- United States

- /

- Communications

- /

- NasdaqGS:VSAT

Is Now the Right Moment for Viasat After Surging 275% and Inmarsat Acquisition?

Reviewed by Bailey Pemberton

- Wondering if Viasat stock is a hidden gem or simply getting ahead of itself? Let’s dig into why now might be the perfect moment to re-examine its valuation.

- The stock has been on a wild ride recently, losing 6.7% in the last week but still surging an incredible 275.8% year-to-date and nearly 298% over the past year. That kind of volatility can signal big opportunity or shifting risks.

- Recent headlines have focused on Viasat’s advancements in satellite technology and its acquisition of Inmarsat. These developments have fueled investor excitement as well as questions about integration challenges. Analysts and the media have also highlighted its growing role in secure communications, drawing attention to developments in the space tech industry.

- Viasat currently scores a solid 5 out of 6 on our value checks for being undervalued. This sets the stage for a closer look at how different valuation methods stack up. We’ll cover those in detail, but be sure to read on for what could be an even more insightful way to judge its worth at the end of this article.

Approach 1: Viasat Discounted Cash Flow (DCF) Analysis

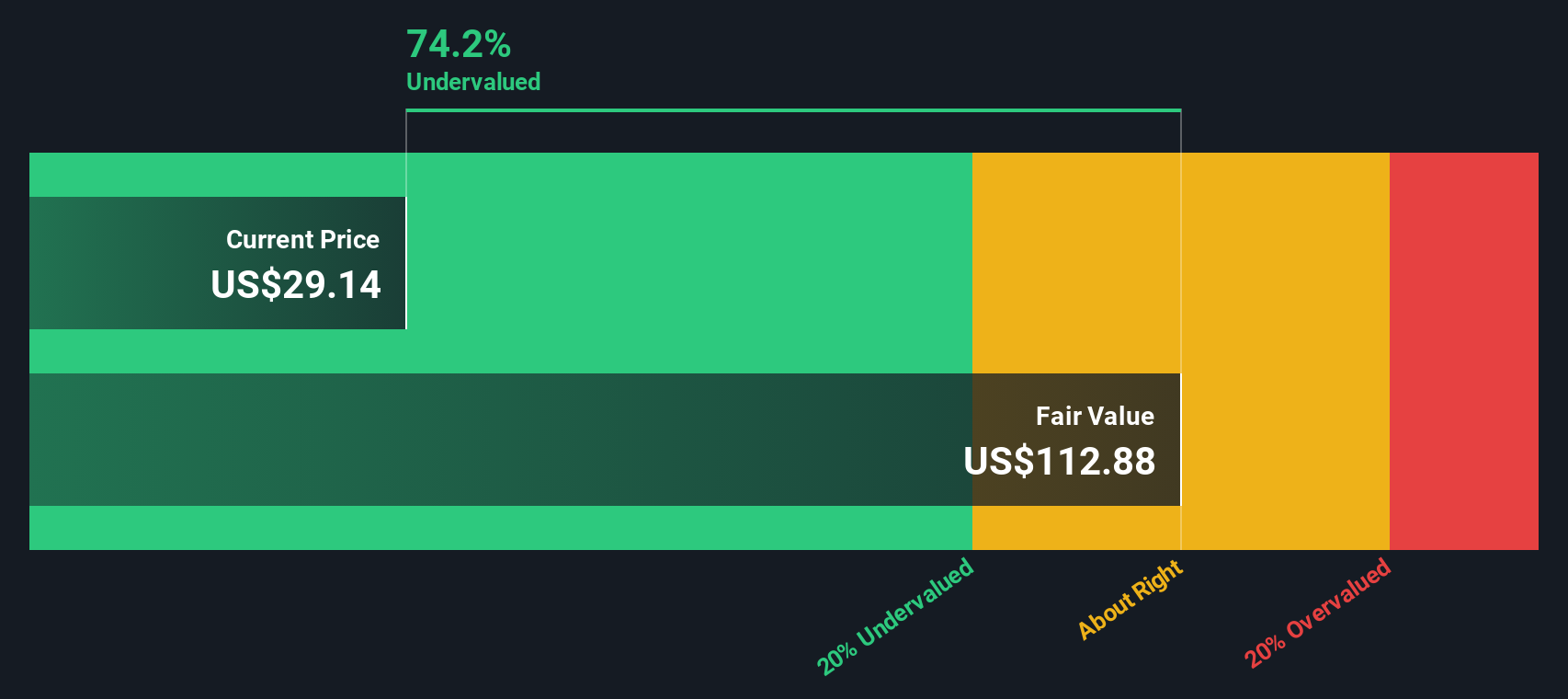

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. For Viasat, this approach helps clarify the gap between its current stock price and its underlying business fundamentals.

Currently, Viasat's free cash flow (FCF) stands at -$328 million. Analysts forecast that FCF will swing positive and reach $573 million by 2028, with subsequent years showing continued growth through Simply Wall St’s extrapolated estimates. In ten years, FCF is projected to exceed $1.15 billion, highlighting optimism for the company’s future cash-generating potential.

Applying the DCF method, Viasat’s fair value is calculated at $63.20 per share. This figure suggests the stock is trading at a 43.3% discount to its estimated intrinsic value. This may indicate that shares are significantly undervalued at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Viasat is undervalued by 43.3%. Track this in your watchlist or portfolio, or discover 878 more undervalued stocks based on cash flows.

Approach 2: Viasat Price vs Sales

The Price-to-Sales (P/S) ratio is a particularly useful metric when assessing companies like Viasat, especially during periods when earnings may be negative or volatile due to heavy investments or industry cycles. By focusing on sales, investors can gauge the value the market places on each dollar of the company’s revenue. This makes it a favored measure in the fast-changing communications sector.

Growth expectations and risk play a big role in determining what constitutes a “normal” or “fair” P/S ratio. Higher growth prospects, strong profit margins, and lower risk often support higher multiples. In contrast, slower growth or higher uncertainty typically mean a lower acceptable ratio.

Viasat’s current P/S ratio is 1.05x. This is well below both the industry average of 2.11x and the average of its peers at 3.33x. To refine this comparison, Simply Wall St offers a proprietary “Fair Ratio,” which is 2.11x for Viasat. This measure is especially insightful because it adjusts for key factors like company growth, risks, profit margin, market cap, and industry nuances. The aim is to represent what the deserved multiple should be rather than relying on a simplistic peer or sector average.

With Viasat’s actual P/S multiple virtually identical to its Fair Ratio, the stock’s current valuation by this approach appears balanced and reasonable.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

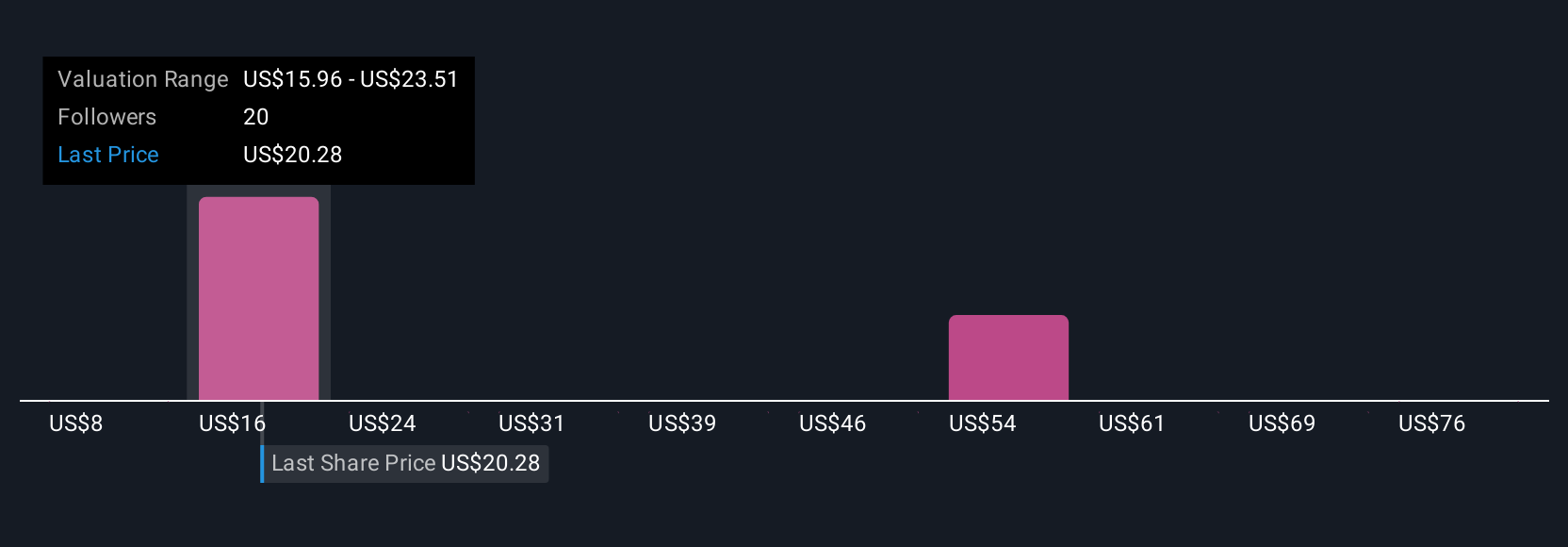

Upgrade Your Decision Making: Choose your Viasat Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your chance to connect the story you see for Viasat, whether based on new technologies, deals, risks, or market trends, directly to your financial assumptions such as fair value, future earnings, or revenue growth.

Rather than just relying on ratios, Narratives help you map out what you believe will drive Viasat’s future success or setbacks and tie those specific beliefs to forecasts and a fair value for the stock. It is a practical approach used by millions on Simply Wall St through the Community page, designed for all investors, not just Wall Street pros.

With Narratives, you can easily compare your fair value to the current share price, which helps you decide when to buy, hold, or sell. Because Narratives update dynamically as news, reports, or new analysis comes in, your outlook always stays current.

For example, a bullish Narrative on Viasat uses assumptions like rising demand for secure connectivity and new satellite launches to forecast a high fair value of $52 per share. On the other hand, a more cautious Narrative that factors in mounting competition and industry risks might justify just $10 per share. Narratives make your investment analysis both personal and powerful.

Do you think there's more to the story for Viasat? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VSAT

Viasat

Provides broadband and communications products and services in the United States and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives