- United States

- /

- Tech Hardware

- /

- NasdaqGS:NTAP

NetApp (NTAP) Margins Hold Steady at 17.7%, Reinforcing Market Narrative of Disciplined Profitability

Reviewed by Simply Wall St

NetApp (NTAP) just posted its Q2 2026 results, with revenue of $1.7 billion and EPS of $1.53. The company has seen revenue range from $1.5 billion to $1.7 billion per quarter over the past year, while EPS fluctuated between $1.16 and $1.67 per share. Profitability continued to push margins, keeping the focus on operating discipline as investors gauge the momentum in these results.

See our full analysis for NetApp.Next, let's see how these numbers compare to the widely held narratives on Simply Wall St and whether the latest figures reinforce or challenge market expectations.

See what the community is saying about NetApp

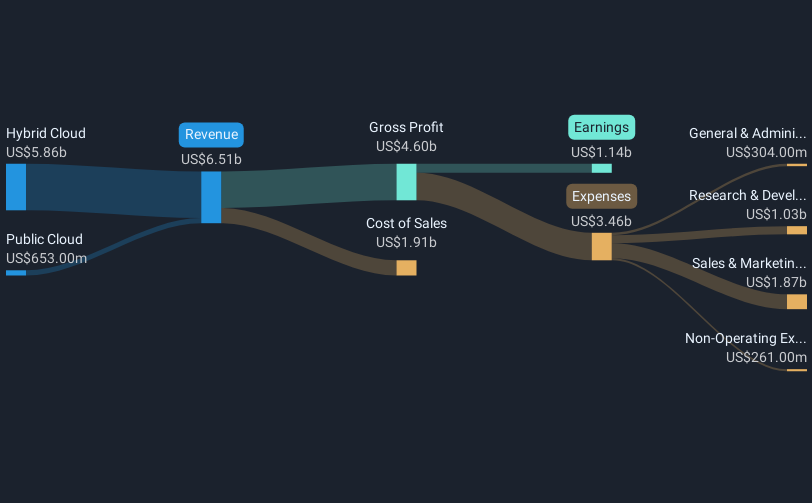

Profit Margins Stay Resilient at 17.7%

- Net profit margin for the past twelve months came in at 17.7%, holding nearly flat compared to last year’s 17.8%, and translating to $1.2 billion in net income on $6.6 billion in revenue.

- Consensus narrative notes that this steady margin performance is seen as a sign of disciplined cost control, even as revenue growth slowed. This contrasts with bears’ concerns regarding margin erosion driven by competitive pricing and pressures from the transition to cloud services.

- Operating discipline has helped the company manage mild headwinds while public cloud services account for a larger share of total revenue.

- Analysts discuss whether margins can remain stable as Keystone Storage-as-a-Service and hyperscaler partnerships reshape the business. The latest figures reinforce the consensus expectation of only mild margin pressure so far.

Discover how the latest margin trends stack up against the consensus narrative and what this means for future profitability. 📊 Read the full NetApp Consensus Narrative.

Valuation Undercuts Peers and Fair Value

- NetApp trades at a Price-to-Earnings ratio of 18.4x, which is below both the global tech industry average of 22.2x and its peer group’s 67.7x. It is currently 41.2% under its DCF fair value of $185.87 per share, with shares last changing hands at $109.25.

- Consensus narrative highlights that this valuation appeals to value seekers, yet forecasts for earnings (8.6% growth annually) and revenue (4.6% growth per year) lag behind the broader US market. This introduces debate over whether the discount is a genuine opportunity or a sign of muted future upside.

- Dividend yield stands at 1.9%, adding an income element that may help offset modest topline growth expectations.

- The relatively small gap between the current share price and the analyst consensus target of $124.00 signals that the Street views NetApp as fairly valued in the near term, despite the low multiple.

Subscription and Cloud Push Gain Traction

- Keystone Storage-as-a-Service revenue increased approximately 80% year-over-year, while cloud services subscriptions grew 33% over the same period, signaling a shift to higher-margin, recurring revenue streams.

- Consensus narrative leans bullish as expanding cloud partnerships and strong uptake of subscription models are cited as drivers for long-term earnings growth. At the same time, some caution remains regarding regional revenue concentration and ongoing product revenue declines associated with the legacy hardware business.

- Momentum from AI and hybrid cloud adoption is cited as supporting optimism for recurring revenues and margin stability, as evidenced by the 9% year-over-year increase in deferred revenue.

- The challenge continues to be balancing this transformation without further dampening short-term revenue or profit growth.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for NetApp on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have another take on the latest results? Share your perspective and shape the narrative in just a few minutes. Do it your way

A great starting point for your NetApp research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

NetApp’s growth forecasts trail those of the wider market, which raises questions about whether its discounted valuation points to modest upside ahead.

If you want to focus on companies with more dependable earnings expansion and consistent sales, check out stable growth stocks screener (2076 results) so you never settle for lackluster growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NetApp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTAP

NetApp

Provides a range of enterprise software, systems, and services that customers use to transform their data infrastructures in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success