- United States

- /

- Tech Hardware

- /

- NYSE:DELL

Dell Technologies (DELL): Net Profit Margin Rises to 5%, Reinforcing Bullish Earnings Narratives

Reviewed by Simply Wall St

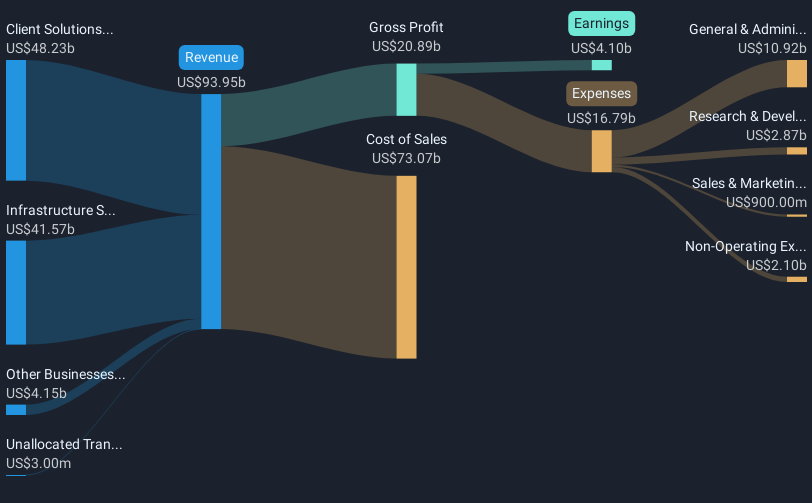

Dell Technologies (DELL) just published its Q3 2026 results, posting revenue of $27.0 billion and basic EPS of $2.28. The company has seen revenue trend from $24.4 billion in Q3 last year to over $29.8 billion in Q2 and now $27.0 billion this quarter. EPS has moved from $1.61 a year ago to $2.36 in Q4 and $2.28 now. Solid profit margins and steady earnings trends continue to shape an intriguing picture for investors eyeing Dell's financial momentum.

See our full analysis for Dell Technologies.Now comes the fun part: we will see how this latest batch of numbers lines up with big-picture narrative views on Dell, and where expectations might need to shift.

See what the community is saying about Dell Technologies

Profit Margins Edge Higher, Beat Sector Trend

- Net profit margin improved to 5% in the last year, up from 4.6%. This surpassed the five-year average annual earnings growth of 8.8%, with earnings rising to 19.7% year-over-year, while the broader US market expects 16% annual earnings growth.

- Analysts' consensus view highlights Dell’s margin strength and quality of earnings as distinguishing characteristics compared to industry peers.

- Dell’s annual margin gain exceeds historic averages, and the $5.2 billion net income over the last twelve months supports the idea that its focus on storage and services is boosting profitability.

- This momentum addresses concerns that slow PC growth might weigh on overall performance, suggesting that other segments are compensating for that weakness.

- Consensus narrative states that Dell’s cross-segment margin resilience is giving analysts increased confidence in multi-year earnings durability.

📊 Read the full Dell Technologies Consensus Narrative.

Share Price Sits Below Analyst Target

- Dell’s last traded share price was $133.26, which is 17.9% below the current analyst price target of $162.43 and also below the DCF fair value estimate of $219.79. This underlines a positive risk/reward outlook.

- According to the consensus among analysts, this trading discount reflects strong potential upside if financial outperformance and profit margin expansion continue.

- The current price-to-earnings ratio of 17.1x is well beneath both the peer group average of 22.3x and the global tech sector average of 22.2x.

- Valuation signals remain favorable due to robust cash generation and ongoing buybacks, offsetting risks from uneven segment growth and high debt.

AI, Storage Strength Offset Cyclical PC Risks

- While consumer segment revenue fell 7%, Dell’s shift toward modern storage and AI infrastructure is supported by analysts’ forecasts for 8.7% annual revenue growth, with profits projected to grow at 12.54% per year over the next several years.

- Based on the consensus narrative, Dell’s growing enterprise AI offerings and margin-rich storage business are expected to help offset near-term weakness in commercial PCs and supply-chain cost pressures.

- Management commentary points to persistent global demand for scalable data center solutions, creating a meaningful cushion as legacy PC and North America server sales slow.

- However, ongoing margin dilution from rapid AI expansion and risks associated with a temporary PC refresh cycle remain key issues for analysts as potential growth threats.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Dell Technologies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something new in Dell’s data? Take just a few minutes to transform your insight into a distinctive narrative. Do it your way

A great starting point for your Dell Technologies research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Although Dell’s rapid AI and storage expansion is promising, ongoing risks from high debt loads and uneven segment growth could pressure future performance.

If you want companies with steady finances and less debt risk, check out solid balance sheet and fundamentals stocks screener (1924 results) for stocks built on stronger balance sheets and fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DELL

Dell Technologies

Designs, develops, manufactures, markets, sells, and supports various comprehensive and integrated solutions, products, and services in the Americas, Europe, the Middle East, Asia, and internationally.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success