- United States

- /

- Communications

- /

- NYSE:CALX

A Look at Calix (CALX) Valuation Following New COO Appointment and Accelerated AI Platform Adoption

Reviewed by Simply Wall St

Calix (CALX) just saw two events catch investor interest. The company named John Durocher as its new Chief Operating Officer, and CoastConnect announced accelerated adoption of Calix’s AI-driven broadband platform.

See our latest analysis for Calix.

Calix’s year-to-date share price return stands at an impressive 63%, signaling that investor optimism is building as the company doubles down on AI-driven platforms and strategic leadership changes. Leadership moves and rapid client adoption of Calix’s technology are helping reshape the company’s growth story, which is further reflected in a strong one-year total shareholder return of 67% and a remarkable five-year total return of 118%. These results suggest that momentum is gaining traction around its expansion and innovation efforts.

If you’re interested in discovering the next big growth stories, now’s the time to broaden your perspective and explore fast growing stocks with high insider ownership.

But after such a strong run, does Calix still have room to surprise investors, or is all the future growth already priced into the stock? Is this a buying opportunity, or is the market already anticipating these developments?

Most Popular Narrative: 30.5% Undervalued

Calix’s current fair value estimate sits well above the last close price, indicating the strongest market voices see room for further upside. The following quote from the most widely followed narrative highlights what could unlock the next wave of interest.

"The upcoming rollout of Calix's third-generation platform, which integrates agentic AI capabilities, is expected to dramatically accelerate broadband providers' ability to monetize new services and experiences across residential, business, and municipal segments. This can drive higher ARPU, increased subscriber growth, reduced churn, and ultimately stronger revenue expansion beginning in the second half of 2025 and accelerating into 2026."

What’s the key to this bold fair value? Hint: The narrative pins its optimism on a breakthrough profit model, unforeseen earnings power, and a revenue ramp the market hasn't priced in yet. Want to see what specific future milestones and financial targets analysts are betting on? The full narrative reveals all.

Result: Fair Value of $79.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower than expected adoption of Calix's new AI platform or rising compliance costs could quickly challenge these bullish expectations and shift sentiment.

Find out about the key risks to this Calix narrative.

Another View: Multiples Add a Note of Caution

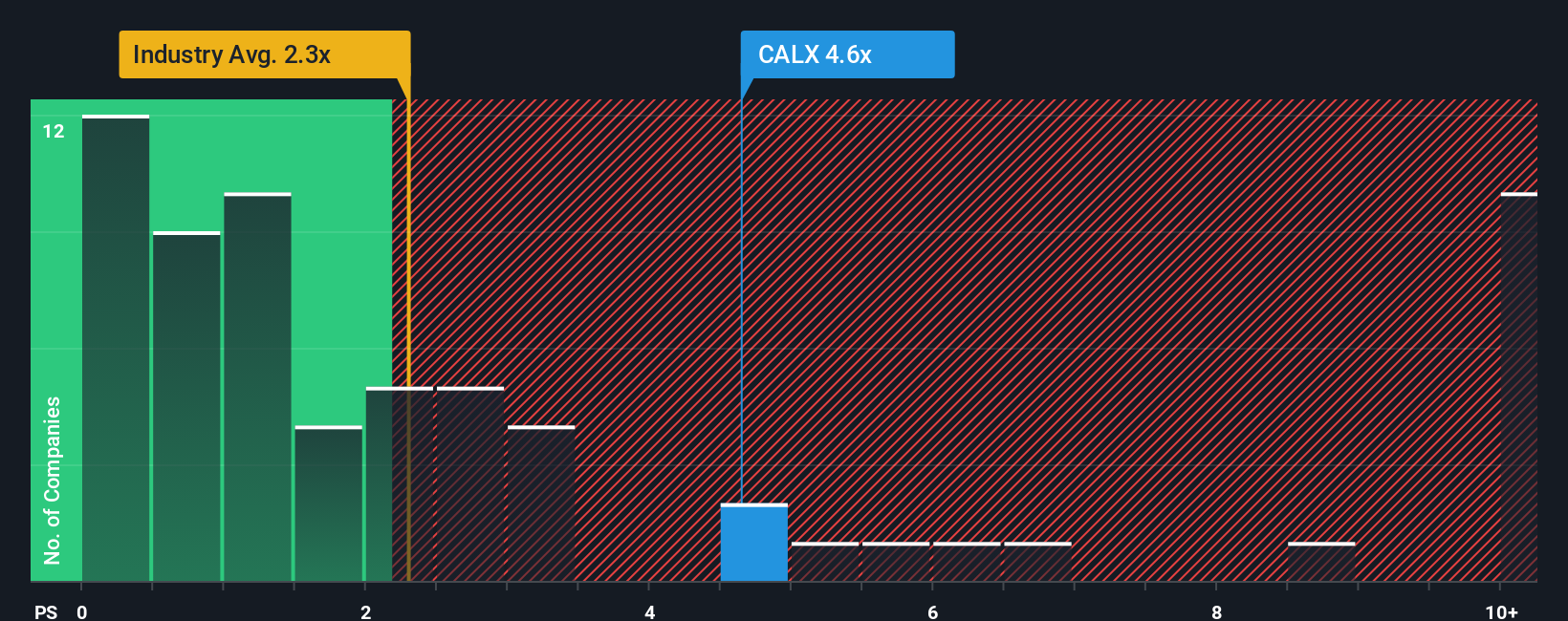

While the fair value estimate points to upside, Calix’s current price-to-sales ratio of 3.9x is much higher than both the industry average (1.9x) and peer group (2.1x). Although our fair ratio calculation lands at 4.4x, the premium suggests the stock already prices in substantial future growth. This could lead to vulnerability if growth stumbles?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Calix Narrative

If you have a different viewpoint or want to dig deeper, take a few moments to review the numbers and craft your own perspective. Do it your way.

A great starting point for your Calix research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that real opportunities go beyond one company. Stay ahead of the market by checking these handpicked stock ideas. Your next winner could be waiting.

- Supercharge your portfolio with growth by acting on these 25 AI penny stocks focused on transforming entire industries through artificial intelligence and automation.

- Lock in consistent income as you review these 15 dividend stocks with yields > 3% offering high yields for investors who value reliable returns alongside potential for capital growth.

- Get positioned early for tomorrow’s breakthroughs and secure a stake in the future of computing with these 28 quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CALX

Calix

Provides cloud and software platforms, and systems and services in the United States, rest of Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026