- United States

- /

- Software

- /

- NYSE:ZETA

Why Zeta Global (ZETA) Is Up 5.7% After Boosting Revenue Outlook and Acquiring Marigold Assets

Reviewed by Sasha Jovanovic

- In the past week, Zeta Global Holdings Corp. announced an upward revision to its revenue guidance for both the remainder of 2025 and the full year 2026, driven by stronger performance and contributions from recent business acquisitions such as Marigold’s enterprise software business. The company also filed a follow-on equity offering, issuing nearly 59,000 shares of Class A Common Stock at US$16.97 each.

- This guidance increase reflects the company's confidence in sustained demand for its omnichannel data-driven marketing platform and the positive integration of recent acquisitions.

- We'll explore how Zeta Global Holdings' raised revenue guidance, particularly from the Marigold acquisition, informs its investment narrative going forward.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Zeta Global Holdings Investment Narrative Recap

To be a shareholder in Zeta Global Holdings, one should believe in the expanding role of AI-driven, data-centric marketing platforms within enterprise environments, especially as companies seek compliant, personalized solutions. The recent upward revision in revenue guidance, propelled by the integration of Marigold’s software business, bolsters the near-term growth catalyst but does not materially reduce the main risk of persistent unprofitability or elevated customer acquisition costs, which remain significant factors to monitor.

Among recent events, the increased revenue guidance disclosed on November 24, 2025, stands out, it provides updated visibility on the positive financial impact of integrating Marigold’s business into Zeta’s platform. This change is relevant as it highlights the near-term revenue boost and supports the company’s narrative around capturing enterprise demand, a key driver for future financial performance.

Yet, in contrast to optimism around new acquisitions and improved revenue guidance, investors should also be aware that persistent losses and high costs remain a factor...

Read the full narrative on Zeta Global Holdings (it's free!)

Zeta Global Holdings' outlook projects $1.9 billion in revenue and $106.5 million in earnings by 2028. This requires 18.3% yearly revenue growth and a $143.1 million earnings increase from current earnings of -$36.6 million.

Uncover how Zeta Global Holdings' forecasts yield a $29.67 fair value, a 63% upside to its current price.

Exploring Other Perspectives

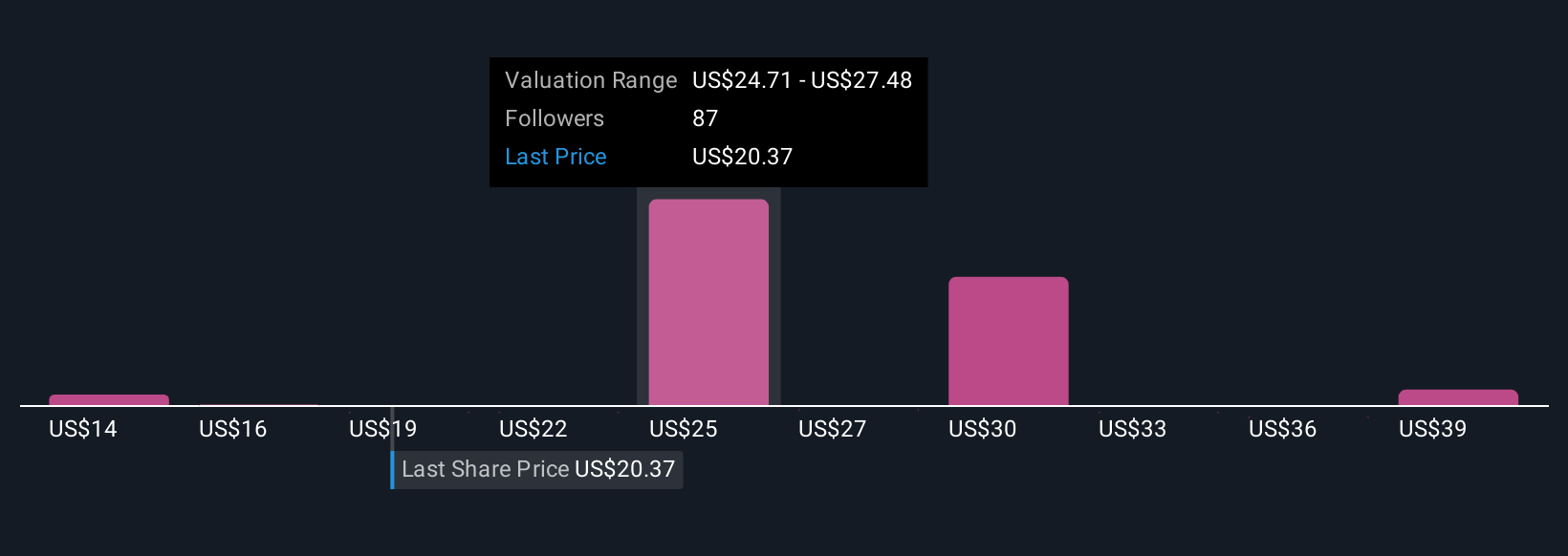

Twenty-nine members of the Simply Wall St Community shared fair value targets for Zeta Global Holdings ranging from US$14.28 to US$41.34. Many see strong growth drivers but continued unprofitability could weigh on results, so consider the full spectrum of opinions before forming your view.

Explore 29 other fair value estimates on Zeta Global Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Zeta Global Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zeta Global Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Zeta Global Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zeta Global Holdings' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zeta Global Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZETA

Zeta Global Holdings

Operates an omnichannel data-driven cloud platform that provides enterprises with consumer intelligence and marketing automation software in the United States and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026