- United States

- /

- Communications

- /

- NasdaqCM:ONDS

The Bull Case For Ondas Holdings (ONDS) Could Change Following Leadership Shift and New Capital Moves

Reviewed by Sasha Jovanovic

- In recent weeks, Ondas Holdings Inc. filed a shelf registration for approximately US$5.59 million in common stock, bolstered its acquisitions in defense and drone technology, and added Maj. Gen. (Ret.) Yoav Har-Even to its Advisory Board.

- These moves highlight Ondas Holdings' commitment to international expansion and funding growth, while prompting discussions around market positioning and potential dilution for investors.

- We’ll examine how the addition of a seasoned defense leader to the Advisory Board could shift Ondas Holdings’ investment outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Ondas Holdings Investment Narrative Recap

To own Ondas Holdings, you need to believe in a turnaround led by the expansion of its autonomous systems and defense technology platforms, especially as revenue expectations in 2025 hinge on international orders and strategic partnerships. The recent US$5.59 million shelf registration and board appointments may help fund ongoing growth, but the most immediate catalyst remains the upcoming Q3 earnings report, while the biggest risk continues to be share dilution and uncertain profitability, neither of which are likely fully resolved by these events.

Among recent developments, the proposed amendment to double authorized common shares (up for vote on November 18, 2025) is closely tied to the dilution risk from new equity offerings, which could impact existing shareholders if not balanced by accelerating revenue and margin improvements.

By contrast, investors should be aware that expanding the share count may affect value per share if revenue growth doesn't keep pace with dilution...

Read the full narrative on Ondas Holdings (it's free!)

Ondas Holdings' outlook anticipates $151.6 million in revenue and $16.3 million in earnings by 2028. This scenario assumes a 141.1% annual revenue growth rate and a $63.2 million increase in earnings from current earnings of -$46.9 million.

Uncover how Ondas Holdings' forecasts yield a $9.50 fair value, a 62% upside to its current price.

Exploring Other Perspectives

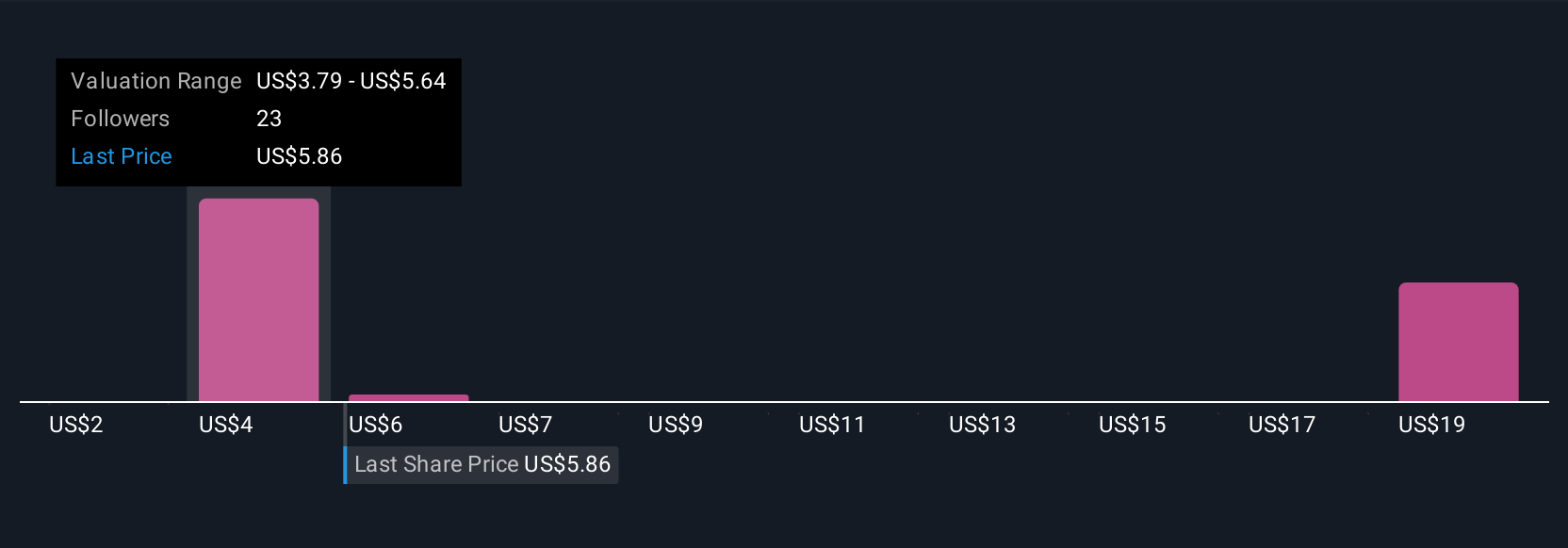

Thirteen Simply Wall St Community fair value estimates for Ondas Holdings range widely from US$0.47 to US$13.85 per share. While perspectives differ, concerns about dilution could weigh on future performance and invite closer attention to how management balances growth and funding.

Explore 13 other fair value estimates on Ondas Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Ondas Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ondas Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ondas Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ondas Holdings' overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ONDS

Ondas Holdings

Provides private wireless, drone, and automated data solutions in the United States and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives