- United States

- /

- Tech Hardware

- /

- NasdaqGS:STX

Can Seagate’s (STX) New Regional Leadership Unlock Growth in Emerging Data Markets?

Reviewed by Sasha Jovanovic

- Seagate Technology Holdings recently appointed Sameer Bhatia as senior regional director for India, the Middle East, Turkey, and Africa, expanding his leadership to oversee the company’s regional strategy and customer relationships in these key markets.

- This move underlines Seagate’s intent to strengthen its footprint and capitalize on rising demand for scalable storage solutions in regions experiencing rapid data creation, digital infrastructure investment, and cloud adoption.

- We'll now examine how Bhatia's appointment to lead IMETA could shape Seagate's broader investment narrative amid accelerating regional data growth.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Seagate Technology Holdings Investment Narrative Recap

Anyone considering Seagate Technology Holdings generally needs to believe in ongoing global demand for large-scale data storage fueled by AI and cloud adoption, as well as the company’s ability to lead in high-capacity, energy-efficient drives. While the appointment of Sameer Bhatia as senior regional director for IMETA highlights commitment to international expansion, it does not appear to meaningfully impact the company’s largest immediate catalyst, mass capacity storage, driven by hyperscale cloud and AI investments, or its major risk, which remains competitive pressure from alternative storage technologies.

Among recent company developments, the launch of new high-performance 30TB Exos and IronWolf drives is directly relevant to Seagate’s current growth narrative. These products serve ongoing demand for scalable capacity in global data centers, echoing the short-term catalyst of increased cloud infrastructure investment and reinforcing Seagate’s focus on innovation to capture more of the enterprise and hyperscale market.

By contrast, investors should be aware of competitive risks posed by rapid adoption of alternative storage technologies such as SSDs, as these...

Read the full narrative on Seagate Technology Holdings (it's free!)

Seagate Technology Holdings is projected to reach $12.0 billion in revenue and $2.5 billion in earnings by 2028. This outlook assumes a 9.5% annual revenue growth rate and a $1.0 billion increase in earnings from the current $1.5 billion.

Uncover how Seagate Technology Holdings' forecasts yield a $287.10 fair value, a 4% upside to its current price.

Exploring Other Perspectives

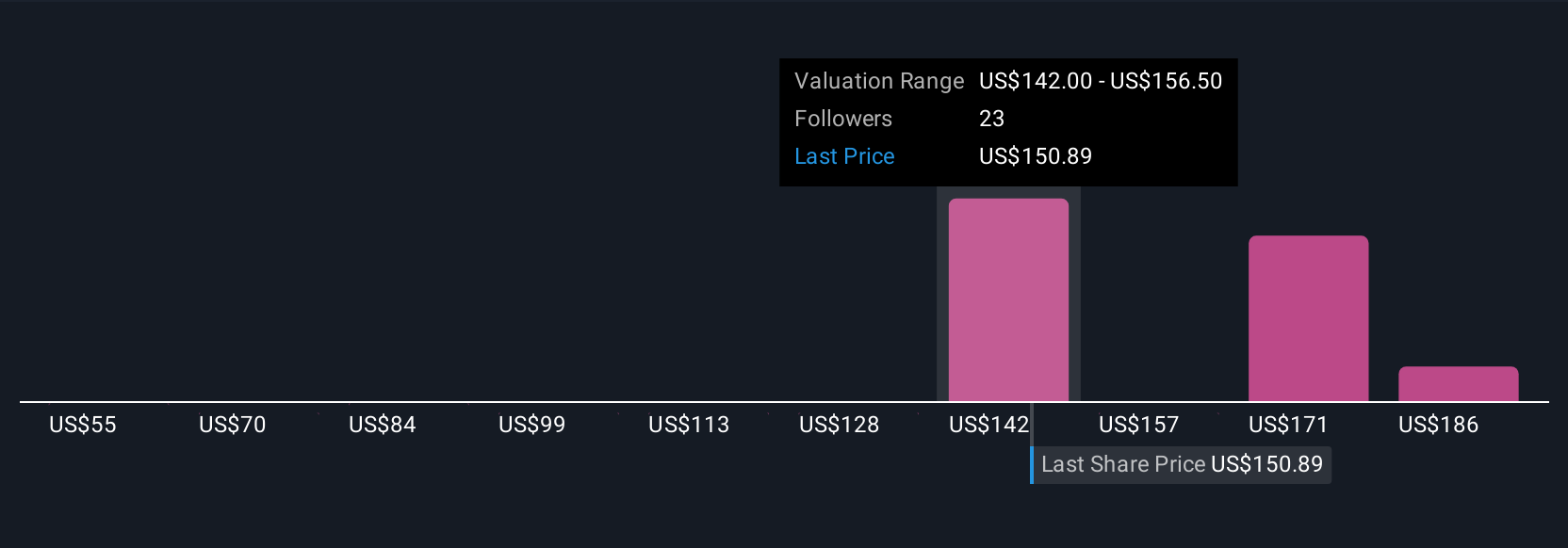

Three fair value estimates from the Simply Wall St Community range from US$215 to US$357, showing a spread of investor views on Seagate. While expansion into growing data markets supports the mass storage catalyst, these differences highlight how performance expectations can shift, see what others are forecasting and why views vary.

Explore 3 other fair value estimates on Seagate Technology Holdings - why the stock might be worth 22% less than the current price!

Build Your Own Seagate Technology Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Seagate Technology Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Seagate Technology Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Seagate Technology Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STX

Seagate Technology Holdings

Engages in the provision of data storage technology and infrastructure solutions in Singapore, the United States, the Netherlands, and internationally.

Reasonable growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026