- United States

- /

- Pharma

- /

- NYSE:ANRO

Spotlight On 3 Promising Penny Stocks With Market Caps Over $30M

Reviewed by Simply Wall St

Amid a backdrop of record highs for the S&P 500 and Nasdaq Composite, investor optimism is being fueled by robust corporate earnings and positive economic indicators. In this context, penny stocks—though often seen as a relic from past market eras—continue to capture attention due to their potential for growth, particularly when backed by strong financial health. This article will explore several penny stocks that stand out for their financial strength and potential long-term value.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| ATRenew (RERE) | $3.28 | $759.26M | ✅ 3 ⚠️ 1 View Analysis > |

| Waterdrop (WDH) | $1.89 | $737.79M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.9664 | $163.33M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.45 | $256.66M | ✅ 3 ⚠️ 0 View Analysis > |

| Puma Biotechnology (PBYI) | $3.34 | $162.81M | ✅ 2 ⚠️ 1 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $99.33M | ✅ 3 ⚠️ 2 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.8601 | $6.32M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.73 | $108.71M | ✅ 3 ⚠️ 2 View Analysis > |

| Tandy Leather Factory (TLF) | $3.575 | $29.45M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 411 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Anghami (ANGH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Anghami Inc. operates a music-streaming platform in the Middle East and North Africa with a market cap of $30.13 million.

Operations: The company's revenue streams include $1.88 million from live events, $64.99 million from subscriptions, and $11.22 million from advertisements.

Market Cap: $30.13M

Anghami Inc. has a market cap of US$30.13 million and operates in the Middle East and North Africa music-streaming sector, generating revenue from subscriptions (US$64.99M), advertisements (US$11.22M), and live events (US$1.88M). Despite its revenue streams, Anghami is unprofitable with a net loss of US$63.55 million in 2024, raising concerns about its sustainability as highlighted by auditor doubts regarding its ability to continue as a going concern. Recent capital raised through convertible notes totaling US$23 million may provide short-term relief but does not address long-term profitability challenges amid high volatility and inexperienced management.

- Dive into the specifics of Anghami here with our thorough balance sheet health report.

- Learn about Anghami's historical performance here.

Ceragon Networks (CRNT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ceragon Networks Ltd. offers wireless transport solutions for cellular operators and other wireless service providers across various regions, with a market cap of approximately $203.65 million.

Operations: The company generated $394.34 million in revenue from its role as a global innovator and leading solutions provider of wireless transport.

Market Cap: $203.65M

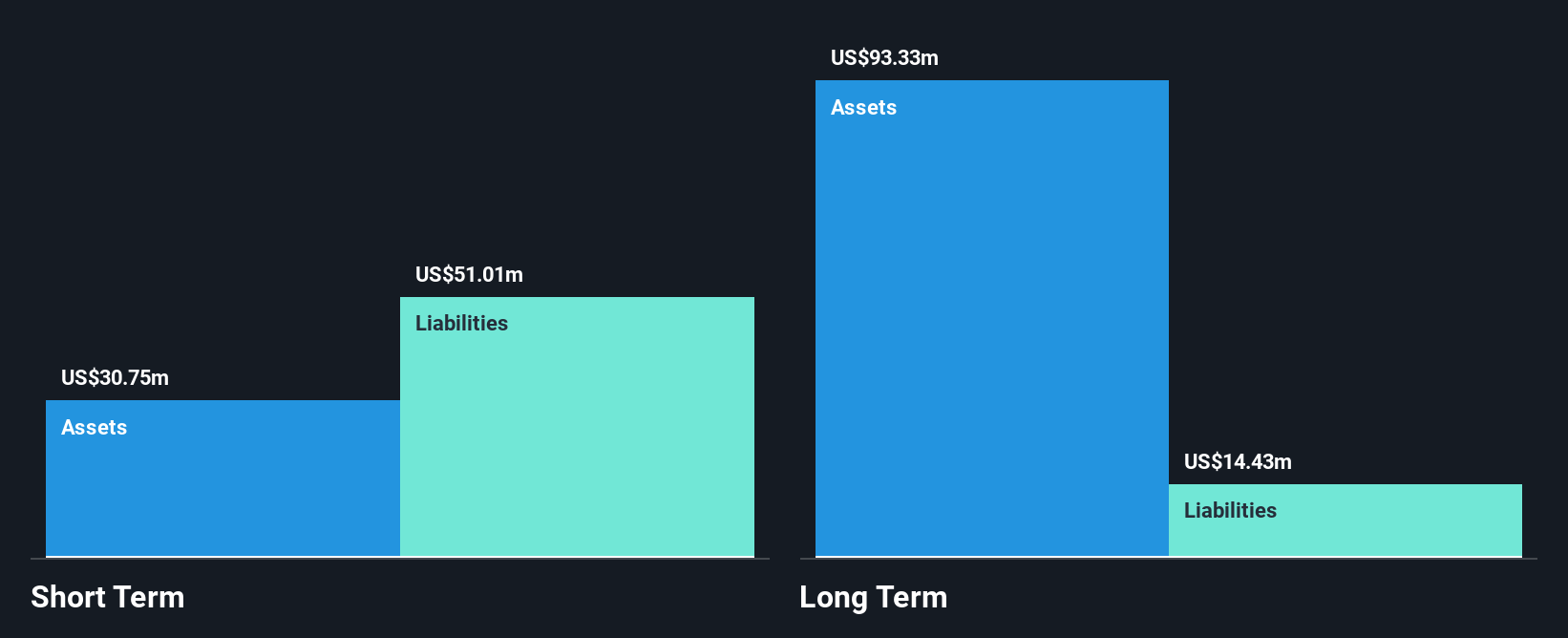

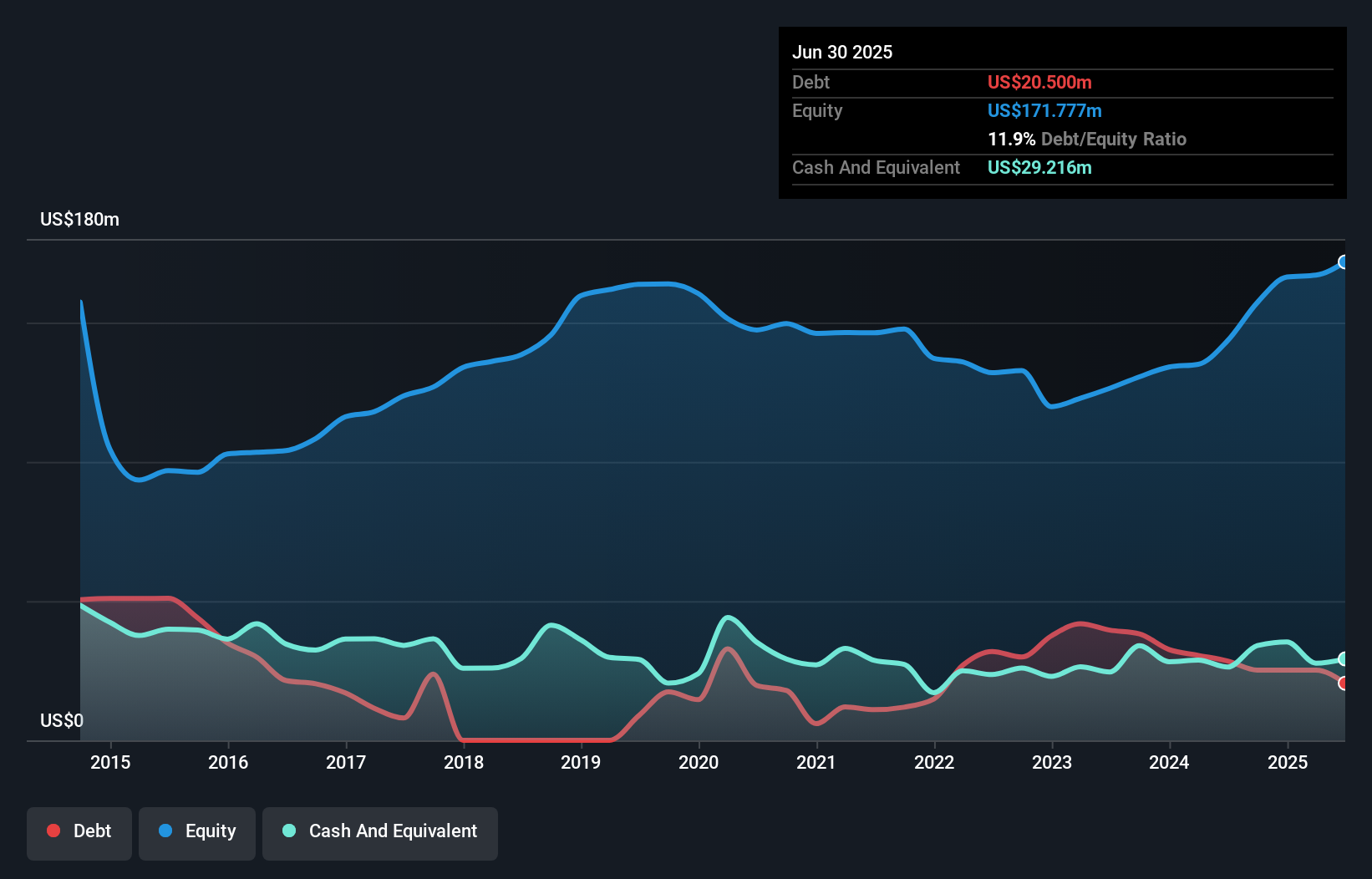

Ceragon Networks Ltd., with a market cap of approximately US$203.65 million, demonstrates strong fundamentals for a penny stock, highlighted by its profitable growth over the past five years and stable net profit margins. Recent product innovations like the IP-50 EXP bolster its position in 5G technology, promising high capacity and cost efficiency. Despite reporting a net loss of US$0.98 million in Q1 2025, Ceragon's revenue guidance remains optimistic at US$390 to $430 million for the year. Its financial stability is underpinned by short-term assets exceeding liabilities and cash reserves surpassing debt levels, ensuring operational resilience amidst industry challenges.

- Navigate through the intricacies of Ceragon Networks with our comprehensive balance sheet health report here.

- Examine Ceragon Networks' earnings growth report to understand how analysts expect it to perform.

Alto Neuroscience (ANRO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alto Neuroscience, Inc. is a clinical-stage biopharmaceutical company based in the United States with a market cap of $83.38 million.

Operations: Currently, there are no reported revenue segments for this clinical-stage biopharmaceutical company.

Market Cap: $83.38M

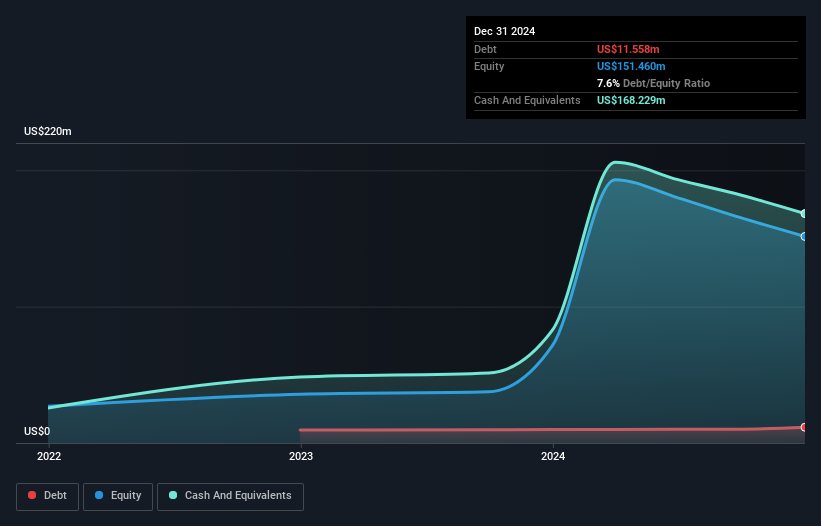

Alto Neuroscience, Inc., with a market cap of US$83.38 million, is a pre-revenue clinical-stage biopharmaceutical company facing significant challenges. It recently encountered legal issues with a class action lawsuit related to its IPO and was dropped from multiple Russell indexes, impacting investor sentiment. Despite these setbacks, Alto continues to advance its pipeline with promising developments in treatment-resistant depression and major depressive disorder through innovative drug candidates like ALTO-203 and ALTO-207. The company has sufficient short-term assets (US$163.5 million) to cover liabilities but remains unprofitable with no revenue streams reported yet.

- Get an in-depth perspective on Alto Neuroscience's performance by reading our balance sheet health report here.

- Learn about Alto Neuroscience's future growth trajectory here.

Key Takeaways

- Click through to start exploring the rest of the 408 US Penny Stocks now.

- Searching for a Fresh Perspective? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANRO

Alto Neuroscience

Operates as a clinical-stage biopharmaceutical company in the United States.

Excellent balance sheet slight.

Market Insights

Community Narratives