- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:TRMB

A Look at Trimble’s (TRMB) Valuation After Raised 2025 Guidance and Strong Quarterly Results

Reviewed by Simply Wall St

Trimble (TRMB) shares saw renewed interest after the company raised its full-year 2025 financial guidance. The move follows a solid earnings report and an update on ongoing share buybacks.

See our latest analysis for Trimble.

Momentum is clearly building for Trimble, with the raised 2025 guidance following higher third-quarter earnings, more share repurchases, and a recent technology lab partnership. The market has responded in kind, with a year-to-date share price return of 13.2% and a 1-year total shareholder return of 8.6%. This reflects renewed optimism about Trimble's growth potential in both the near and longer term.

If strong guidance and tech-driven strategies have your attention, now’s a smart time to broaden your search and discover fast growing stocks with high insider ownership

With shares climbing this year and forecasts improving, investors must now decide if Trimble’s fundamentals signal untapped value or if all of the company's growth prospects are already reflected in the current price.

Most Popular Narrative: 19.2% Undervalued

Trimble’s latest narrative points to a fair value notably higher than its recent closing price, amplifying the buzz about further upside if key drivers play out as expected.

“The migration from hardware-focused, CapEx models to bundled, subscription-based offerings, even in traditionally hardware-oriented segments, expands the addressable market, improves revenue visibility, and increases recurring revenue mix. This drives greater predictability and enhanced long-term earnings.”

Curious what bold assumptions could push Trimble’s value far beyond current price? The calculation centers on aggressive recurring revenue growth and some ambitious future profit targets. Only the full narrative reveals the catalysts and the controversial valuation logic that power this forecast.

Result: Fair Value of $97.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in government spending and rapid technology shifts could undermine Trimble’s transition and dampen the optimistic growth outlook.

Find out about the key risks to this Trimble narrative.

Another View: Valuation Gaps to Watch

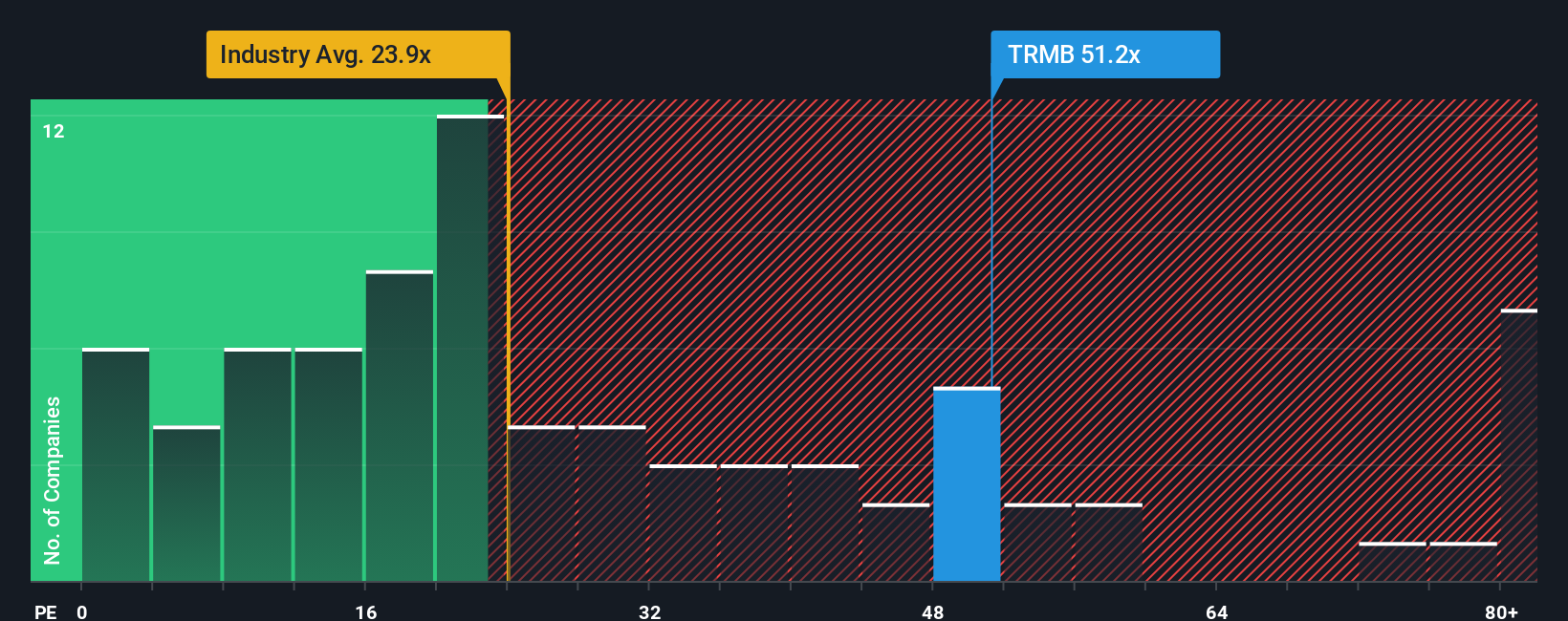

Looking through the lens of valuation ratios, Trimble’s price-to-earnings sits far above both the electronic industry average and the estimated fair ratio. While this signals optimism for future profit growth, it also suggests investors are taking on greater valuation risk than peers. Can this premium really last?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trimble Narrative

If you think the numbers tell a different story or want to investigate the details yourself, you can shape your own outlook in just minutes. Do it your way

A great starting point for your Trimble research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

The best opportunities often appear where others aren’t looking. Other sharp investors are already using Simply Wall Street’s powerful tools to spot tomorrow’s winners. Don’t wait and risk missing out on unique stocks that match your goals.

- Uncover high-yield opportunities and tap into reliable annual income by checking out these 16 dividend stocks with yields > 3%.

- Gain an edge with future-shaping innovations by viewing these 25 AI penny stocks targeting real-world AI applications and scalable growth.

- Position yourself ahead of the crowd by screening for the market’s most attractively priced gems using these 876 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trimble might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRMB

Trimble

Provides technology solutions that enable professionals and field mobile workers to enhance or transform their work processes in North America, Europe, the Asia Pacific, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives