Does CTS (CTS) Revamped Credit Line and New COO Hint at a Shift in Capital Discipline?

Reviewed by Sasha Jovanovic

- CTS Corporation recently entered into a new five-year unsecured revolving credit facility of US$300 million with a syndicate of banks, replacing its prior US$400 million facility and using initial borrowings to repay US$63.3 million under the former agreement.

- Alongside this refinancing, CTS has seen an internal leadership shift, with long-serving Senior Vice President Martin Baumeister resigning and 2024 hire Pratik Trivedi stepping into the new Chief Operating Officer role, potentially reshaping how the company uses its reduced but flexible borrowing capacity.

- We’ll now examine how the new US$300 million revolving credit facility could influence CTS’s investment narrative around growth and margins.

Find companies with promising cash flow potential yet trading below their fair value.

CTS Investment Narrative Recap

To own CTS today, you need to believe its shift toward medical, industrial, and aerospace markets can offset transportation softness and support healthy margins, even as growth moderates. The new US$300 million revolving credit facility and COO appointment look more like housekeeping than game changers for the near term, with transportation demand trends and competitive pressure in Europe still the most important catalyst and risk, respectively, for the story right now.

The refinancing announcement is the clearest link to the current news, because it defines how much balance sheet flexibility CTS has if it continues to invest behind higher margin, diversified end markets. While the facility is smaller than the previous US$400 million line, its unused capacity, alternative currency options, and incremental loan feature could still support CTS’s plans in medical and industrial applications as it works to improve its mixed margin profile.

Yet behind this financial flexibility, investors should pay close attention to the risk that transportation demand, especially in China...

Read the full narrative on CTS (it's free!)

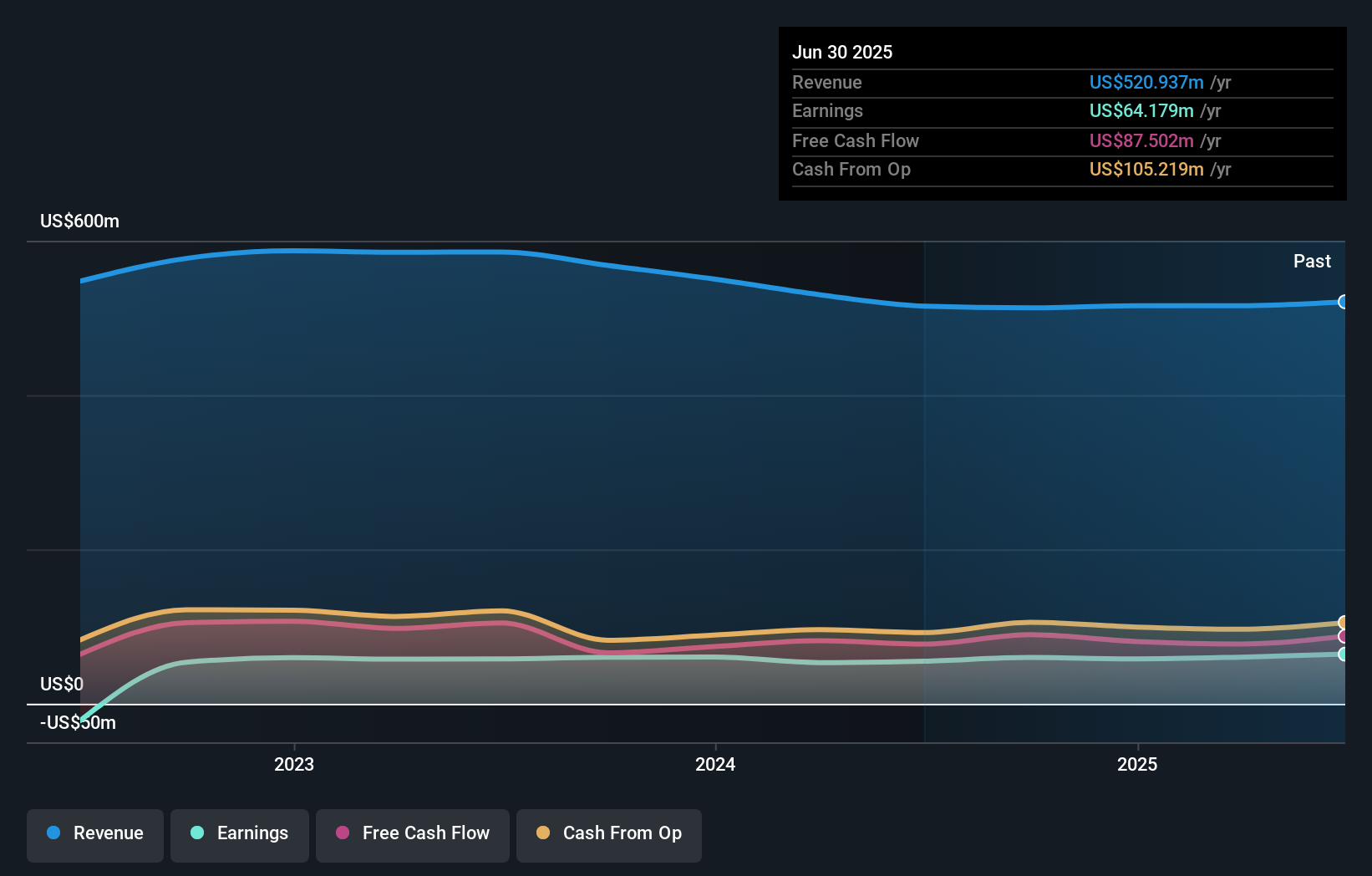

CTS’ narrative projects $610.6 million revenue and $78.8 million earnings by 2028.

Uncover how CTS' forecasts yield a $47.00 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community currently place CTS’s fair value between US$43.27 and US$47, illustrating how even a small sample can span a few dollars per share. You will want to weigh those views against the key risk that prolonged transportation softness, including China related pressures and tariffs, could restrain revenue growth and margins over time and explore how others see that shaping CTS’s future performance.

Explore 2 other fair value estimates on CTS - why the stock might be worth as much as 6% more than the current price!

Build Your Own CTS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CTS research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free CTS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CTS' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTS

CTS

Designs, manufactures, and sells sensors, connectivity components, and actuators in North America, Europe, and Asia.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026