- United States

- /

- Software

- /

- NYSE:U

Trade Alert: CFO & Senior VP Of Unity Software Jarrod Yahes Has Sold Stock

We wouldn't blame Unity Software Inc. (NYSE:U) shareholders if they were a little worried about the fact that Jarrod Yahes, the CFO & Senior VP recently netted about US$2.6m selling shares at an average price of US$42.01. That diminished their holding by a very significant 85%, which arguably implies a strong desire to reallocate capital.

The Last 12 Months Of Insider Transactions At Unity Software

In the last twelve months, the biggest single sale by an insider was when the Co-Founder & Independent Director, David Helgason, sold US$6.8m worth of shares at a price of US$26.11 per share. That means that an insider was selling shares at slightly below the current price (US$42.52). When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. However, while insider selling is sometimes discouraging, it's only a weak signal. This single sale was just 3.4% of David Helgason's stake.

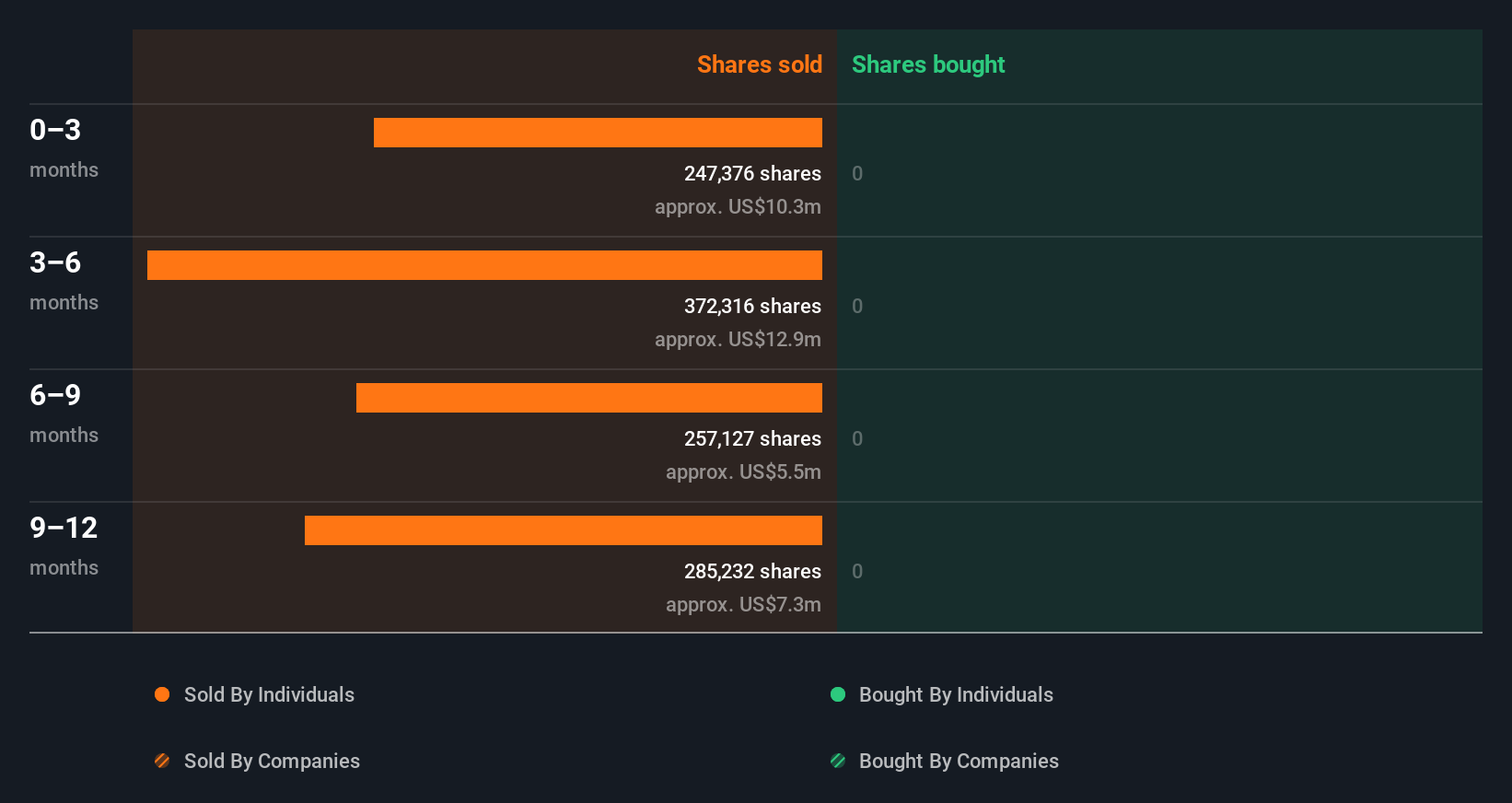

Unity Software insiders didn't buy any shares over the last year. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

See our latest analysis for Unity Software

If you are like me, then you will not want to miss this free list of small cap stocks that are not only being bought by insiders but also have attractive valuations.

Insider Ownership Of Unity Software

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. It's great to see that Unity Software insiders own 2.7% of the company, worth about US$495m. Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

So What Does This Data Suggest About Unity Software Insiders?

Insiders sold stock recently, but they haven't been buying. And even if we look at the last year, we didn't see any purchases. The company boasts high insider ownership, but we're a little hesitant, given the history of share sales. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. Case in point: We've spotted 2 warning signs for Unity Software you should be aware of.

Of course Unity Software may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.