- United States

- /

- Communications

- /

- NasdaqGS:LITE

Lumentum Holdings (LITE) Raises $1.1 Billion via Convertible Notes Will This Reshape Its Growth Path?

Reviewed by Simply Wall St

- On September 5, 2025, Lumentum Holdings completed a US$1.1 billion convertible senior unsecured note offering with a 0.375% fixed coupon, due in March 2032 under Rule 144A.

- This sizeable convertible debt issuance not only provides substantial capital but also introduces potential future equity dilution and balance sheet impacts for Lumentum Holdings.

- We'll examine how this large convertible note issuance could influence Lumentum's growth outlook and future capital structure.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Lumentum Holdings Investment Narrative Recap

To be a shareholder in Lumentum Holdings, one needs to believe in the rapid and sustained expansion of the global cloud and AI data center markets, as well as Lumentum's ability to maintain its position as a critical optical component supplier to leading hyperscale customers. The recent US$1.1 billion convertible notes offering brings in significant funding, but it does not materially shift the core short-term catalyst, meeting strong demand for cloud and AI-related products, nor does it immediately mitigate the key risk of heavy revenue concentration in a small number of large customers. Among recent developments, Lumentum’s August announcement of funding for U.S.-based semiconductor facility capacity expansion is closely tied to the core growth drivers. This move aligns with the acceleration of demand in AI supply chains and supports the company's efforts to alleviate ongoing capacity constraints, which remains central to its ability to capture new growth opportunities. In contrast, investors should be mindful of the possibility that greater funding alone may not address Lumentum's exposure to...

Read the full narrative on Lumentum Holdings (it's free!)

Lumentum Holdings' outlook anticipates $3.1 billion in revenue and $389.1 million in earnings by 2028. This forecast relies on 23.4% annual revenue growth and a $363.2 million increase in earnings from the current $25.9 million.

Uncover how Lumentum Holdings' forecasts yield a $139.84 fair value, a 14% downside to its current price.

Exploring Other Perspectives

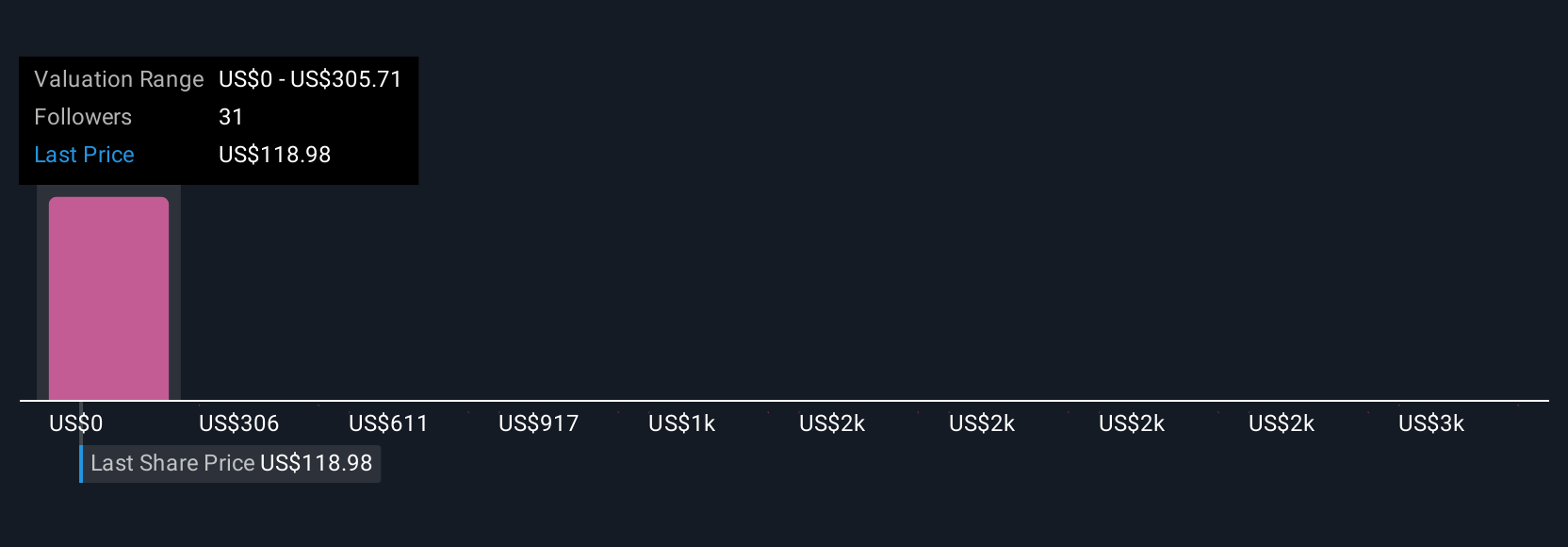

Eleven members of the Simply Wall St Community estimated fair values for Lumentum ranging from US$305.71 to US$3,057.06. While many expect growth from data center demand, some highlight the persistence of customer concentration risk, consider how these differing outlooks may influence your view.

Explore 11 other fair value estimates on Lumentum Holdings - why the stock might be a potential multi-bagger!

Build Your Own Lumentum Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lumentum Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lumentum Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lumentum Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LITE

Lumentum Holdings

Manufactures and sells optical and photonic products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Exceptional growth potential with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success