- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:TRMB

Is Trimble Fairly Priced After Its 7.3% Weekly Surge and Digital Expansion News?

Reviewed by Bailey Pemberton

- Wondering if Trimble is a great value buy right now? Here is what you need to know about the company’s stock and its potential.

- After a strong 7.3% jump in the past week and a year-to-date increase of 16.6%, Trimble’s share price is catching fresh attention. This comes alongside a 12.2% gain over the last year.

- Recent headlines about Trimble’s expansion into digital construction technologies and strategic partnerships have contributed to the positive momentum, suggesting investor expectations for growth may be increasing. The market appears to be reacting to Trimble’s push into advanced automation and connected workflows, which could influence its industry presence.

- On the latest valuation check, Trimble scored 3 out of 6 for being undervalued, placing it in the middle of the pack. Here is how different valuation methods compare, with a perspective that may help you better understand its real worth.

Find out why Trimble's 12.2% return over the last year is lagging behind its peers.

Approach 1: Trimble Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s fair value by projecting its expected future cash flows and then discounting them back to today’s value. This helps investors determine what a business could be worth based on the money it is expected to generate in the coming years.

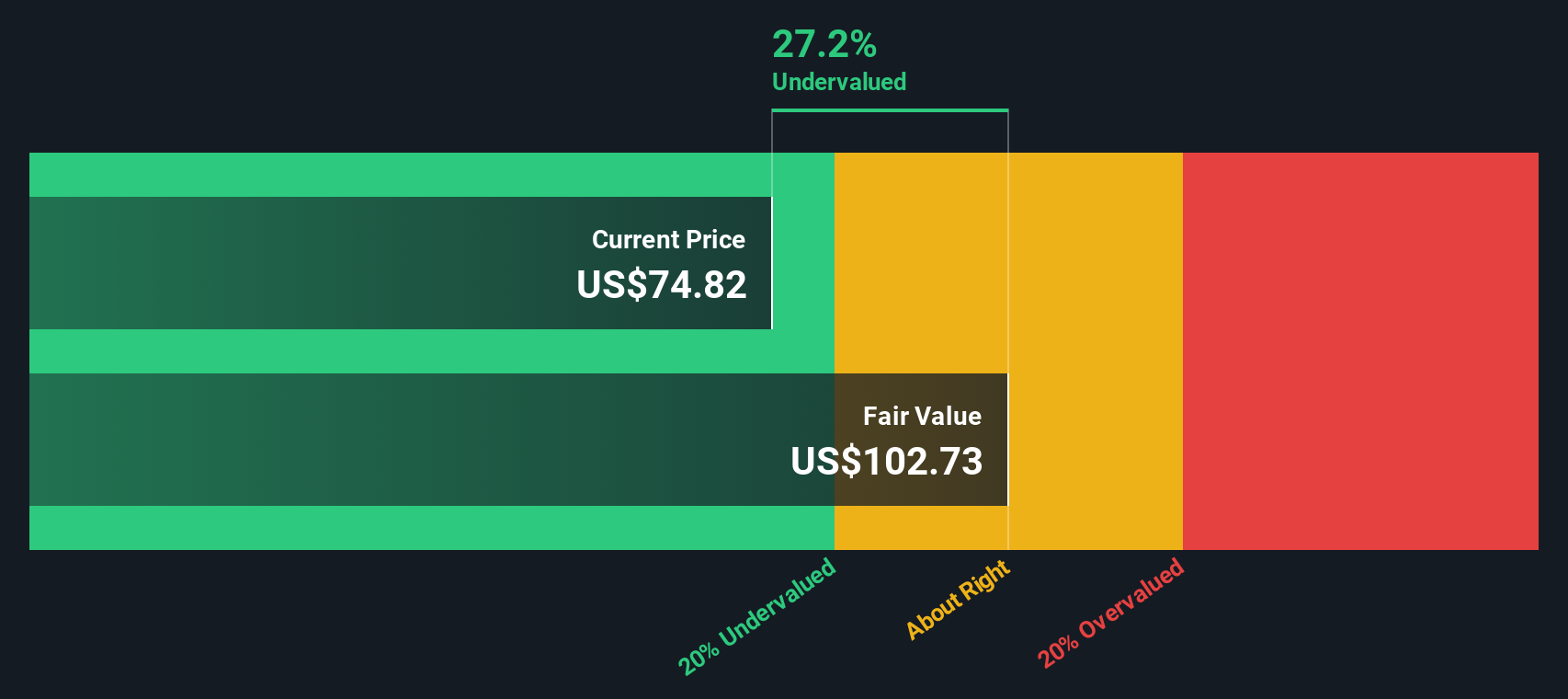

For Trimble, the DCF analysis begins with the company’s latest twelve-month Free Cash Flow (FCF) of $307.56 Million. Analyst forecasts extend out to 2027, projecting FCF growth to $1.01 Billion. After this, cash flows are extrapolated over the next decade, anticipating continued expansion, with 2035 FCF estimates reaching approximately $1.84 Billion. All values are reported in US dollars.

Based on these projections, Trimble’s intrinsic value is calculated at $102.69 per share, which is approximately 20.9% higher than the current share price. This suggests that, according to the DCF analysis, Trimble stock is presently undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Trimble is undervalued by 20.9%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: Trimble Price vs Earnings

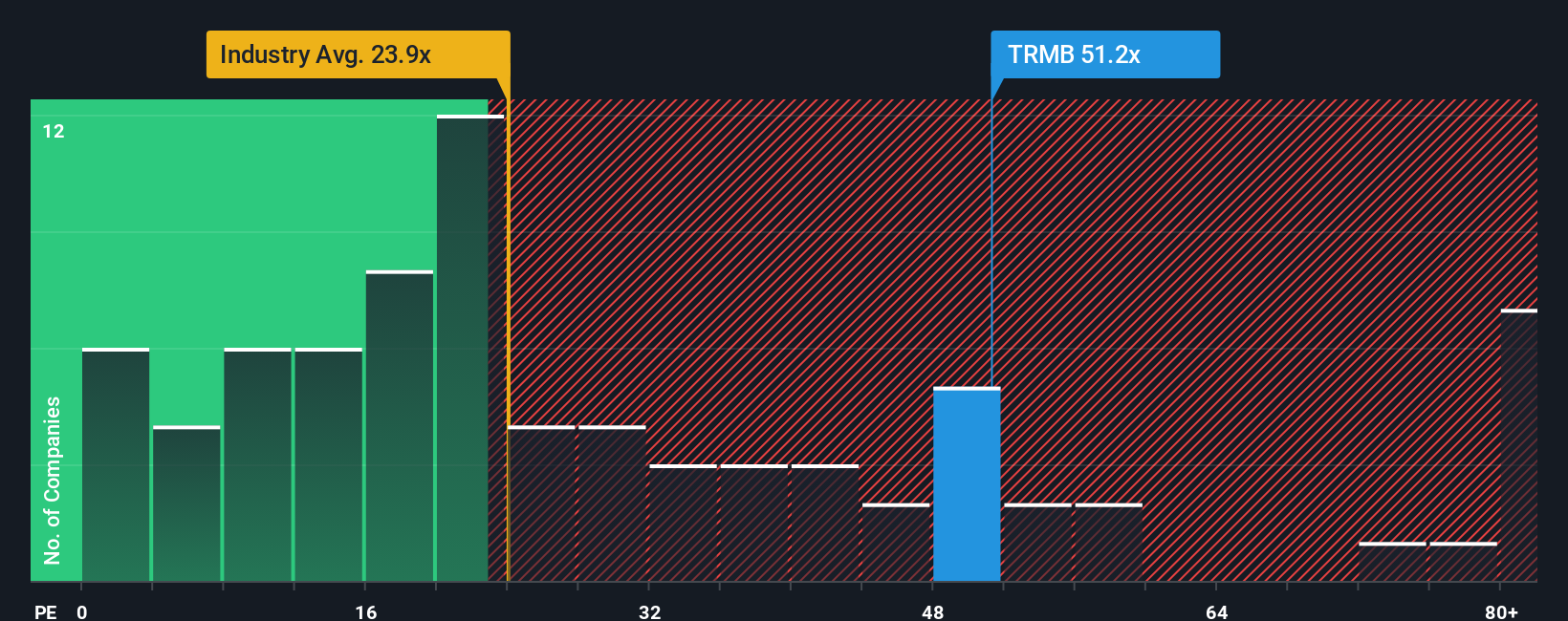

The Price-to-Earnings (PE) ratio is widely used to value profitable companies because it directly compares a company’s share price with its per-share earnings. This makes the PE ratio a solid benchmark for assessing how much the market is willing to pay for each dollar of current earnings, especially for firms like Trimble that consistently generate profits.

Growth expectations and risk level play a significant role in determining what a "normal" or "fair" PE ratio should be. Higher growth prospects or lower risks generally justify a higher multiple, while more uncertain futures typically warrant lower valuations. Investors often look at industry averages and peers as points of reference.

Trimble’s current PE ratio is 54.07x, which stands notably higher than both the peer average of 36.59x and the Electronic industry average of 24.65x. At first glance, this suggests the stock is richly valued versus broader benchmarks. However, Simply Wall St’s proprietary “Fair Ratio,” calculated to be 33.65x for Trimble, takes into account specifics unique to the company, such as its earnings growth, profit margins, industry context, market capitalization, and risk profile.

Rather than relying solely on general benchmarks, the Fair Ratio provides a more tailored assessment of what Trimble’s valuation should be. Because it incorporates factors like growth outlook and operational efficiency, it offers a sharper lens than simply comparing Trimble to its peers or industry average.

Comparing the actual PE ratio (54.07x) to the Fair Ratio (33.65x) reveals that Trimble’s stock is currently being valued significantly above what is suggested by its fundamentals and risk factors.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Trimble Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a unique way to connect a company’s story with your own view of Trimble’s products, management, and industry trends, linked to real financial forecasts and a resulting fair value. Rather than only crunching numbers, Narratives let you express your perspective behind those numbers, tying your assumptions such as revenue growth, future profit margins, and earnings directly to what you believe the stock is truly worth.

On Simply Wall St’s Community page, Narratives are available to everyone and used by millions of investors. They make the investment process easy and accessible, giving you a tool to compare your calculated fair value to Trimble’s current share price. Narratives dynamically update as news or earnings are released, allowing your outlook to evolve with new information.

For example, some investors using Narratives might believe Trimble can achieve rapid cloud adoption and margin expansion, assigning a bullish fair value close to $100 per share. Others may highlight risks from competition or slower recurring revenue growth, landing on a more cautious value near $84. Narratives empower you to make smarter, story-driven decisions that reflect your own view of Trimble’s future.

Do you think there's more to the story for Trimble? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trimble might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRMB

Trimble

Provides technology solutions that enable professionals and field mobile workers to enhance or transform their work processes in North America, Europe, the Asia Pacific, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success