- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLXS

Plexus (PLXS): Evaluating Valuation After Strong Q4 Earnings Beat and Renewed Analyst Focus

Reviewed by Simply Wall St

Plexus (PLXS) just surpassed expectations with its fourth-quarter earnings, reporting an earnings per share of $2.14. This clear beat has quickly put the company on investors’ radar and has prompted discussion about its future growth prospects.

See our latest analysis for Plexus.

Plexus’s standout quarterly results have come amid a year of mixed share price momentum. Despite a recent 3.04% gain over the past week and a steady 5.41% share price return for the quarter, its year-to-date share price remains down 8.24%. Looking at a broader timeframe, the total shareholder return over the past year sits at -14.43%. The stock’s three- and five-year total shareholder returns of 31.78% and 80.43% indicate meaningful long-term value for patient investors.

If you’re looking to spot the next set of companies building momentum, now is a great time to explore fast growing stocks with high insider ownership

With shares trading below analysts’ targets and recent results exceeding expectations, the big question is whether Plexus is currently undervalued or if the market is already pricing in most of its growth potential.

Most Popular Narrative: 10% Undervalued

Plexus’s narrative consensus places fair value notably above the latest close. This suggests investors could be overlooking some key drivers of future value compared to the current price.

The company's increasing success in winning programs in high-margin, complex sectors such as healthcare/life sciences, aerospace, and defense (including strong defense pipeline in Europe and record sector wins) is shifting the revenue mix toward segments with higher pricing power and more stable, long-term contracts. This should positively impact both revenue consistency and net margin expansion.

Want to know the method behind this bold valuation call? Discover the crucial trajectory for revenue mix, margins, and long-term contracts that sets this price target apart. The underlying assumptions could change your perspective on Plexus. Uncover the details that analysts are betting on and decide if the numbers stack up.

Result: Fair Value of $159 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tariff uncertainties and customer concentration could disrupt revenue momentum if large clients delay orders or if global trade tensions worsen.

Find out about the key risks to this Plexus narrative.

Another View: Market Ratios Tell a Different Story

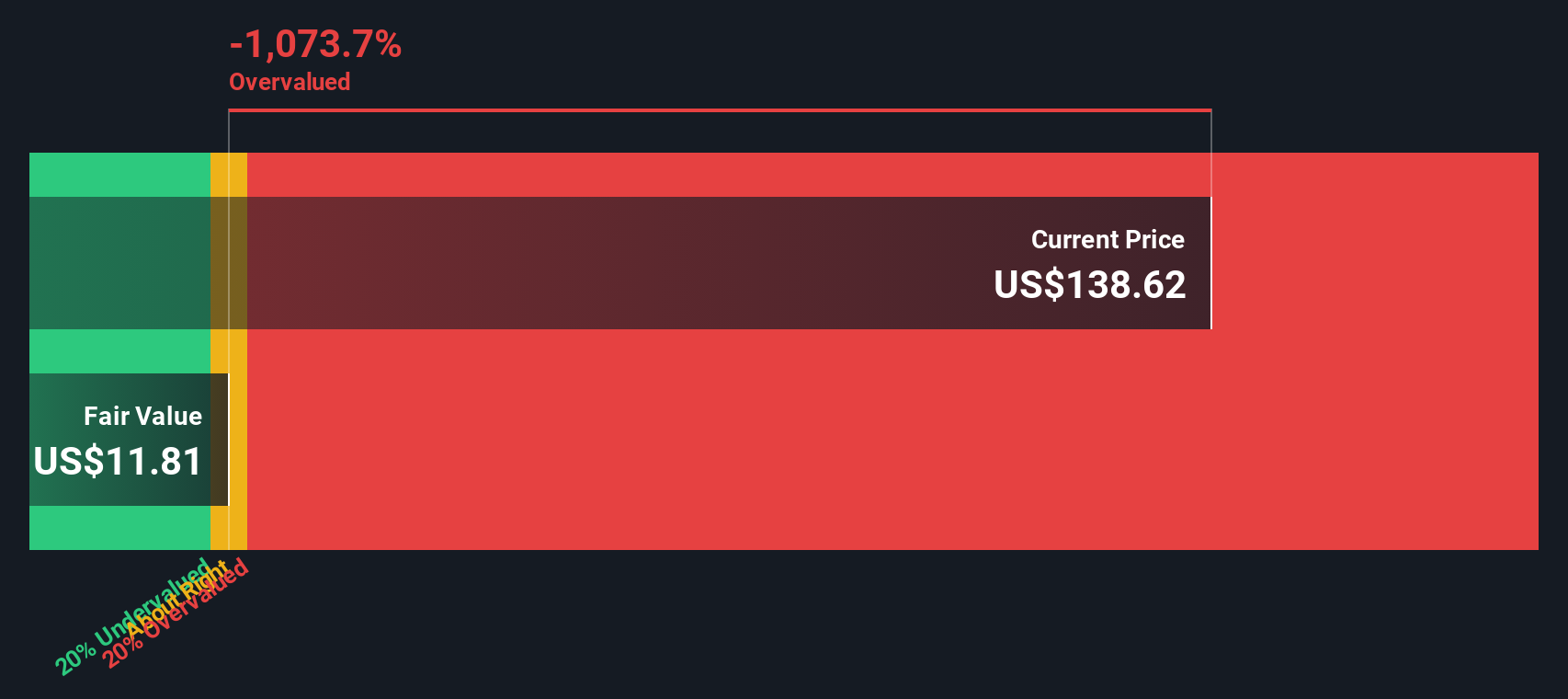

Our SWS DCF model says Plexus is trading well above its estimate of fair value. The current price of $142.43 is compared to a DCF value of $63.95. This suggests the market’s optimism may be running ahead of fundamental cash flows. Will investors keep paying up, or is caution warranted?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Plexus Narrative

If you want to dig deeper or come to your own conclusion, it only takes a few minutes to shape your own perspective from the data. Do it your way

A great starting point for your Plexus research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let your portfolio miss out on fresh ideas that can give you an edge. The most promising trends and sectors are just a click away. Seize your next opportunity now!

- Uncover income potential and consistency with these 14 dividend stocks with yields > 3%, offering yields above 3% for those seeking regular returns and stability in turbulent markets.

- Jump into tech innovation by checking out these 25 AI penny stocks and stay ahead with companies advancing artificial intelligence and shaping tomorrow’s industries.

- Target undervalued opportunities where hidden value may reward patient investors by harnessing these 923 undervalued stocks based on cash flows to spot high-quality businesses trading below intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLXS

Plexus

Provides electronic manufacturing services in the United States, the Asia-Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026