- United States

- /

- Communications

- /

- NYSE:CIEN

Why Ciena (CIEN) Is Up 5.4% After Launching Terabit Network with Colt Technology Services

Reviewed by Sasha Jovanovic

- Colt Technology Services and Ciena recently announced the rollout of a new transatlantic and terrestrial terabit network using Ciena's WaveLogic 6 Extreme transponder, boosting single-fibre capacity by 20% and reducing power and carbon emissions by half compared to earlier models.

- This collaboration directly addresses the accelerating global demand for bandwidth from AI-driven applications, gaming, and streaming while marking a significant advance in energy-efficient network infrastructure for hyperscalers and enterprises.

- We'll examine how this leap in network capacity and energy efficiency could reshape Ciena's investment narrative in an era of AI-driven connectivity.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Ciena Investment Narrative Recap

For an investor to own shares of Ciena, belief in the ongoing global surge in demand for AI-driven, high-capacity optical networks is central. The Colt Technology partnership highlights Ciena's ability to address this demand with advanced solutions, potentially strengthening its leadership in cloud and hyperscaler infrastructure. However, heavy revenue concentration among a handful of key customers remains the most important short-term risk, and the Colt news only modestly diversifies this exposure for now.

Among recent developments, the TAM-1 subsea cable partnership in the Americas stands out as another example of Ciena's technology being selected for next-generation backbone infrastructure. Projects like these reinforce current catalysts, expanding Ciena's reach into major network upgrades required for high-capacity, energy-efficient intercontinental data traffic.

But with such concentrated dependence on a few very large hyperscaler customers, investors should also watch for signs of sudden shifts in client spending that...

Read the full narrative on Ciena (it's free!)

Ciena's narrative projects $6.5 billion revenue and $590.5 million earnings by 2028. This requires 12.5% yearly revenue growth and a $449.6 million earnings increase from $140.9 million today.

Uncover how Ciena's forecasts yield a $142.06 fair value, a 22% downside to its current price.

Exploring Other Perspectives

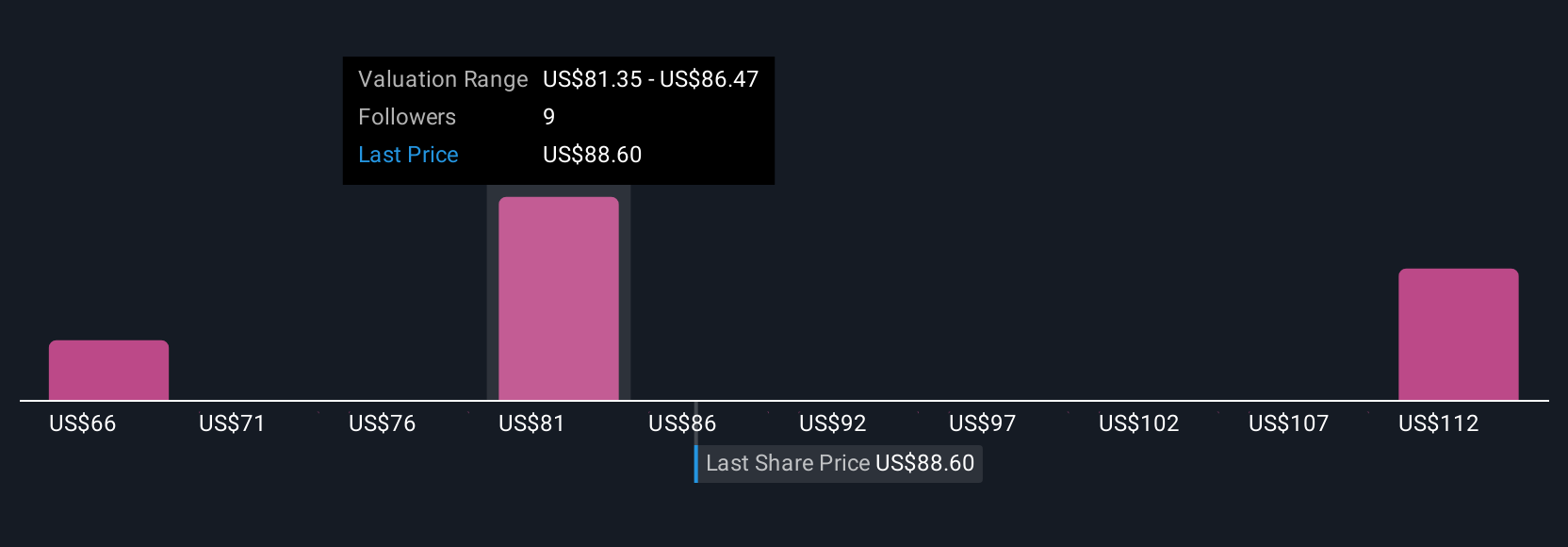

Five members of the Simply Wall St Community have posted fair value estimates for Ciena from US$67.93 to US$142.06. With big cloud providers rapidly expanding network capacity and using Ciena's technology, your view on hyperscaler capital spending could make all the difference.

Explore 5 other fair value estimates on Ciena - why the stock might be worth as much as $142.06!

Build Your Own Ciena Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ciena research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Ciena research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ciena's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CIEN

Ciena

A network technology company, provides hardware, software, and services for various network operators in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and India.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives