- United States

- /

- Software

- /

- OTCPK:ABXX.F

A Look at Abaxx Technologies (OTCPK:ABXX.F) Valuation After ARTEX Partnership and Enwex German Wind Futures Launch

Reviewed by Simply Wall St

Abaxx Technologies (OTCPK:ABXX.F) has been in the spotlight following two key moves: a partnership with ARTEX AG to modernize asset trading and the launch of the Enwex German Wind Futures contract. These developments highlight Abaxx's expanding global reach and focus on market infrastructure innovation.

See our latest analysis for Abaxx Technologies.

After a year of eye-catching developments, Abaxx Technologies is drawing more attention from growth-minded investors. The 237.5% year-to-date share price return and 204.9% total shareholder return over the last 12 months suggest momentum is decisively building. Recent partnerships and innovative product launches also reinforce the company’s forward-looking strategy.

If you’re interested in where tech and innovation meet financial markets, now could be the perfect time to explore the opportunities in See the full list for free..

With the stock’s extraordinary gains and headline-grabbing partnerships, the big question is whether these advances have already been reflected in the current share price or if further upside could await patient investors.

Price-to-Book Ratio of 29.1x: Is it justified?

With Abaxx Technologies trading at a price-to-book ratio of 29.1 times, the stock is priced dramatically higher than its peer average and the broader industry. At the last close price of $27.64, valuation is a key focus for any potential investor assessing its rapid rise.

The price-to-book ratio measures a company’s market value relative to its net asset value. This metric is particularly important for asset-light, innovation-driven technology businesses like Abaxx. In this sector, investors often use this ratio to evaluate whether market enthusiasm for growth is outpacing the underlying fundamentals.

Abaxx's 29.1x price-to-book ratio stands in marked contrast to the US software industry average of just 3.6x and the peer average of 2.6x. This notable difference suggests markets may be factoring in aggressive growth assumptions or a significant premium for innovation and future potential. Without a fair ratio provided for regression-based adjustment, the current multiple can be difficult to justify compared to where markets typically settle for this sector.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 29.1x (OVERVALUED)

However, slower revenue growth or a steep discount to analyst targets could quickly prompt a reassessment of Abaxx Technologies’ lofty valuation.

Find out about the key risks to this Abaxx Technologies narrative.

Another View: Discounted Cash Flow Perspective

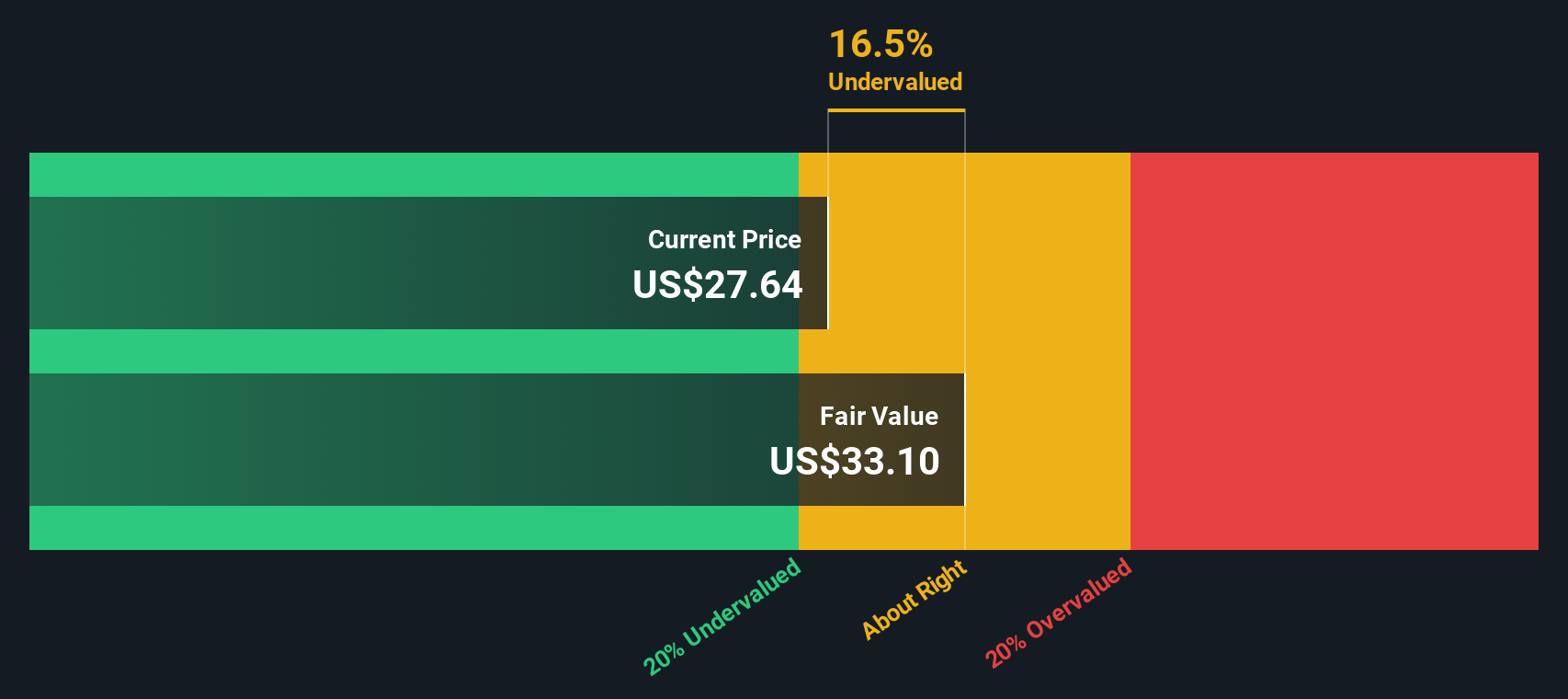

Looking from another angle, our DCF model suggests Abaxx Technologies is actually trading about 16.5% below our estimate of fair value. While multiples paint an overvalued picture, the SWS DCF model points to possible upside. So, which story should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Abaxx Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 885 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Abaxx Technologies Narrative

If you see the story unfolding differently or want to dig into the numbers on your own terms, you can shape your own take in just a few minutes with Do it your way.

A great starting point for your Abaxx Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your portfolio to one big mover. Explore more opportunities by considering fresh stock picks that reflect the trends shaping today’s markets.

- Unlock potential growth by checking out these 24 AI penny stocks, which offers exposure to AI-driven companies at the forefront of innovation and automation.

- Capture income and stability with these 16 dividend stocks with yields > 3%, featuring stocks providing reliable yields above 3% for your long-term strategy.

- Position yourself ahead of the curve in crypto and blockchain with these 82 cryptocurrency and blockchain stocks, connecting you to visionary players who are building the digital economy’s new core.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:ABXX.F

Abaxx Technologies

Engages in developing software tools which enable commodity traders and finance professionals to communicate, trade, and transact in Canada.

Adequate balance sheet with limited growth.

Market Insights

Community Narratives