Does Ongoing CEO Insider Selling at Arlo Technologies (ARLO) Reveal Shifting Management Sentiment?

Reviewed by Sasha Jovanovic

- On December 1, 2025, Arlo Technologies CEO Matthew Mcrae sold 257,242 shares, continuing a year-long trend of insider sales and no insider purchases at the company.

- This pattern of persistent insider selling, particularly from the CEO, is uncommon and can be an important signal for investors monitoring executive sentiment.

- To better understand the implications of such substantial insider sales, we'll review how this development may influence Arlo Technologies' investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Arlo Technologies Investment Narrative Recap

For investors considering Arlo Technologies, the core belief centers on the company’s ability to expand its high-margin subscription services in a competitive smart home security market. The recent CEO share sale news does not appear to directly impact Arlo's near-term key catalyst, continued adoption and migration to higher-priced AI-driven service tiers, but highlights ongoing focus on executive confidence and shareholder alignment as a risk. Among recent announcements, Arlo’s August launch of its new camera lineup with added AI-powered features stands out. This expansion supports the growth catalyst of increasing subscriber and ARPU figures, which are central to the narrative on recurring revenue expansion and margin strength. However, in contrast, it’s important for investors to be aware of signals such as persistent insider sales, particularly when...

Read the full narrative on Arlo Technologies (it's free!)

Arlo Technologies' narrative projects $632.0 million in revenue and $103.1 million in earnings by 2028. This requires 7.6% yearly revenue growth and a $110.1 million increase in earnings from the current -$7.0 million.

Uncover how Arlo Technologies' forecasts yield a $23.20 fair value, a 63% upside to its current price.

Exploring Other Perspectives

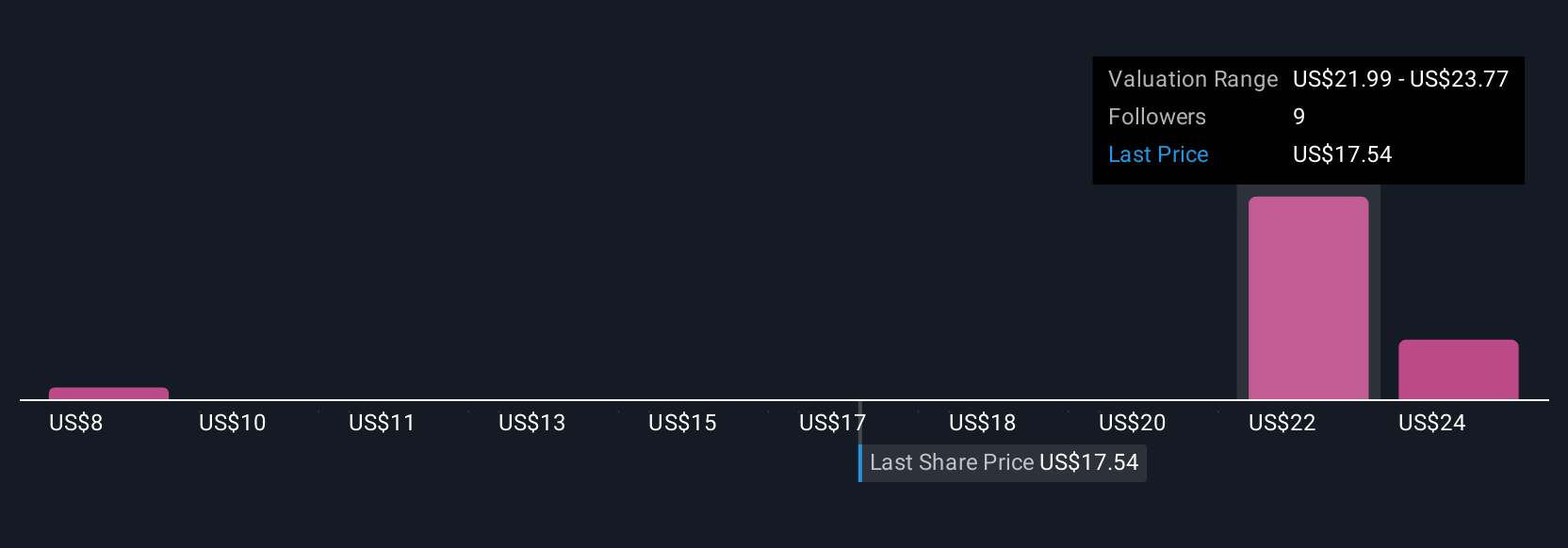

Four fair value estimates from the Simply Wall St Community range from US$7.79 to US$23.20 per share. While many see earnings growth potential, some participants are mindful of risks like margin pressure and competition, resulting in a broad set of views you may want to explore.

Explore 4 other fair value estimates on Arlo Technologies - why the stock might be worth as much as 63% more than the current price!

Build Your Own Arlo Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arlo Technologies research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Arlo Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arlo Technologies' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARLO

Arlo Technologies

Provides cloud-based platform services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific regions.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026