Fabrinet (FN): Assessing Valuation After a Strong Year-To-Date Rally

Reviewed by Simply Wall St

See our latest analysis for Fabrinet.

It has been a standout period for Fabrinet, with strong momentum carrying the share price up by 4.5% in just the past day and an impressive 7.8% over the last week. That comes in addition to a year-to-date share price return of 104%, highlighting Fabrinet’s reputation as a growth bright spot. Looking further out, total shareholder returns have climbed over 98% in the last year and an eye-opening 548% over five years, reflecting sustained long-term gains as enthusiasm continues to build around the company’s performance.

If Fabrinet’s rally has you thinking about what else could be on the move, why not broaden your perspective and discover fast growing stocks with high insider ownership

With shares on such a steep upward trajectory, investors are left wondering: is Fabrinet still undervalued, or is the current price already factoring in all of its future growth potential?

Most Popular Narrative: 6.3% Undervalued

Fabrinet’s last close of $449.06 stands at a modest 6.3% discount to the fair value estimate set by the most popular narrative, suggesting upside remains in the eyes of analysts following the company closely.

The ongoing surge in global data traffic and AI workloads is accelerating demand for high-speed optical components and data center interconnect (DCI) solutions. This is reflected in Fabrinet's record telecom revenue and rapid DCI growth (up 45% year-over-year), supporting the outlook for continued above-trend revenue growth.

Want to know what’s fueling this price target? It isn’t just hype. Discover how ambitious growth forecasts and bullish margin assumptions combine to create a valuation scenario you can’t afford to ignore. Dive in to see what sets this narrative apart from the rest.

Result: Fair Value of $479.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, supply chain disruptions or the loss of a major customer could quickly threaten Fabrinet's impressive growth and its future earnings prospects in the cloud sector.

Find out about the key risks to this Fabrinet narrative.

Another View: Multiples Tell a Different Story

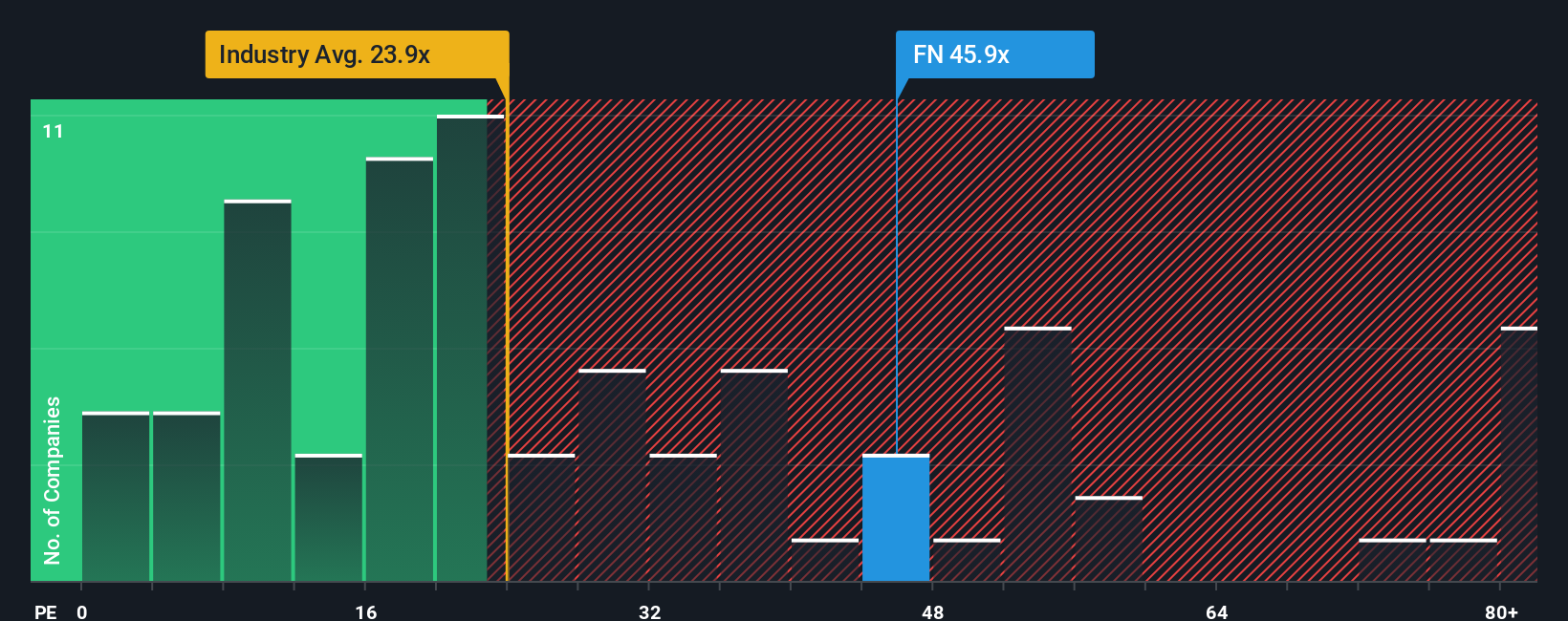

While the fair value estimate offers an uplifting outlook for Fabrinet, the company looks pricey when comparing its price-to-earnings ratio against peers. At 45.8x, Fabrinet trades well above the US Electronic industry average of 24.6x and the peer average of 36.6x. Even the fair ratio of 39.2x indicates that investors are paying a clear premium, which raises questions about how much more upside is left if expectations stumble.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fabrinet Narrative

If you’re looking to go beyond analyst opinions and crunch the numbers yourself, you can build your own perspective in just a few minutes. Do it your way

A great starting point for your Fabrinet research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one stand-out stock. Make your next move with high-potential opportunities that match your strategy on Simply Wall Street’s Screener platform.

- Tap into high-yield opportunities and grow your passive income stream with these 15 dividend stocks with yields > 3% which offers generous returns and steady payouts.

- Leap ahead in the AI revolution by targeting tomorrow’s innovators through these 25 AI penny stocks as they lead advancements in machine learning and automation.

- Capitalize on breakthrough science by searching these 27 quantum computing stocks to find companies making headway in quantum computing and next-generation technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FN

Fabrinet

Provides optical packaging and precision optical, electro-mechanical, and electronic manufacturing services in North America, the Asia-Pacific, and Europe.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success