- United States

- /

- Communications

- /

- NYSE:CIEN

Will Fidium’s Texas Rollout of Ciena’s 400G Optical Tech Shift the CIEN Growth Narrative?

Reviewed by Sasha Jovanovic

- Fidium recently announced it has deployed Ciena's advanced optical solutions to deliver next-generation wavelength services up to 400G across its DASH fiber network, connecting major Texas cities and extending high-speed connectivity to new regions.

- This deployment highlights Ciena's technology as a cornerstone for enabling large-scale, high-capacity, low-latency connectivity demanded by data centers and enterprise clients in rapidly expanding technology corridors.

- We'll explore how Fidium's rollout of Ciena's optical solutions across Texas could influence Ciena's long-term growth narrative and industry positioning.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Ciena Investment Narrative Recap

To own Ciena, an investor needs to believe in accelerating, long-term demand for data center and cloud connectivity, driven by AI and rising global data traffic. The Fidium deployment confirms Ciena's role at the center of this trend, but does not fundamentally alter the key short-term catalyst: ongoing, large-scale cloud and enterprise network buildouts. However, the risk of heavy customer concentration remains, as even high-profile client wins cannot offset sudden shifts in purchasing from Ciena's largest buyers.

The October announcement that Colt Technology Services is rolling out a terabit network with Ciena's technology is particularly relevant, echoing the Fidium news and reinforcing Ciena's momentum in high-capacity, low-latency optical deployments. This supports the view that hyperscaler and enterprise demand may continue to be a powerful growth engine for Ciena, especially as AI adoption accelerates.

By contrast, investors should also be aware that exposure to a small number of hyperscale customers can quickly...

Read the full narrative on Ciena (it's free!)

Ciena's narrative projects $6.5 billion revenue and $590.5 million earnings by 2028. This requires 12.5% yearly revenue growth and an earnings increase of $449.6 million from the current earnings of $140.9 million.

Uncover how Ciena's forecasts yield a $142.06 fair value, a 26% downside to its current price.

Exploring Other Perspectives

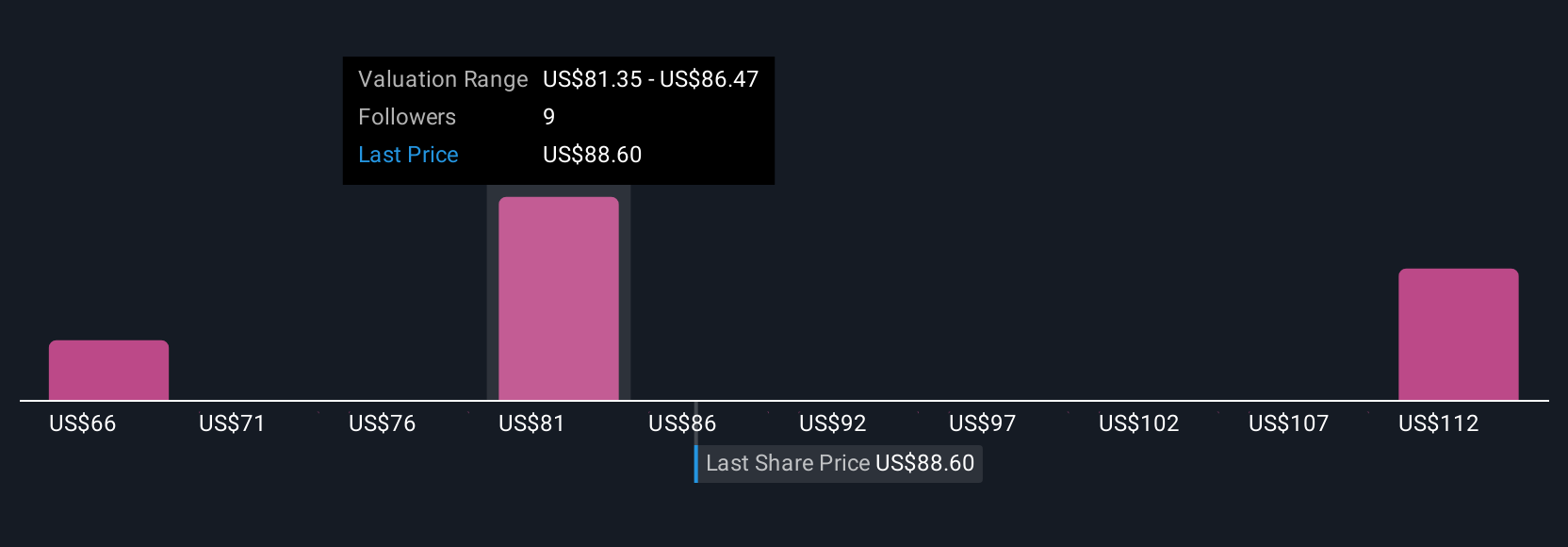

Five fair value estimates from the Simply Wall St Community range from US$67.93 to US$142.06 per share. As buyers weigh aggressive cloud infrastructure demand, the impact of customer concentration risk on Ciena’s results remains a live issue for many market participants.

Explore 5 other fair value estimates on Ciena - why the stock might be worth less than half the current price!

Build Your Own Ciena Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ciena research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Ciena research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ciena's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CIEN

Ciena

A network technology company, provides hardware, software, and services for various network operators in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and India.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives