- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:ZBRA

How Investors May Respond To Zebra Technologies (ZBRA) Leadership Shift In People Function And Elo Integration

Reviewed by Sasha Jovanovic

- Zebra Technologies has announced that Melissa Luff Loizides will become Chief People Officer on January 1, 2026, succeeding Jeff Schmitz, who will oversee the Elo acquisition integration through the second quarter of 2026 before retiring.

- This planned succession highlights Zebra’s emphasis on continuity in talent leadership at the same time it works to integrate Elo and support long-term workforce planning.

- Next, we’ll examine how this leadership transition in the People function may influence Zebra’s investment narrative around growth and integration.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Zebra Technologies Investment Narrative Recap

To own Zebra Technologies, you generally need to believe in long term demand for automation, data capture, and intelligent devices across supply chains and customer touchpoints. The Chief People Officer transition itself is unlikely to materially change the near term focus on integrating Elo, which remains a key catalyst, or lessen the risk that acquisitions and heavy R&D spending might not deliver the expected benefits.

The CPO change is closely tied to the Elo Touch Solutions acquisition, since outgoing CPO Jeff Schmitz will stay on to lead that integration through the second quarter of 2026. This linkage keeps people, culture, and workforce planning clearly embedded in the Elo integration effort, which matters for realizing any cross selling opportunities while still managing the higher competitive intensity and margin pressure in those more consumer facing markets.

Yet even as Zebra leans into the Elo opportunity, investors should be aware that...

Read the full narrative on Zebra Technologies (it's free!)

Zebra Technologies' narrative projects $6.2 billion revenue and $855.4 million earnings by 2028. This requires 6.0% yearly revenue growth and about a $307 million earnings increase from $548.0 million today.

Uncover how Zebra Technologies' forecasts yield a $358.47 fair value, a 41% upside to its current price.

Exploring Other Perspectives

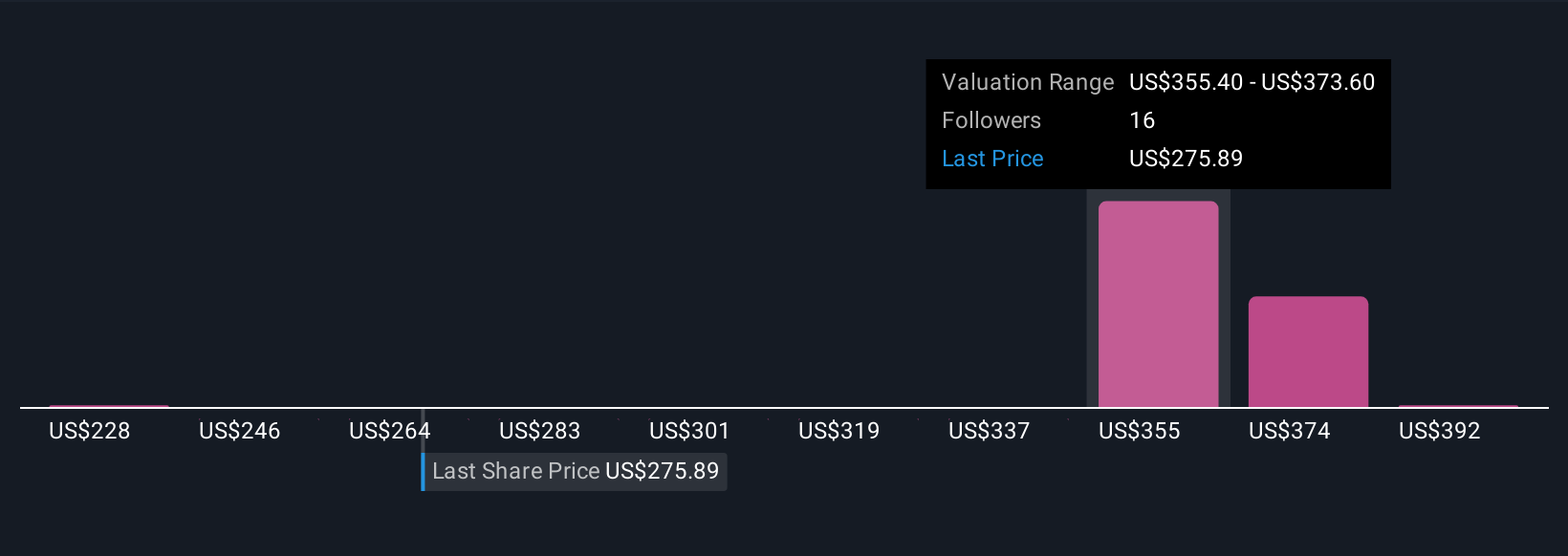

Five members of the Simply Wall St Community see Zebra’s fair value between US$228 and US$410, reflecting very different expectations. Set those views against the Elo integration risk, where tougher consumer facing markets could influence how the business performs over time.

Explore 5 other fair value estimates on Zebra Technologies - why the stock might be worth as much as 62% more than the current price!

Build Your Own Zebra Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zebra Technologies research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Zebra Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zebra Technologies' overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zebra Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZBRA

Zebra Technologies

Provides enterprise asset intelligence solutions in the automatic identification and data capture solutions industry worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026