- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CGNX

Is the AI-Enabled SLX Launch Reshaping the Investment Case for Cognex (CGNX)?

Reviewed by Sasha Jovanovic

- On November 19, 2025, Cognex Corporation presented at the Stephens Annual Investment Conference in Nashville, highlighting strong third-quarter performance with double-digit revenue growth in consumer electronics, logistics, and packaging, and record EBITDA margins since mid-2023.

- A key highlight was the launch of Cognex’s AI-enabled SLX product line, which expands the company’s vision solutions into higher-value logistics applications and reflects management’s focus on market recovery and moderated declines in automotive.

- We'll explore how the introduction of the AI-enabled SLX product line could impact Cognex's investment narrative and future outlook.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Cognex Investment Narrative Recap

To be a shareholder in Cognex today, you need to believe in its ability to expand margins and sustain growth through higher-value, AI-driven vision solutions while successfully diversifying away from more cyclical markets such as automotive. The recent news strengthens the near-term catalyst, growth in logistics and consumer electronics, via the SLX product launch, but persistent pricing pressures and competition in core hardware remain the business's primary risks, and those are not materially changed by this update.

Of the company’s recent announcements, the SLX product line launch is most relevant, as it directly targets the expanding logistics sector. This move reflects Cognex’s push to capitalize on AI-enabled solutions, accelerating end-market diversification and potentially buffering revenue swings common in traditional markets.

In contrast, ongoing pressure on pricing power and the risk of further commoditization in machine vision hardware are factors investors should watch for…

Read the full narrative on Cognex (it's free!)

Cognex's outlook projects $1.2 billion in revenue and $241.2 million in earnings by 2028. This scenario requires a 10.2% annual revenue growth rate and a $119.1 million increase in earnings from the current $122.1 million.

Uncover how Cognex's forecasts yield a $48.90 fair value, a 28% upside to its current price.

Exploring Other Perspectives

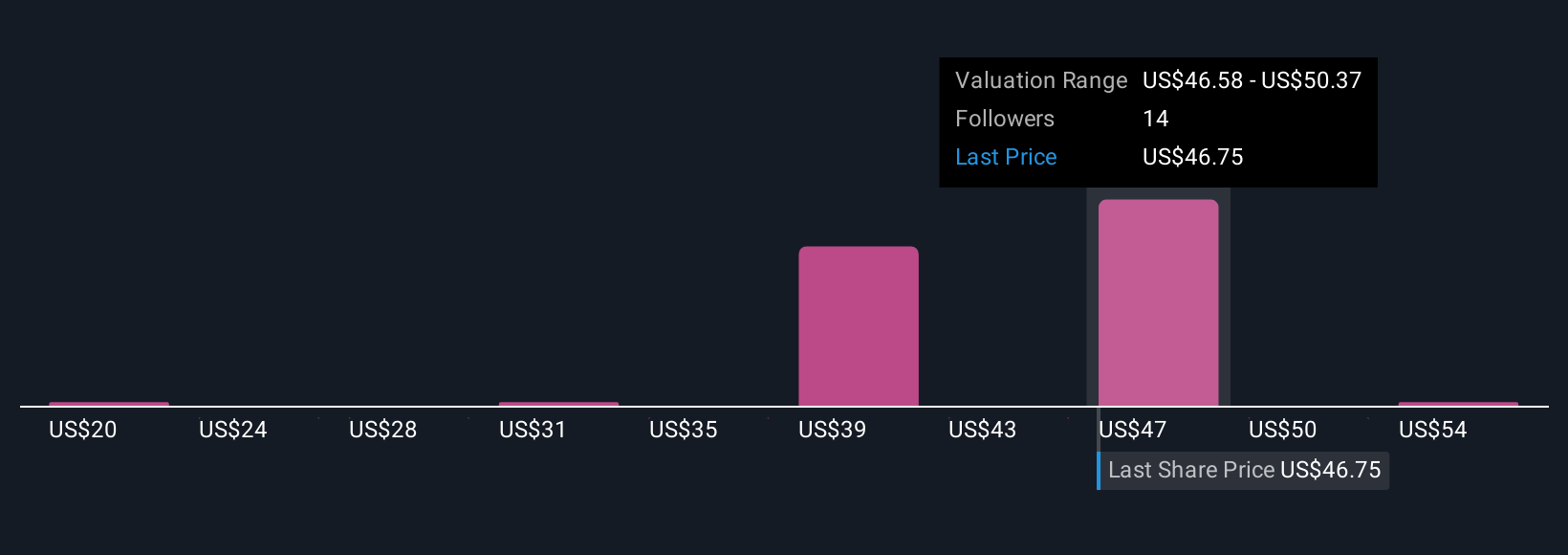

The Simply Wall St Community provides four fair value estimates for Cognex, spanning a wide US$20 to US$48.90 range. With the company deepening its focus on AI-powered logistics, you will find that opinions on growth drivers and competition differ widely, explore how these views could impact your own expectations.

Explore 4 other fair value estimates on Cognex - why the stock might be worth 48% less than the current price!

Build Your Own Cognex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cognex research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Cognex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cognex's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CGNX

Cognex

Provides machine vision products that capture and analyze visual information to automate manufacturing and distribution tasks worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026