these 81 cryptocurrency and blockchain stocks before others catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GLW

Corning

Operates in optical communications, display technologies, environmental technologies, specialty materials, and life sciences businesses.

High growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026