- United States

- /

- Software

- /

- NYSE:YEXT

Yext (YEXT) Valuation in Focus After Recent Net Income Growth and 2024 Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Yext.

Yext’s share price has built some real momentum in 2024, with a year-to-date share price return of nearly 33 percent as investors take notice of its operational improvements. Even longer-term shareholders have seen a solid 3-year total shareholder return of 68.5 percent. This marks a significant change from the muted gains of the past year.

If recent performance has you rethinking your watchlist, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

Yet with shares trading near their price target and only a modest 9 percent discount to analyst expectations, the key question remains: Is Yext still undervalued, or is the market already factoring in all of its future growth?

Most Popular Narrative: 8% Undervalued

The most popular narrative sets Yext's fair value at $9.44, just above the recent close of $8.68, signaling expectations for modest further upside. This viewpoint centers on strong future profit growth potential, underpinned by new AI-driven offerings and expansion into high-value verticals.

“Launch and strong early reception of Yext Scout, with a mix of new and existing customers and a waitlist of 2,000+, demonstrates product-market fit for new AI-driven offerings that address evolving brand discovery needs, likely accelerating upsell, customer retention, and ARR growth.”

How much optimism is baked into this bullish narrative? There is a bold financial roadmap behind these fair value projections, one that relies on rising revenue, fatter margins, and a profit leap that few would have predicted a year ago. Want to know what is fueling Wall Street’s confidence in these numbers? Read the full story and find out.

Result: Fair Value of $9.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressure from low-cost competitors and broader economic uncertainty could undermine both Yext's growth and market optimism in the coming quarters.

Find out about the key risks to this Yext narrative.

Another View: Multiples Paint a Different Picture

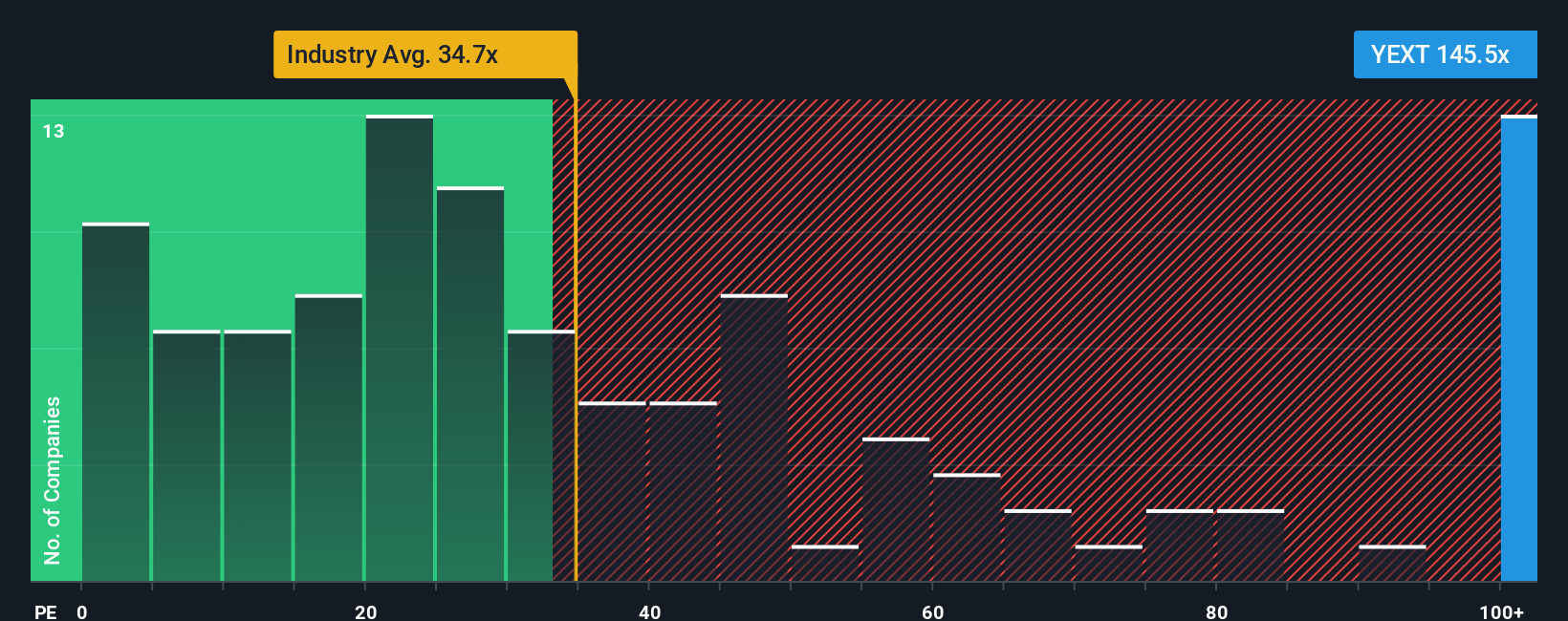

Not everyone sees clear value here. Based on earnings multiples, Yext trades at a steep 143.6 times earnings, much higher than peers (34.2x) and the industry average (32.5x). Even compared to the fair ratio of 39.3x, the current valuation looks stretched. This raises the risk that expectations may have run ahead of reality. Does this premium signal real long-term potential, or are investors getting ahead of themselves?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Yext Narrative

If you see the numbers differently or want to dig even deeper into Yext's story, you can shape your own take in just a few minutes. Do it your way

A great starting point for your Yext research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

New opportunities are just a click away. Unearth stocks with powerful potential. This is where smart investors set themselves apart from the crowd.

- Capture the momentum with these 882 undervalued stocks based on cash flows to unlock hidden gems trading at attractive prices before the crowd arrives.

- Maximize your passive income by targeting these 14 dividend stocks with yields > 3% that offer steady yields and can strengthen your returns.

- Get ahead of the trend by zeroing in on these 27 AI penny stocks that are poised to shape tomorrow's tech landscape with disruptive innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YEXT

Yext

Provides a platform that offers answers to consumer questions in North America and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives