- United States

- /

- Software

- /

- NYSE:ZETA

Is Zeta Global a Bargain After Its 7.6% Jump on Partnership News?

Reviewed by Bailey Pemberton

- Ever wondered if Zeta Global Holdings stock is really a hidden gem, or just another name in the fast-moving tech world? Let’s break down what the numbers might be telling us about its true value.

- In just the last week, Zeta’s stock jumped 7.6%, yet it is still down 3% year-to-date and about 10% over the past year, despite a huge 116.8% run-up across the past three years.

- The stock price has been moving on the back of high-profile partnership announcements and new product launches in the digital marketing space. Investors have been reacting to Zeta’s expanding client roster, alongside enthusiasm for innovations aimed at boosting its competitive edge.

- According to our checklist of six key value metrics, Zeta scores a 5 out of 6, meaning it is undervalued in almost every key area. We will walk through those different ways to assess value in a moment. Stick around, because there is an even smarter way to think about it at the end of this article.

Find out why Zeta Global Holdings's -10.0% return over the last year is lagging behind its peers.

Approach 1: Zeta Global Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is truly worth by projecting its future cash flows and then discounting them to today’s value. Essentially, it lets investors see what Zeta Global Holdings might generate in dollars over time and works backward to figure out what that is worth right now.

For Zeta Global Holdings, the most recent Free Cash Flow (FCF) reported is $129.5 million. Analysts forecast strong growth in the years ahead, with estimates reaching $272.65 million by 2027. Looking further out, projections extend to 2035, with annual FCF potentially rising toward $478.8 million. It is important to note that estimates beyond five years are Simply Wall St extrapolations rather than analyst consensus.

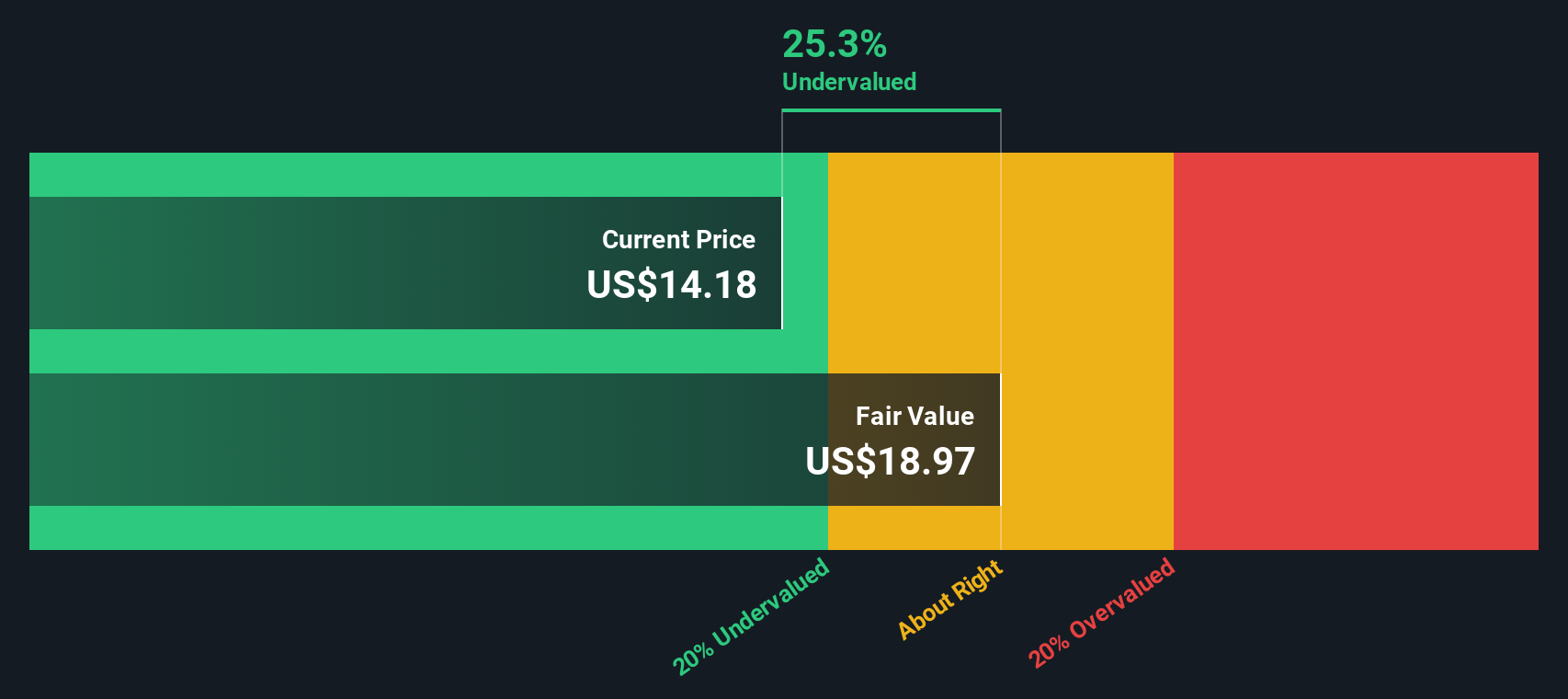

After accounting for these future cash flows and discounting them, the DCF model calculates Zeta’s intrinsic value at $26.84 per share. Compared to the current price, this implies Zeta is trading at a 32.3% discount to its estimated fair value, which suggests the shares appear significantly undervalued right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Zeta Global Holdings is undervalued by 32.3%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: Zeta Global Holdings Price vs Sales

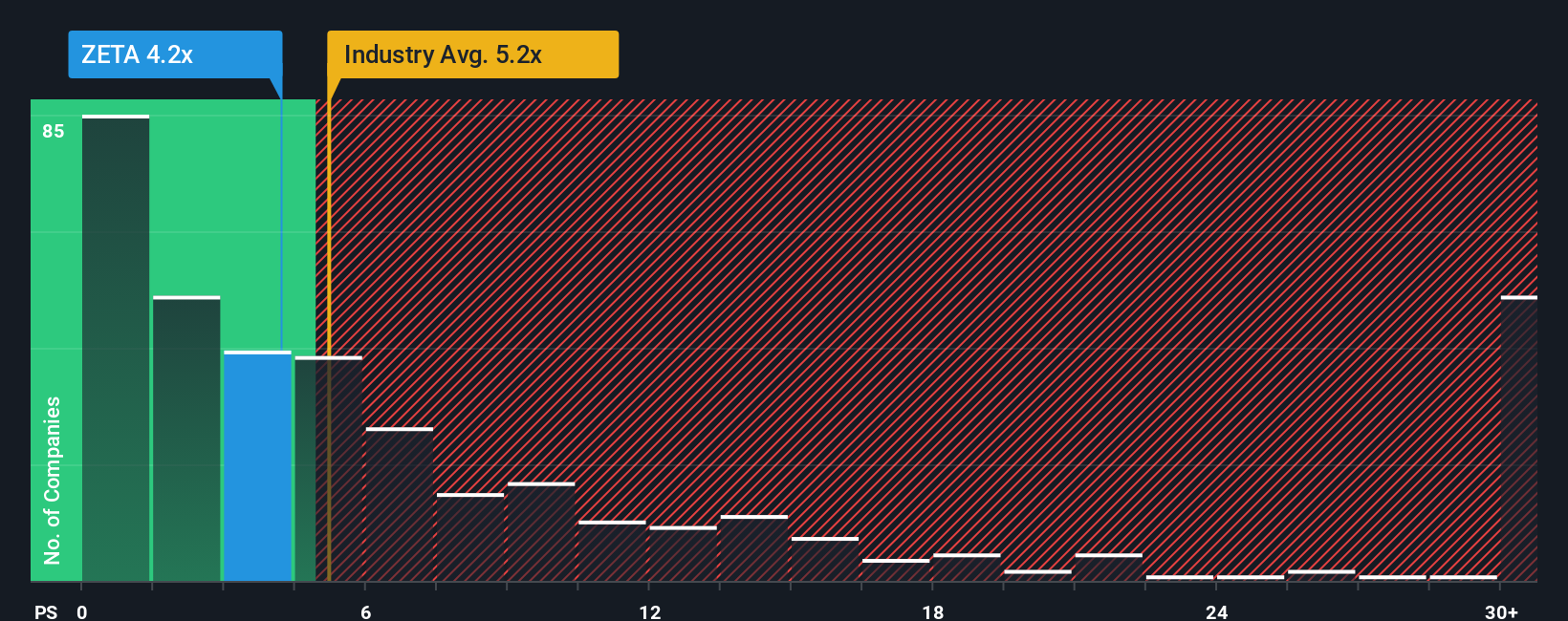

The Price-to-Sales (P/S) ratio is a well-established way to value rapidly growing, profitable companies in tech when earnings can be volatile or not fully reflective of growth potential. This makes it particularly suitable for Zeta Global Holdings, whose reported losses make earnings-based ratios less informative.

A company’s P/S ratio reflects investor expectations for its growth and risk. Higher growth prospects tend to justify a higher multiple, while greater risk or lower profit margins can pull the ratio downward. The current P/S ratio for Zeta Global Holdings stands at 3.57x. When compared with the Software industry average of 4.69x and a peer group average of 11.27x, Zeta appears modestly priced.

Simply Wall St’s proprietary “Fair Ratio” goes a step further by accounting for Zeta’s unique parameters, including its earnings growth, market capitalization, profit margins, and risk factors. Unlike industry or peer averages, the Fair Ratio is custom-fit to the business’s profile and provides a clearer sense of what valuation is justified for Zeta specifically. Currently, Zeta's Fair Ratio is calculated at 6.31x, well above its actual P/S valuation of 3.57x. This substantial gap suggests the market is not crediting Zeta with its full potential based on its growth and risk outlook.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Zeta Global Holdings Narrative

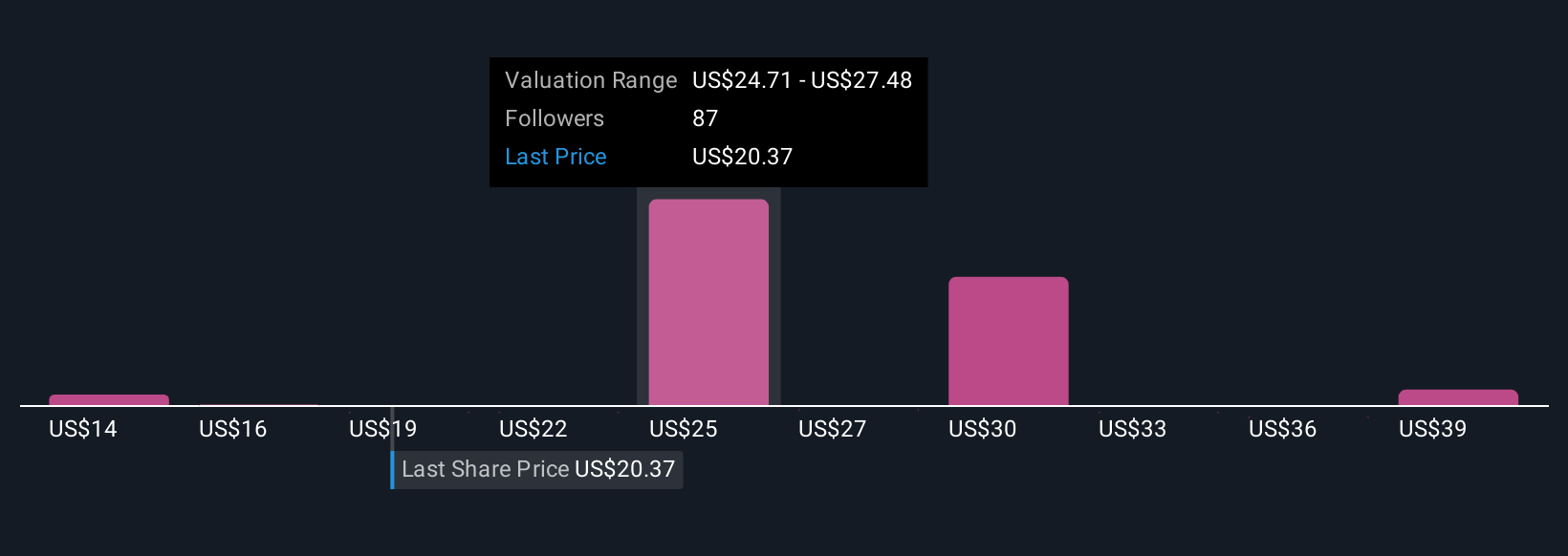

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives, a smarter, more flexible approach to investment decision-making that goes beyond the numbers. A Narrative is your personal story about a company, informed by your own forecasts for revenue, earnings, and margins, which then shape your view of fair value. Narratives work by connecting your belief about how Zeta's business will evolve to a financial model and then to a real-time estimate of what the stock is actually worth.

Available directly in the Simply Wall St Community page, Narratives are designed to be simple and accessible, empowering millions of investors to quickly translate their research and perspectives into actionable insights. By comparing a Narrative's Fair Value with today's Price, you can instantly see whether Zeta looks like a buy or a sell based on your outlook. In addition, Narratives automatically update when new information is released, such as earnings, company news, or major product launches, so your view always keeps pace with the market.

For example, one investor may craft a bullish Narrative for Zeta, believing it will reach $44 per share based on aggressive growth and margin targets, while another may take a more cautious view and see fair value closer to $18. Narratives make it easy to compare, adjust, and personalize your decisions, making it possible to invest with more confidence and transparency than ever before.

Do you think there's more to the story for Zeta Global Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zeta Global Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZETA

Zeta Global Holdings

Operates an omnichannel data-driven cloud platform that provides enterprises with consumer intelligence and marketing automation software in the United States and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success