- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:NOVT

A Look at Novanta's (NOVT) Valuation Following Q3 Results and 2026 Growth Guidance

Reviewed by Simply Wall St

Novanta (NOVT) just released third-quarter results with slightly higher revenue but lower net income compared to last year. Alongside the earnings, management shared outlooks for the next quarter and 2026, outlining expectations for ongoing growth.

See our latest analysis for Novanta.

Novanta’s recent earnings announcement and plans for a Composite Units Offering have stirred up renewed attention, and the impact is clear in its price action. The stock has rebounded strongly, with a 27% share price return over the past month and a 16% gain over 90 days. However, on a longer view, total shareholder return has slid 27% over the past year. This mix of short-term momentum and longer-term underperformance suggests investors are watching closely to see if the company can turn recent growth forecasts into a sustained rebound.

If stories like Novanta’s comeback have you curious about which stocks could be next, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares rising sharply in recent weeks but still trading below analyst targets, the question now is whether Novanta is undervalued or if the recent optimism has already been fully reflected in the stock price. Is there still a buying opportunity, or is the market already pricing in all the expected growth?

Most Popular Narrative: 6.4% Undervalued

Novanta’s widely followed narrative sees fair value at $141.50, a modest premium to the latest close of $132.48. With shares trading just below this benchmark, the market is weighing ambitious profit growth targets against sector pressures.

Rapid adoption of robotics and automation in manufacturing and healthcare (including AI-enabled warehouse automation, surgical robotics, and future humanoid robotics) is accelerating demand for Novanta's advanced sensing and precision motion technologies. The company's design wins and multi-year contracts (for example, $50M warehouse robotics deal, multiple new design wins in physical AI and robotics) position it to grow revenue at above-market rates through 2026 and beyond.

Want to know what powers this valuation premium? The narrative leans on aggressive earnings expansion and a future profit multiple that rivals big tech. Curious which forward-looking bets on robotics and profit margins make up the foundation for that fair value call? The numbers behind these bold projections may surprise you.

Result: Fair Value of $141.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent trade friction with China or slower recoveries in key business segments could quickly challenge these upbeat long-term growth expectations.

Find out about the key risks to this Novanta narrative.

Another View: More Than One Way to Value Novanta

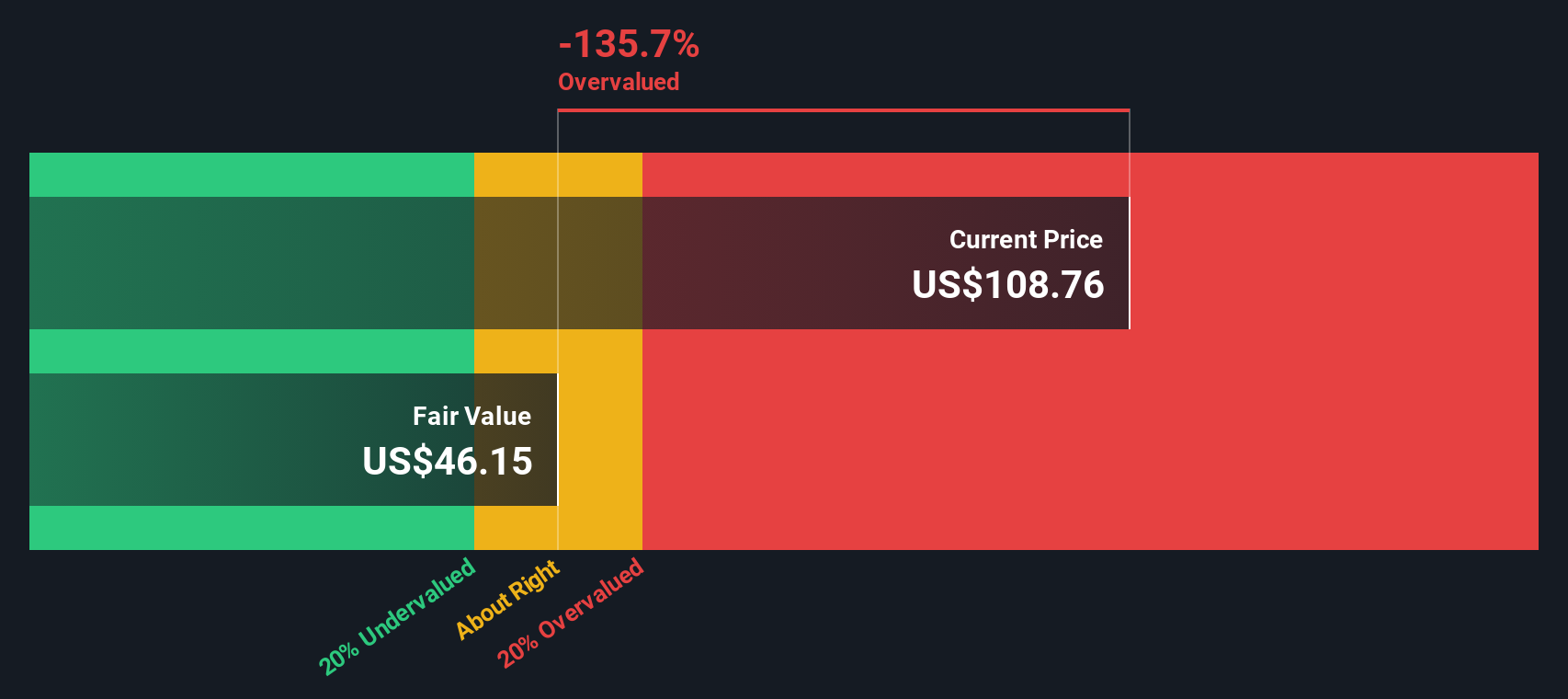

Switching lenses, our SWS DCF model offers a sharply contrasting perspective. It suggests Novanta is actually overvalued at the current share price by a wide margin. This model weighs up long-term cash flows and projects much lower fair value than what the market and analysts expect. So, which approach should drive your conviction: narrative-driven earnings optimism or hard numbers from intrinsic value models?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Novanta for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 836 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Novanta Narrative

If the numbers or stories above do not line up with your own outlook, dive into the data and shape your own Novanta view in just a few minutes. Do it your way

A great starting point for your Novanta research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Seize the opportunity to tap into fresh stock strategies that could reshape your portfolio outcomes. Don’t sit back and let these next possibilities pass you by.

- Unlock potential with these 25 AI penny stocks as you capitalize on the AI wave and advances in smart automation.

- Boost your income with these 20 dividend stocks with yields > 3% which offers attractive yields above 3 percent and a consistent payout record.

- Position yourself early by targeting value opportunities among these 836 undervalued stocks based on cash flows that are driven by strong fundamentals and favorable cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novanta might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NOVT

Novanta

Provides precision medicine, precision manufacturing, medical solutions, robotics and automation solutions, and advanced surgery solutions in the United States and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives