- United States

- /

- Tech Hardware

- /

- NasdaqGS:WDC

AI-Fueled Storage Demand And Insider Selling Could Be A Game Changer For Western Digital (WDC)

Reviewed by Sasha Jovanovic

- In recent weeks, Western Digital has drawn investor attention as a newly focused hard disk drive pure play, reporting a 27% year-over-year revenue increase in its first quarter of fiscal 2026 amid strong AI-driven data center storage demand.

- At the same time, a series of insider share sales and a new analyst price target have raised questions about how leadership and external observers view the company’s prospects as AI-related storage needs accelerate.

- Now we’ll explore how Western Digital’s stronger AI-linked storage demand, alongside insider selling activity, could reshape its existing investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Western Digital Investment Narrative Recap

To own Western Digital today, you need to believe that AI-driven data center storage demand can outweigh the risks of relying so heavily on a handful of hyperscale customers and on HDD technology staying relevant. The latest insider selling and new price target appear more like sentiment signals than events that fundamentally alter the near term catalyst, which is sustained AI-related cloud orders, or the key risk of customer concentration and technology shifts.

The recent insider trading pattern, including Cynthia Tregillis’ and Gubbi Vidyadhara K’s share sale filings, sits alongside Western Digital’s 27% year over year revenue increase in Q1 FY2026, underscoring the tension between strong AI-focused operating momentum and questions about how closely insiders’ actions align with that growth story.

But investors should still pay close attention to how vulnerable Western Digital remains to shifts in buying patterns from a small group of hyperscale cloud customers and...

Read the full narrative on Western Digital (it's free!)

Western Digital's narrative projects $11.9 billion revenue and $2.2 billion earnings by 2028. This requires 7.6% yearly revenue growth and about a $0.6 billion earnings increase from $1.6 billion today.

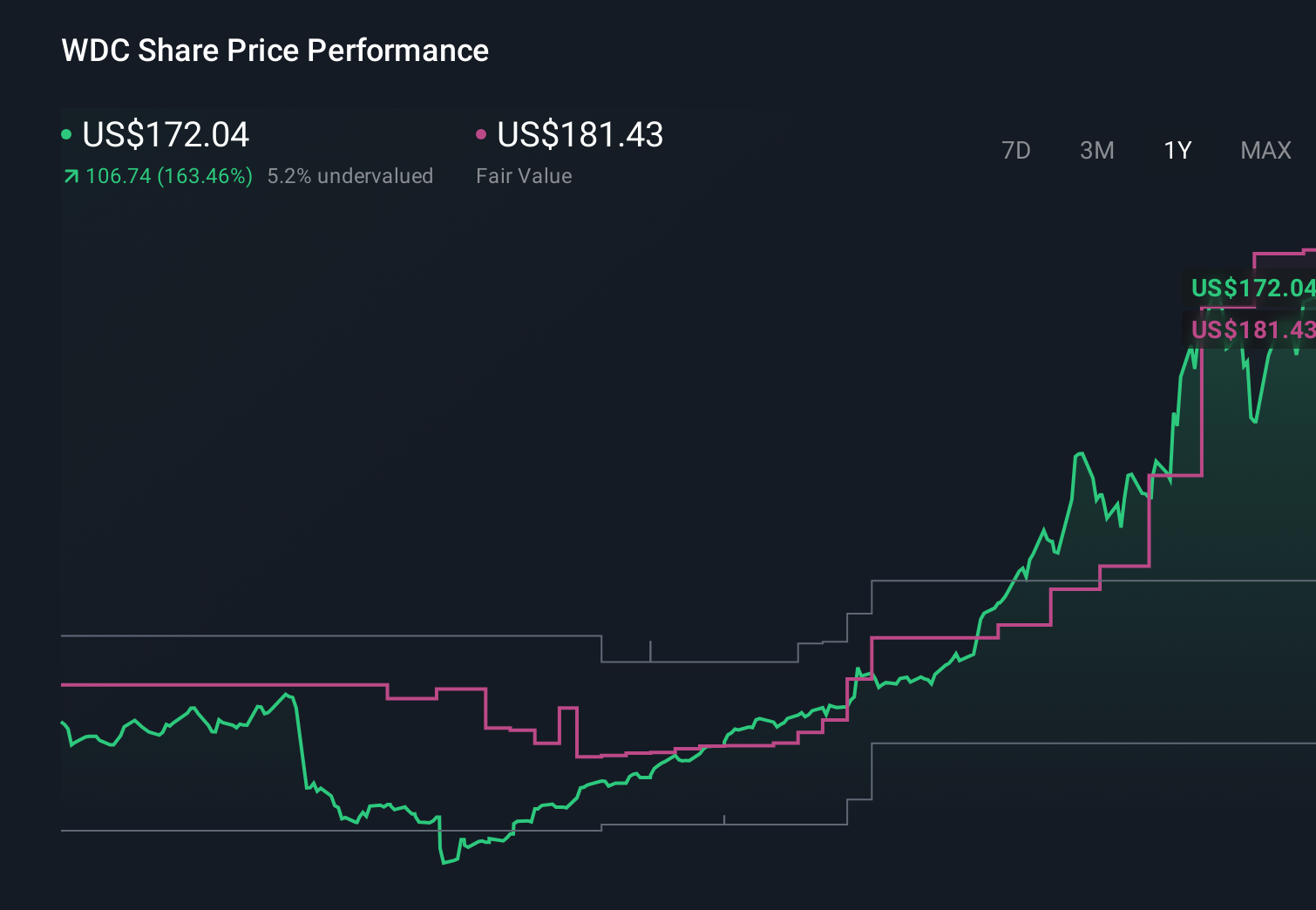

Uncover how Western Digital's forecasts yield a $181.43 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span roughly US$85 to US$231, showing how widely retail expectations can spread. Set against Western Digital’s AI driven storage catalyst and customer concentration risk, this range underlines why you may want to compare several viewpoints before forming a view on the stock’s potential performance.

Explore 4 other fair value estimates on Western Digital - why the stock might be worth 50% less than the current price!

Build Your Own Western Digital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Western Digital research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Western Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Western Digital's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDC

Western Digital

Develops, manufactures, and sells data storage devices and solutions based on hard disk drive (HDD) technology in the United States, Asia, Europe, the Middle East, and Africa.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026