- United States

- /

- Tech Hardware

- /

- NasdaqCM:OSS

One Stop Systems (OSS): Losses Worsen Despite 15.1% Revenue Growth, Challenging Bull Narratives

Reviewed by Simply Wall St

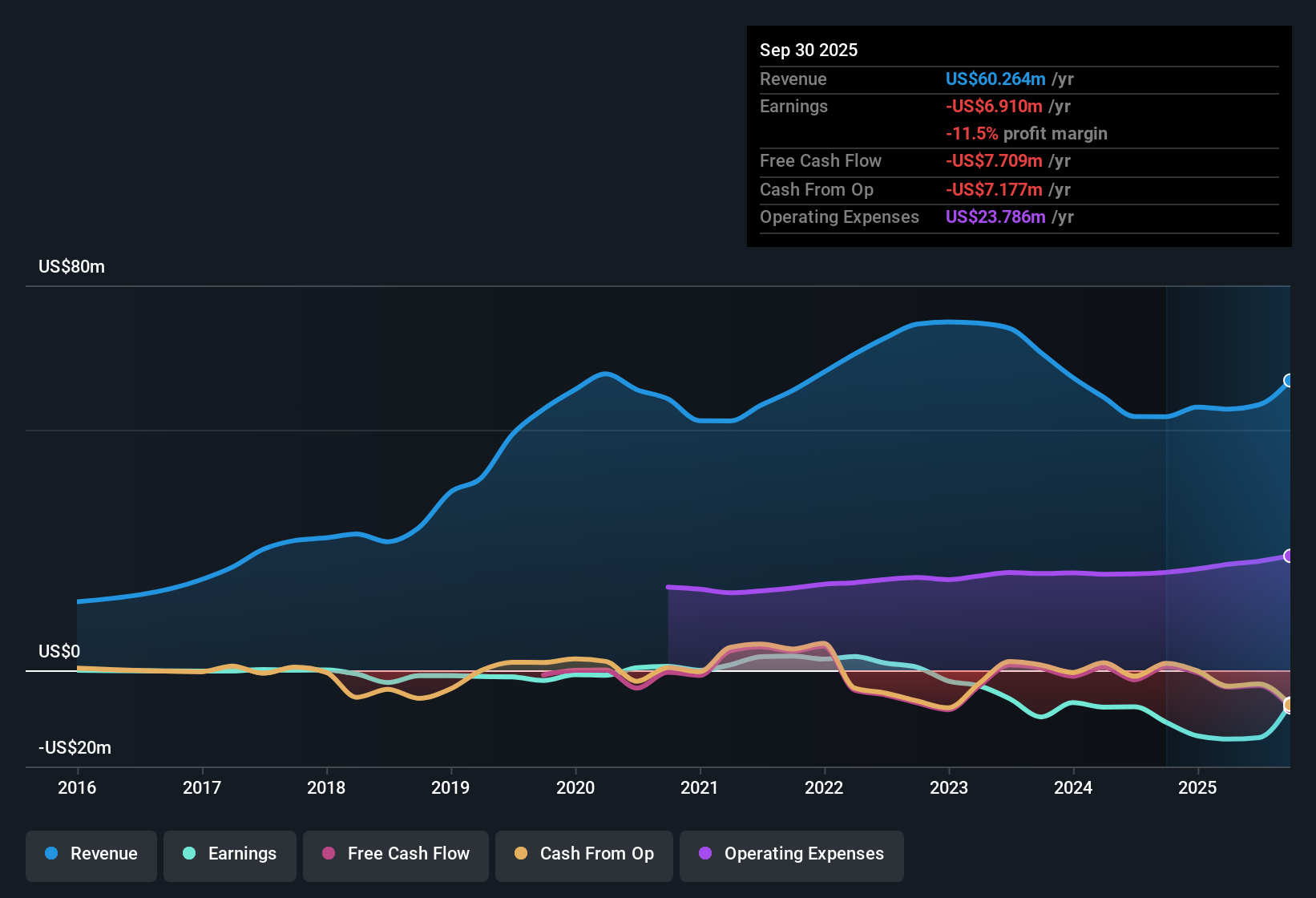

One Stop Systems (OSS) is forecasting revenue growth of 15.1% per year, outpacing the US market’s projected 10.5% annual increase. Despite this robust top-line outlook, the company remains unprofitable and has experienced annual net losses rising at a steep 69.1% rate over the past five years, with no meaningful improvement in net profit margins. As a result, investors find themselves weighing the prospect of strong revenue expansion against ongoing challenges in profitability and a higher-than-average valuation multiple.

See our full analysis for One Stop Systems.The next section will examine how these numbers compare with the most widely followed narratives in the market, highlighting where assumptions are confirmed and where the data tells a different story.

See what the community is saying about One Stop Systems

AI Platform Launches Drive Margin Hopes

- New proprietary PCIe Gen5 platforms like Ponto are expected to boost average selling prices and support higher margins, starting in 2026, according to the latest EDGAR summary.

- Analysts' consensus view points to multi-year defense and commercial platform wins that give OSS visibility into revenue and margin expansion.

- Platform-level opportunities and a robust book-to-bill ratio above 2 highlight increasing predictability and reinforce the margin upside case.

- However, these bullish expectations depend on successfully scaling production and capitalizing on expanding demand for rugged, AI-focused computing solutions.

Contract Volatility Overshadows Growth

- OSS’s dependence on government and defense contracts makes revenue streams highly unpredictable because of timing delays and shifting budget cycles identified in the EDGAR risk factors.

- Analysts' consensus view warns that revenue stability and sustained margin gains are at risk.

- Volatile government spending, supply chain disruptions, and the threat from larger integrated competitors could diminish OSS’s advantage in its niche.

- International uncertainty, especially weaker European IT spending, leaves consolidated performance exposed to disruption and slowdowns.

Valuation Premium Versus Peers

- One Stop Systems currently trades at 2.6x Price-to-Sales, above both the US tech industry average of 1.8x and direct peer average of 0.6x, suggesting the stock is relatively expensive based on sales multiples.

- Analysts' consensus view notes that, despite the lofty multiple, the current share price of $5.76 still sits below the consensus analyst target.

- Bulls might claim the projected 15.1% annual revenue growth justifies the premium, but ongoing unprofitability and rising net losses challenge the case for a sustained re-rating.

- If OSS fails to reach the expected profitability milestones, its premium valuation could quickly become difficult to defend against lower-multiple peers.

- To see how analysts factor in these valuation concerns as part of their balanced case for OSS, check out the full consensus narrative for a deeper dive into upside and downside scenarios. 📊 Read the full One Stop Systems Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for One Stop Systems on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the data? Shape your perspective by creating your own narrative in just a few minutes. Do it your way

A great starting point for your One Stop Systems research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite robust revenue growth forecasts, One Stop Systems struggles with persistent losses and an expensive valuation. These factors may be hard to justify if profitability does not improve.

If valuation risks are on your mind, discover better-priced opportunities with these 836 undervalued stocks based on cash flows that are more attractively valued based on their future cash flows and fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:OSS

One Stop Systems

Designs, manufactures, and markets rugged high-performance compute, high speed switch fabrics, and storage systems for edge applications of artificial intelligence and machine learning, sensor processing, sensor fusion, and autonomy in the United States and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives