- United States

- /

- Tech Hardware

- /

- NasdaqGS:WDC

Does Western Digital’s (WDC) ESOP Share Offering Hint at a Shift in Capital Allocation Strategy?

Reviewed by Sasha Jovanovic

- Western Digital Corporation recently filed a shelf registration to offer up to US$1.11 billion of common stock, with 8,000,000 shares intended for an Employee Stock Ownership Plan (ESOP) related offering.

- This move has implications for the company’s capital structure and may raise questions among investors concerning potential equity dilution and future financial flexibility.

- We’ll explore how Western Digital’s sizeable ESOP-related share offering could impact its investment outlook and long-term capital allocation strategy.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Western Digital Investment Narrative Recap

To be a Western Digital shareholder today, you need to believe in the sustained demand for high-capacity storage, particularly from AI and cloud-driven data growth. The recent US$1.11 billion shelf registration, primarily for an ESOP-related offering, should not materially alter the company’s most important near-term catalyst, customer adoption of new storage technologies, but it does raise valid questions about dilution and balance sheet management; the biggest risk remains its heavy reliance on a few hyperscale/cloud customers.

One particularly relevant announcement came on October 31, 2025, when Western Digital completed a buyback of 9,200,000 shares valued at US$702.41 million. This transaction, alongside the new share offering, reflects active capital allocation decisions and highlights management’s balancing act between supporting employee participation and maintaining financial flexibility.

By contrast, a major risk investors should watch is the potential impact if Western Digital’s hyperscale customers shift to in-house storage or...

Read the full narrative on Western Digital (it's free!)

Western Digital's outlook anticipates $11.9 billion in revenue and $2.2 billion in earnings by 2028. Achieving this means sustaining a 7.6% annual revenue growth rate and increasing earnings by $0.6 billion from the current $1.6 billion.

Uncover how Western Digital's forecasts yield a $180.57 fair value, a 11% upside to its current price.

Exploring Other Perspectives

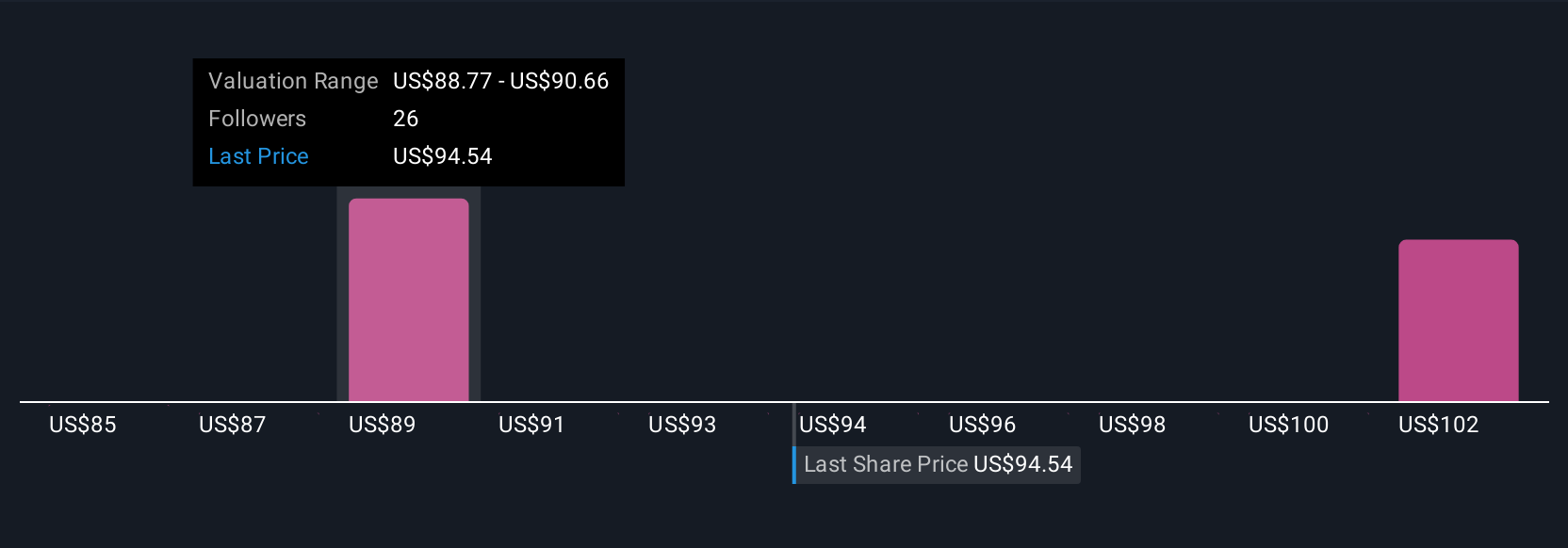

Simply Wall St Community members have shared four fair value estimates ranging from US$85 to US$230,486. Investor opinions vary widely, especially with Western Digital’s revenue so concentrated in a few large cloud clients. Explore these viewpoints and assess how customer concentration could influence future results.

Explore 4 other fair value estimates on Western Digital - why the stock might be worth 48% less than the current price!

Build Your Own Western Digital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Western Digital research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Western Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Western Digital's overall financial health at a glance.

No Opportunity In Western Digital?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDC

Western Digital

Develops, manufactures, and sells data storage devices and solutions based on hard disk drive (HDD) technology in the United States, Asia, Europe, the Middle East, and Africa.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026