- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:LASR

Is nLIGHT (LASR) Still Undervalued After Its Powerful One-Year Share Price Surge?

Reviewed by Simply Wall St

nLIGHT (LASR) has quietly turned into one of the market’s stronger comeback stories, with the stock up about 26% over the past 3 months and more than tripling year to date.

See our latest analysis for nLIGHT.

That recent 15.7% one month share price return has simply extended a powerful year to date move, with the one year total shareholder return above 230%. This suggests momentum investors are increasingly willing to pay up for nLIGHT’s growth story.

If nLIGHT’s run has you wondering what else might be setting up for a breakout, this could be a good moment to explore high growth tech and AI stocks for other potential opportunities.

Yet with the shares trading below analyst targets but already up severalfold, investors now face a key question: Is nLIGHT still undervalued, or is the market already pricing in all of its future growth?

Most Popular Narrative: 12.2% Undervalued

With nLIGHT closing at $36.44 against a narrative fair value of $41.50, the current market price sits below the valuation implied by its projected trajectory.

The rapid growth and expanding pipeline in aerospace and defense, particularly around high-power laser solutions (e.g., HELSI-2 program, DE M-SHORAD, Golden Dome initiative, and increased directed energy orders internationally), positions nLIGHT to benefit from rising global defense spending and modernization, supporting strong multi-year revenue growth.

Want to see what kind of revenue ramp, margin lift, and rich future earnings multiple are baked into that fair value? The narrative spells out an aggressive growth path, a profitability transformation, and a valuation profile more typical of market darlings than loss making hardware names. Curious how those moving pieces combine to justify a premium price tag?

Result: Fair Value of $41.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upbeat scenario could unravel if defense program funding slips or execution stumbles as amplifier products scale from R&D to mass production.

Find out about the key risks to this nLIGHT narrative.

Another View: Multiples Flash a Caution Signal

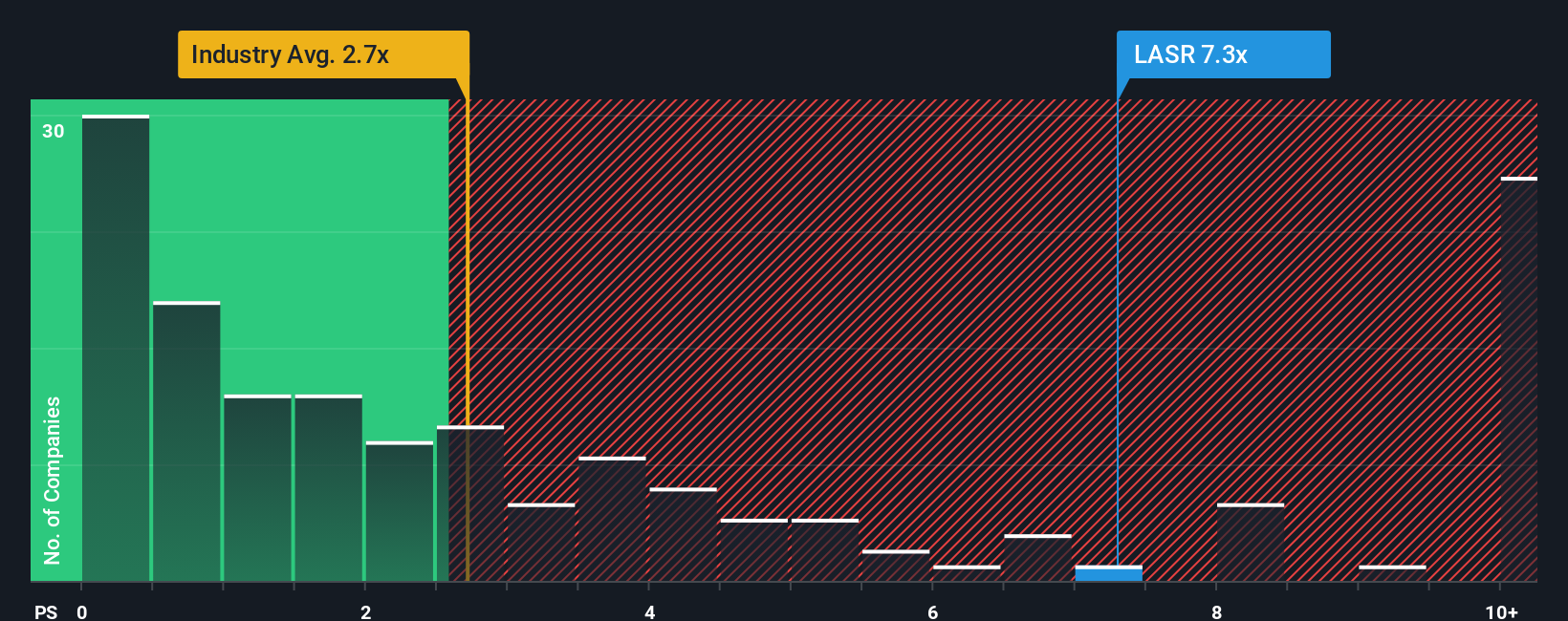

While the narrative fair value points to 12.2% upside, the simple price to sales lens tells a very different story. nLIGHT trades around 8.1 times sales, far richer than the US Electronic industry at 2.5 times and peers at 3.5 times, and well above a fair ratio of 1.4 times that the market could eventually gravitate toward.

If sentiment cools or growth underwhelms, that gap leaves little margin for error and plenty of room for the valuation to compress. Are investors leaning into a durable growth story, or chasing a momentum trade that could reverse quickly?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own nLIGHT Narrative

If you want to dig into the numbers yourself or challenge these assumptions, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your nLIGHT research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before momentum cools, put Simply Wall Street’s Screener to work and line up your next moves so you are not scrambling after the market has already moved.

- Capture potential bargains early by scanning these 906 undervalued stocks based on cash flows where strong cash flows may not yet be fully reflected in current share prices.

- Capitalize on innovation tailwinds by targeting these 26 AI penny stocks that could benefit as artificial intelligence adoption accelerates across industries.

- Strengthen your income stream by reviewing these 15 dividend stocks with yields > 3% that aim to pair attractive yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LASR

nLIGHT

Designs, develops, manufactures, and sells semiconductor and fiber lasers for industrial, microfabrication, and aerospace and defense applications.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026