- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CDW

Will CDW’s (CDW) Leadership Shift and Buyback Completion Redefine Its Capital Allocation Strategy?

Reviewed by Sasha Jovanovic

- Earlier this month, CDW Corporation reported third-quarter 2025 results, increased its quarterly dividend to US$0.63 per share, and announced the completion of a multi-year share buyback program totaling 55.5 million shares for US$5.66 billion.

- In addition to operational updates, CDW also disclosed executive leadership changes, with Sona Chawla retiring and the integration of innovation and services functions under Mukesh Kumar, signaling a focus on digital transformation and long-term customer engagement.

- We’ll now evaluate how CDW’s sizable buyback completion and modest net income decline affect its investment narrative moving forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

CDW Investment Narrative Recap

To be a CDW shareholder today, I believe you need confidence in the company's ability to deliver consistent value through growth in IT services and its disciplined capital return strategy. The completion of the multi-year buyback supports the investment case for shareholder returns, but recent earnings results with flat revenue growth and modestly lower net income mean that the biggest short-term catalyst remains the successful expansion into higher-value services, while ongoing margin pressure and education funding changes are the biggest risks. There is little evidence from this quarter's news that these catalysts or risks have materially shifted near term.

Among recent updates, the expansion of Mukesh Kumar’s role to integrate innovation and services best aligns with CDW’s most important catalyst: accelerating recurring revenue from services and solutions. This operational shift could support margin resilience amid competitive pressures, provided it delivers on the goal of deeper customer engagement and higher-value deals, helping address what investors are looking for in the next phase of the company’s growth.

Yet, unlike the focus on buybacks, investors should be aware that the pressure from gross margin declines remains an important consideration if...

Read the full narrative on CDW (it's free!)

CDW's narrative projects $24.3 billion revenue and $1.3 billion earnings by 2028. This requires 3.5% yearly revenue growth and a $0.2 billion earnings increase from $1.1 billion today.

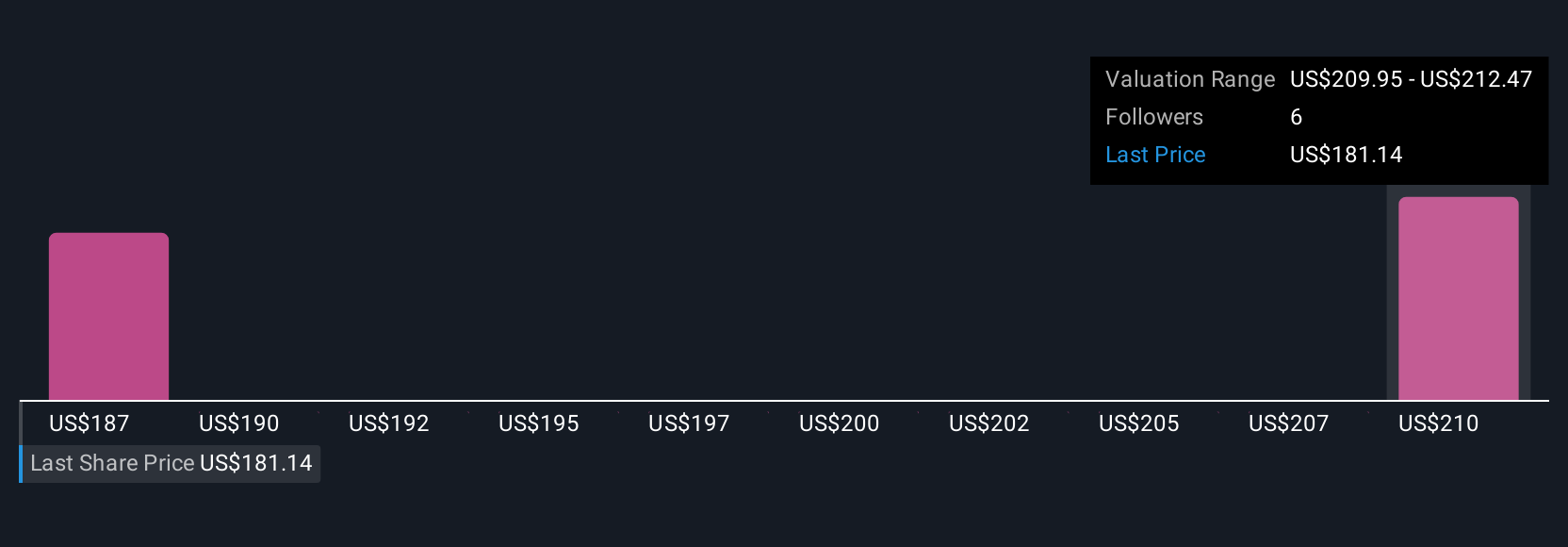

Uncover how CDW's forecasts yield a $203.40 fair value, a 43% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members place CDW’s fair value between US$178.69 and US$234.14, across three individual estimates. Their views span US$55,000 in difference, while analysts see revenue mix as a key variable for future performance. See how your own analysis compares with other unique viewpoints.

Explore 3 other fair value estimates on CDW - why the stock might be worth just $178.69!

Build Your Own CDW Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CDW research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CDW research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CDW's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CDW

CDW

Provides information technology (IT) solutions in the United States, the United Kingdom, and Canada.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives