- United States

- /

- Semiconductors

- /

- NYSE:JKS

US Growth Companies With High Insider Ownership For November 2024

Reviewed by Simply Wall St

As the U.S. stock market rebounds from a pre-Thanksgiving downturn, major indices like the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite are on track to close November with significant gains due to a post-election rally. In this buoyant market environment, companies with strong growth prospects and high insider ownership can be particularly appealing as they may indicate confidence from those closest to the business in its future potential.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Duolingo (NasdaqGS:DUOL) | 14.6% | 41.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.6% |

| Coastal Financial (NasdaqGS:CCB) | 18% | 46.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| BBB Foods (NYSE:TBBB) | 22.9% | 43.3% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.7% | 95% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 50% |

We'll examine a selection from our screener results.

EHang Holdings (NasdaqGM:EH)

Simply Wall St Growth Rating: ★★★★★★

Overview: EHang Holdings Limited is an autonomous aerial vehicle (AAV) technology platform company operating in China and internationally, with a market cap of approximately $948.65 million.

Operations: The company's revenue is primarily derived from its Aerospace & Defense segment, totaling CN¥348.48 million.

Insider Ownership: 32.8%

EHang Holdings has demonstrated significant growth potential with a substantial increase in sales from CNY 28.62 million to CNY 128.13 million year-over-year for Q3 2024, despite ongoing net losses. The company announced a $30 million share repurchase program and secured strategic investments totaling over $22 million, reflecting strong insider confidence. EHang's collaboration on solid-state battery technology and expansion into new markets like Thailand underline its commitment to innovation and market penetration in the eVTOL sector.

- Dive into the specifics of EHang Holdings here with our thorough growth forecast report.

- Our valuation report unveils the possibility EHang Holdings' shares may be trading at a premium.

JinkoSolar Holding (NYSE:JKS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JinkoSolar Holding Co., Ltd. and its subsidiaries are involved in the design, development, production, and marketing of photovoltaic products with a market cap of approximately $1.20 billion.

Operations: The company generates revenue primarily from its manufacturing segment, amounting to CN¥104.44 billion.

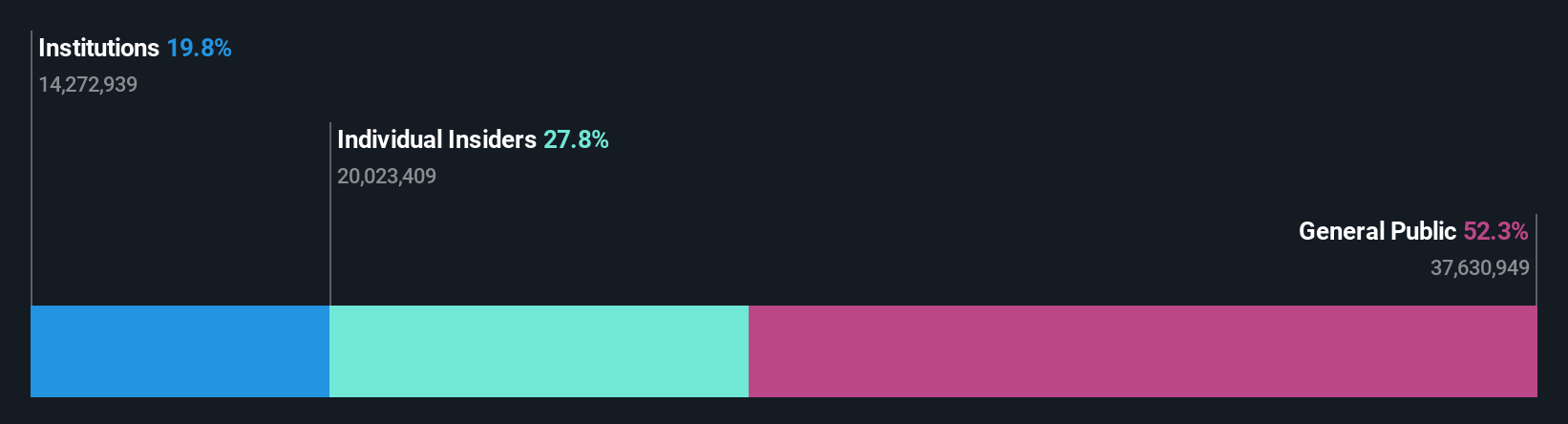

Insider Ownership: 37.4%

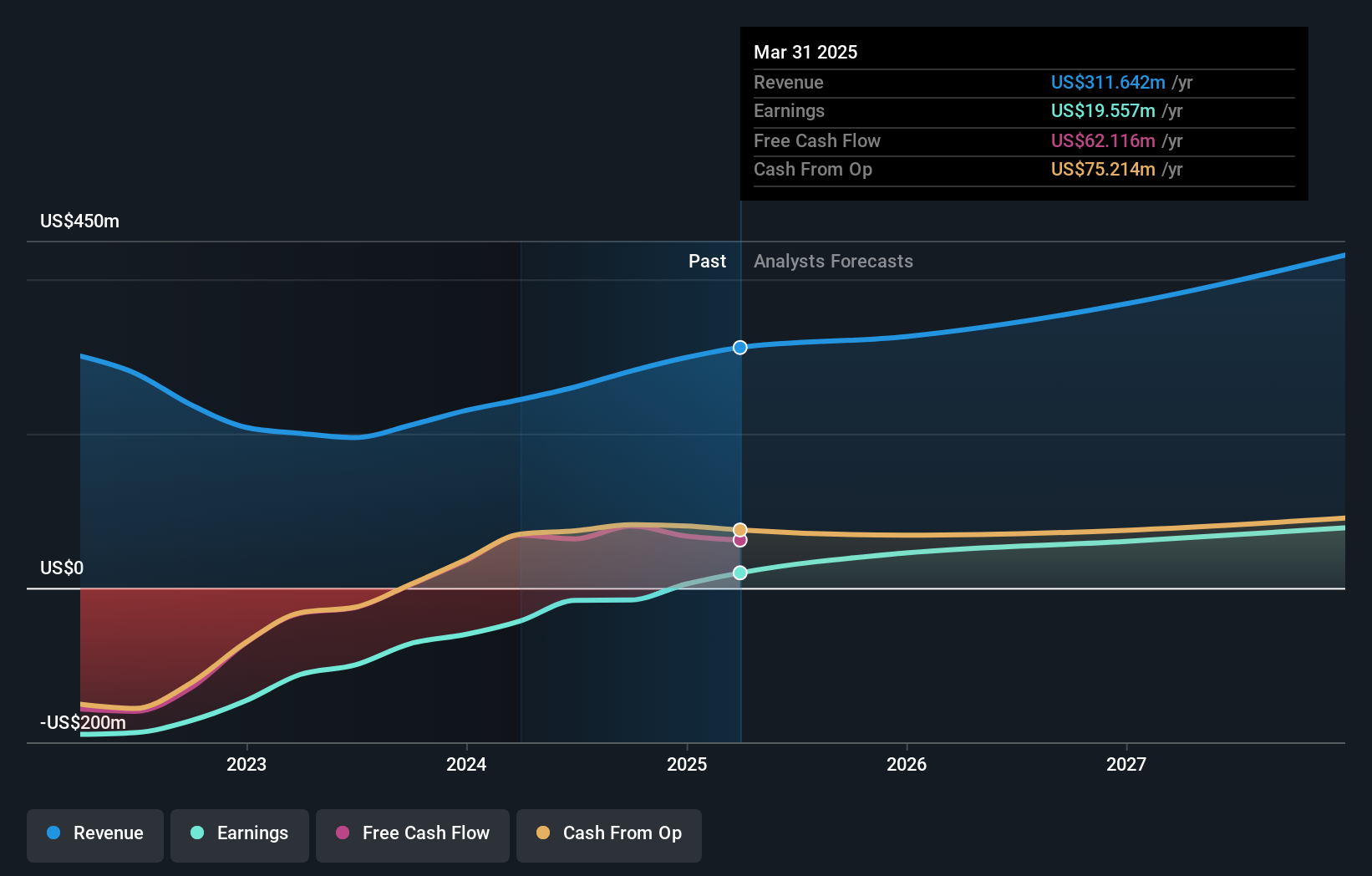

JinkoSolar Holding is experiencing a challenging period with declining earnings, reporting net income of CNY 22.53 million for Q3 2024 compared to CNY 1,323.37 million the previous year. Despite this, its revenue growth forecast of 13.1% annually surpasses the US market average. The company has completed a significant share buyback and plans to raise CNY 4.5 billion through GDRs to fund expansion projects in the US and China, indicating strategic growth intentions despite recent financial hurdles.

- Take a closer look at JinkoSolar Holding's potential here in our earnings growth report.

- Our valuation report here indicates JinkoSolar Holding may be undervalued.

Tuya (NYSE:TUYA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tuya Inc. provides a specialized Internet of Things (IoT) cloud development platform both in China and globally, with a market cap of approximately $929.37 million.

Operations: The company's revenue segment includes Internet Software & Services, generating approximately $280.97 million.

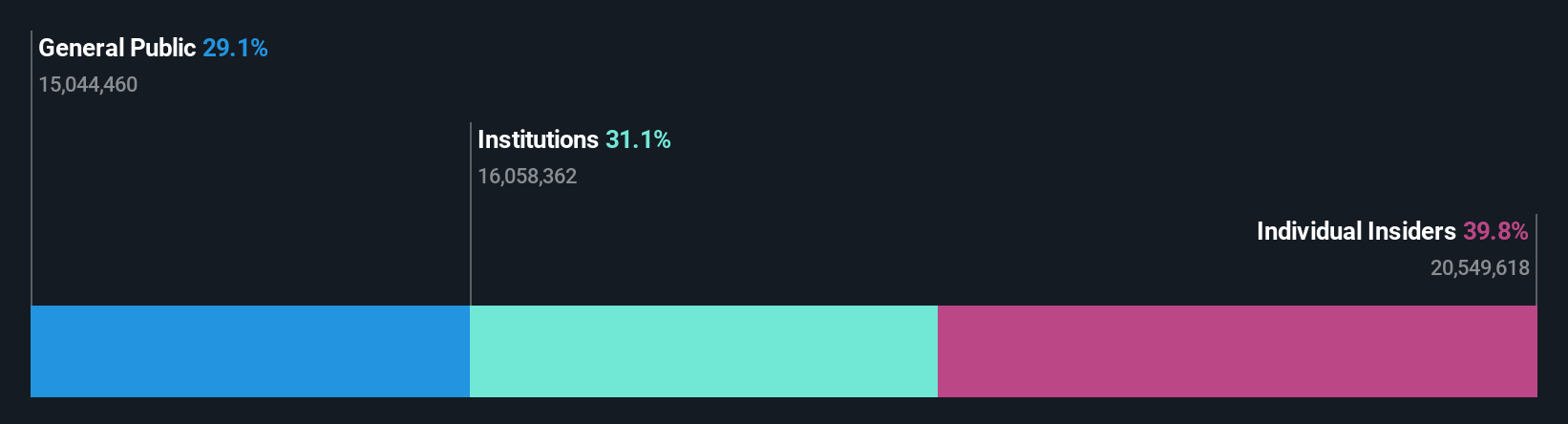

Insider Ownership: 36%

Tuya is expanding its European presence by upgrading its Düsseldorf headquarters, enhancing partnerships with major brands like Schneider and Philips. Recent strategic collaborations in the Middle East aim to bolster smart city initiatives. Despite being dropped from the FTSE All-World Index, Tuya's revenue is forecasted to grow faster than the US market average at 14.8% annually, though slower than 20%. It reported US$81.62 million in Q3 sales, narrowing net losses significantly year-over-year.

- Navigate through the intricacies of Tuya with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Tuya implies its share price may be lower than expected.

Make It Happen

- Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 209 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JKS

JinkoSolar Holding

Engages in the design, development, production, and marketing of photovoltaic products.

Undervalued with excellent balance sheet.